Table of Contents

All About Income Tax Return Filing in FY 2023- 2024

An Income Tax Return has to be filed by every taxpayer every year. The taxpayers must file an Income Tax Return (ITR) due to many reasons including carrying forward losses, claiming an income tax refund, claiming tax deductions etc. There is a process of Income Tax Return Filing online which is called E-filing. The Department of Income Tax has provided the option of E –filing the income tax return. ITR Filing for Salaried Employees is must so that they can claim for the tax deductions.

Income Tax Return last date

The last date of filing ITR for FY 2023-24 will be 31st July 2024 while the taxpayers who have been required to conduct an income tax audit and have business income must have to file ITR by 31st October 2024. So, find about the Income Tax Return filing near me and file your ITR.

Steps for E- filing the Income Tax Return

The steps for e-filing the Income Tax Return are mentioned below. You have to follow the given steps for Income Tax Return Filing.

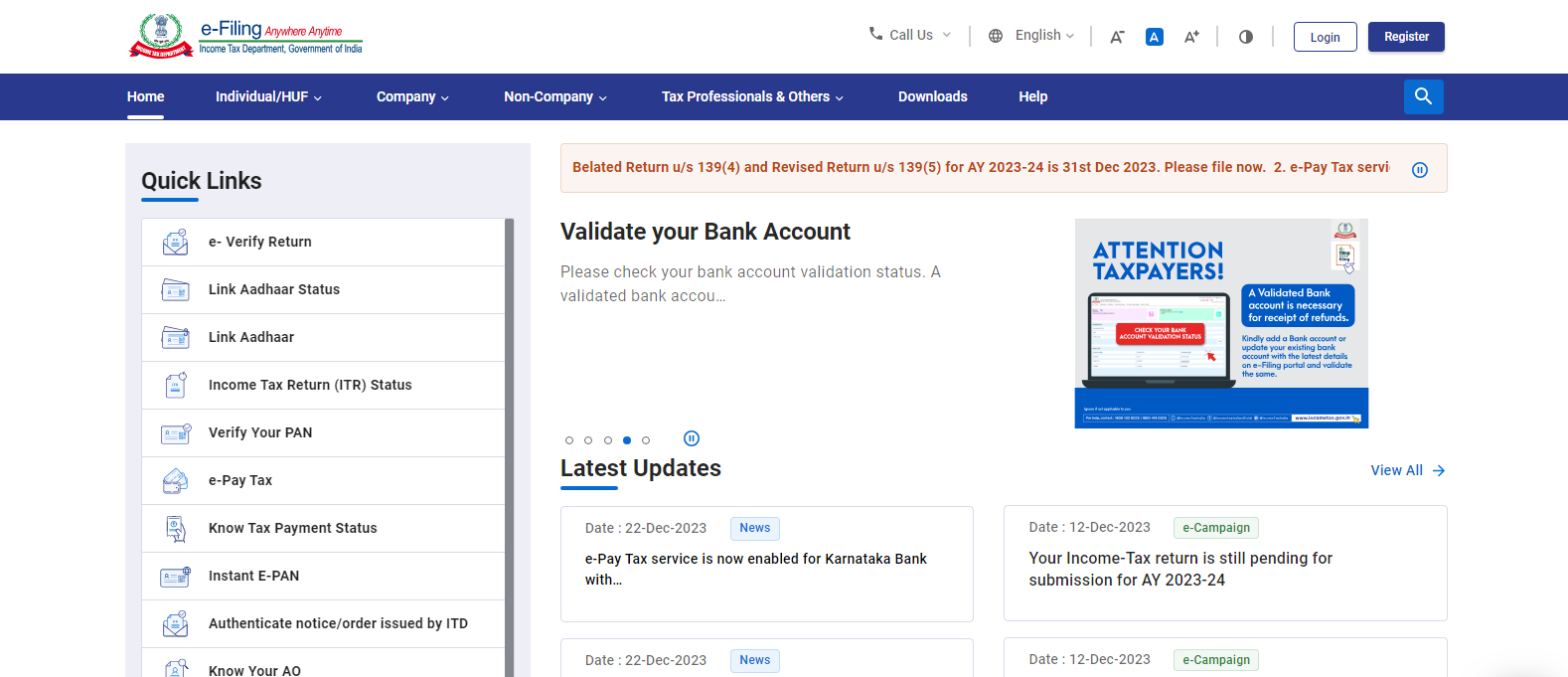

Step 1: Official website of e-filing

Firstly, you have to visit the official website for e-filing of income tax return which is https://www.incometax.gov.in/iec/foportal/

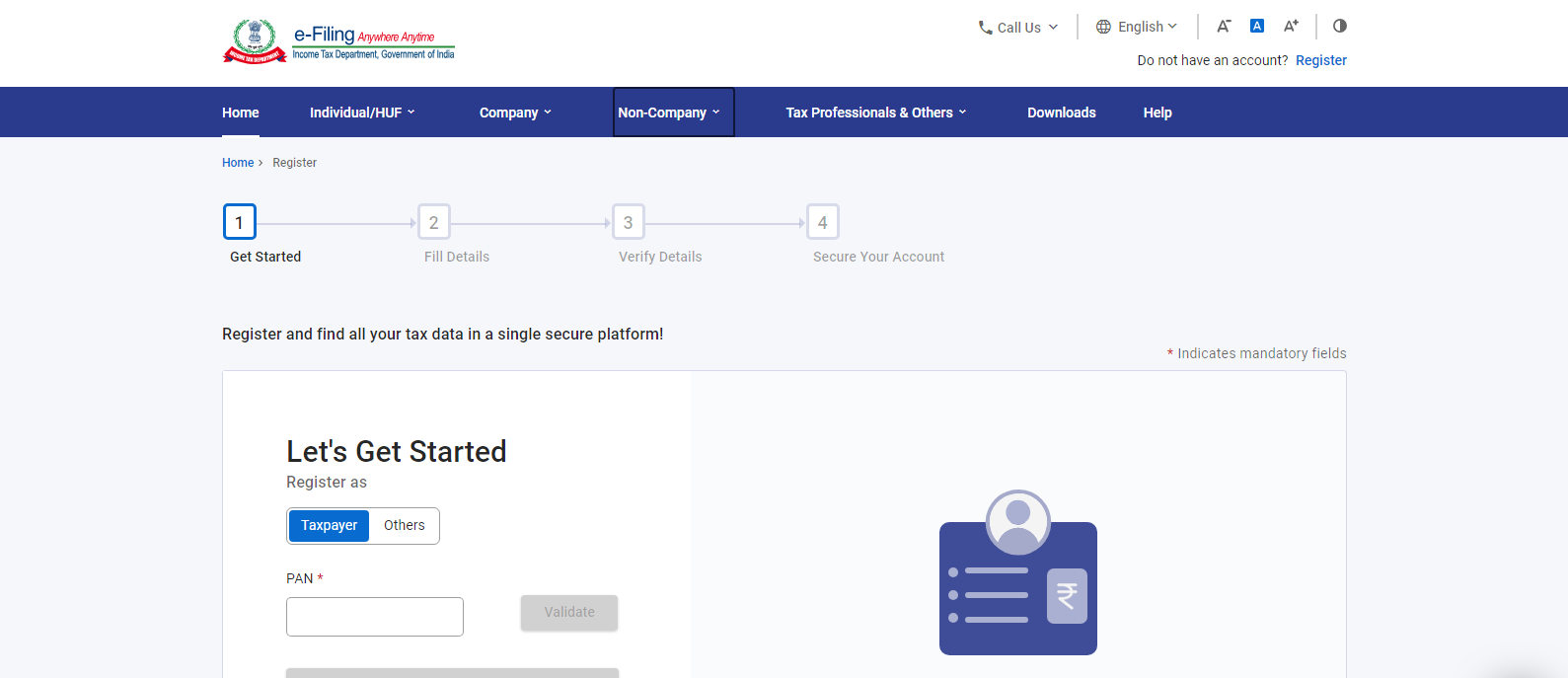

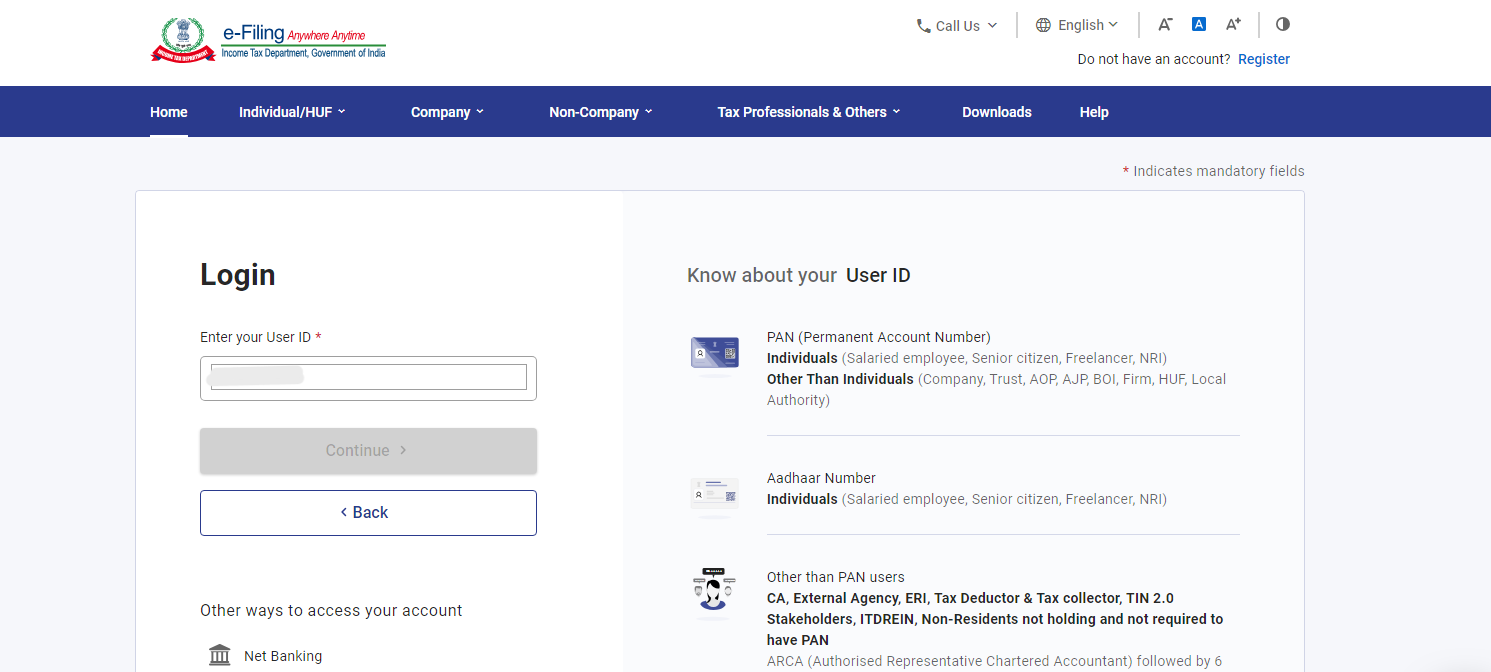

Step 2: Register/ login

If you are a first-time user you have to register yourself

If you are a repeat user you have to log in to the website-

- You have to enter your PAN as your user id and then click ‘Continue’.

- You have to check the security message give in the tick box.

- Then, you have to enter your password & click on the ‘Continue’ button.

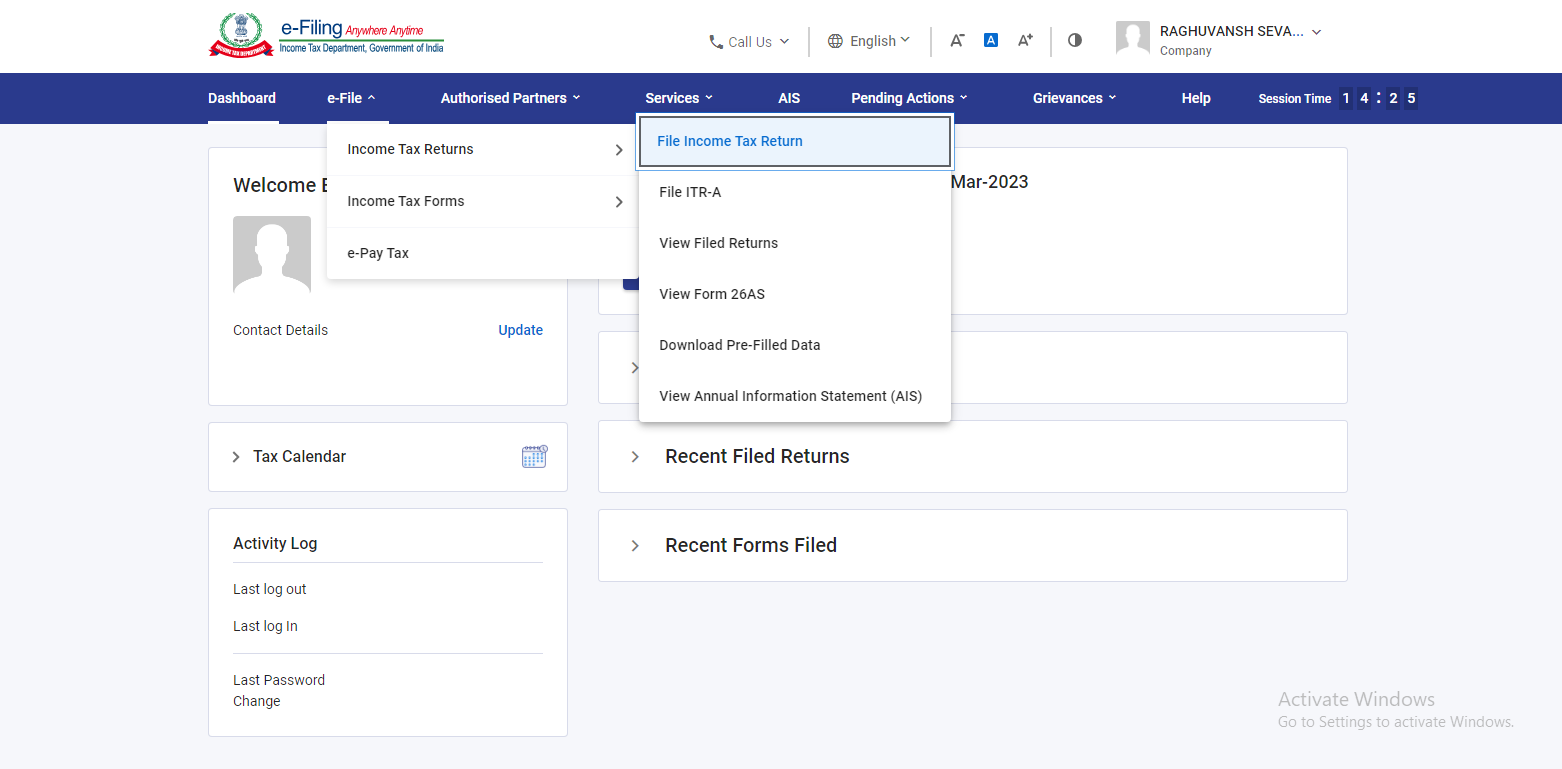

Step 3: Selecting the option of ‘File Income Tax Returns’

After logging in, you will see the e-file menu on the menu bar. When you click on e – file menu then, you will get the option of ‘Income Tax Returns’ on clicking which you will see the option of ‘File Income Tax Return’ and you have to click on that option.

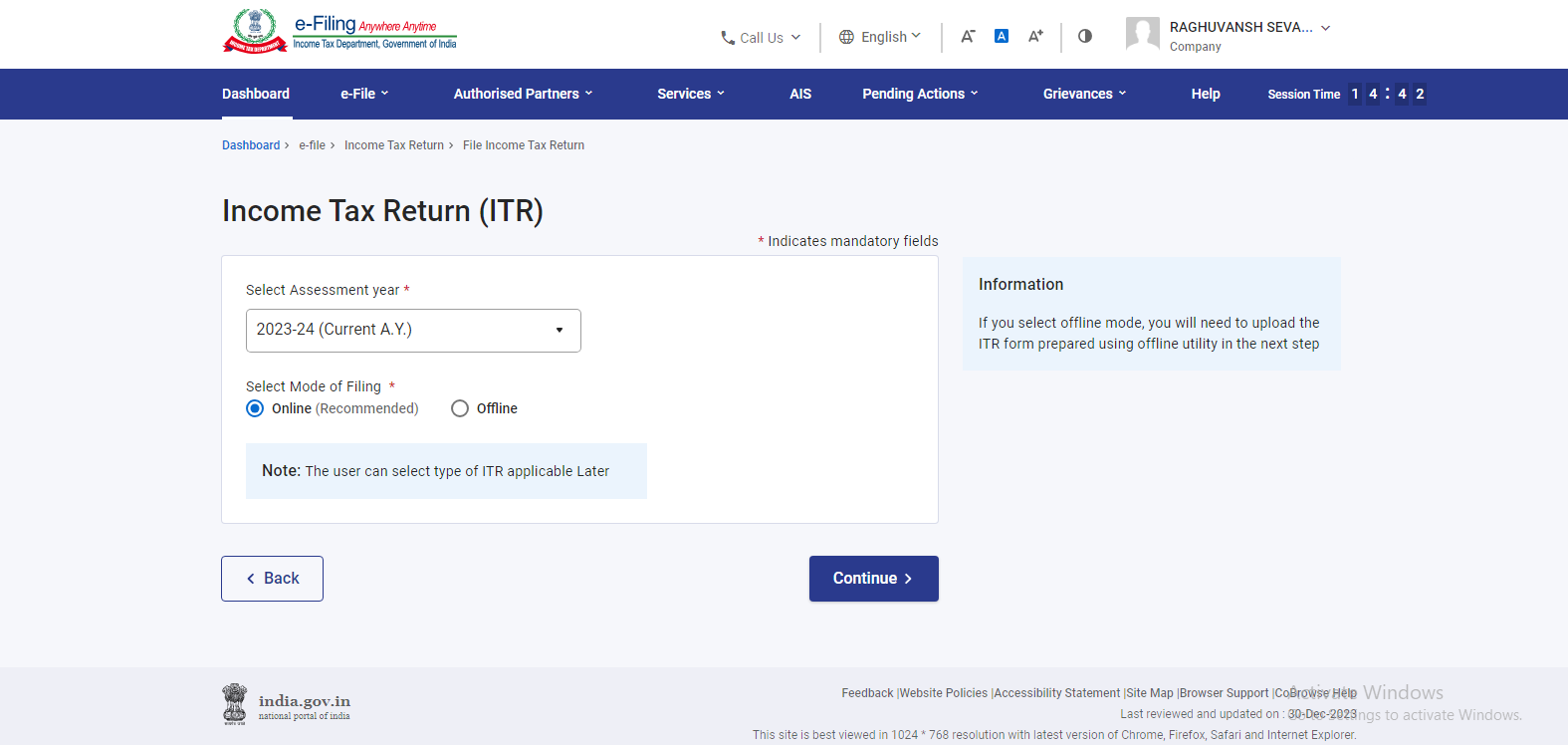

Step 4: Select the assessment year

You will be redirected to the page of Income Tax return where you have to select the ‘assessment year’ and the ‘mode of filing’ for which you wish to file the income tax return and then you have to click on ‘Continue’

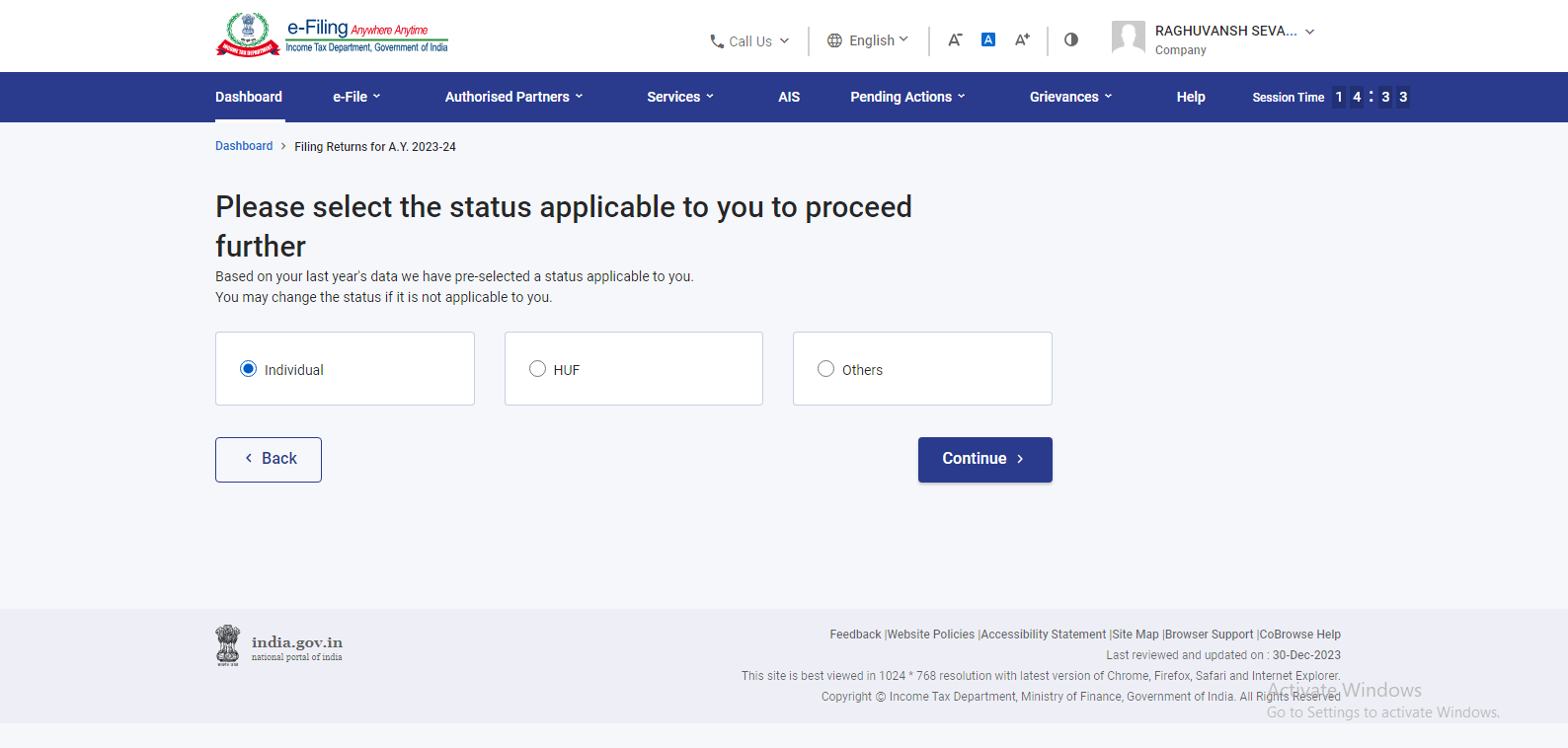

Step 5: Select the status

Then, you have to select the status of filing ITR among Individual, HUF, or other and click on ‘Continue’

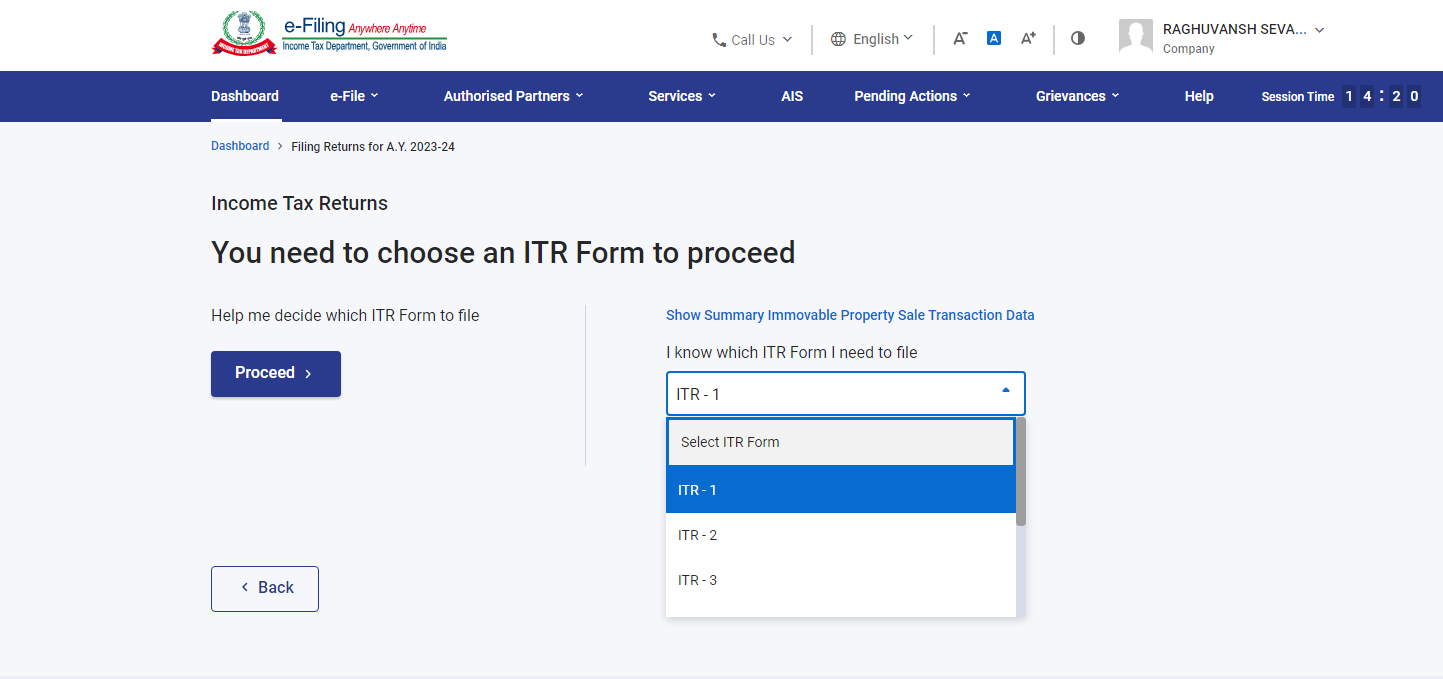

Step 6: Select the ITR type

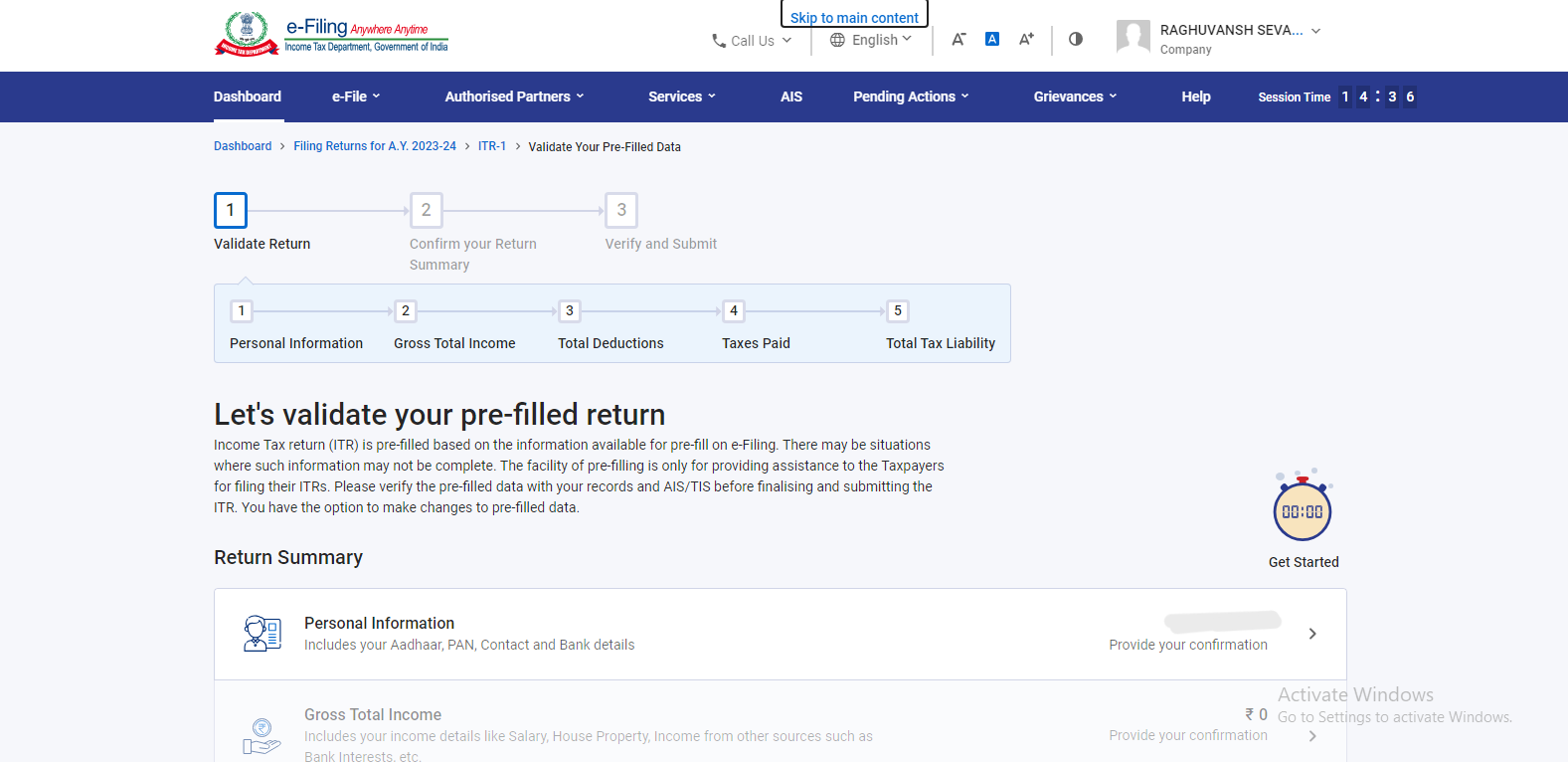

After that, you have to select the ITR form and for filing online you have two options ITR 1 & ITR 4.

If you choose ITR 1 then you have to fill the following details-

-

Personal information:

Your basic details including your full name, PAN, Aadhaar Number, contact details, and bank account details.

-

Gross total income:

You have to enter & verify your total income from all the sources along with the details of exempt income.

-

Total deductions:

The information about the deductions that you need to be claimed under the different sections.

-

Tax paid:

Reflects the tax paid by you from all the sources but not been limited to TDS, TCS, Advance Tax & Self-assessment

-

Total tax liability:

This section reflects the total tax liability as per the information provided by you previously. If the amount is negative then it can be claimed as a refund and if the amount is positive then you have to paid this as tax

If you select the ITR 4 then you have to fill the following details-

-

Personal information:

Your basic details including your full name, PAN, Aadhaar Number, contact details, bank account details.

-

Gross total income:

You have to enter & verify your total income from all the sources along with the details of exempt income.

-

Total deductions:

The information about the deductions that you need to be claimed under the different sections.

-

Tax paid:

Reflects the tax paid by you from all the sources but not been limited to TDS, TCS, Advance Tax & Self-assessment

-

Total tax liability:

This section reflects the total tax liability as per the information provided by you previously. If the amount is negative then it can be claimed as a refund and if the amount is positive then you have to pay this as tax

-

Disclosures:

Here you have to provide the financial particulars that have been pertained to your business, information of gross receipts that have been reported for GST, and the exempted income.

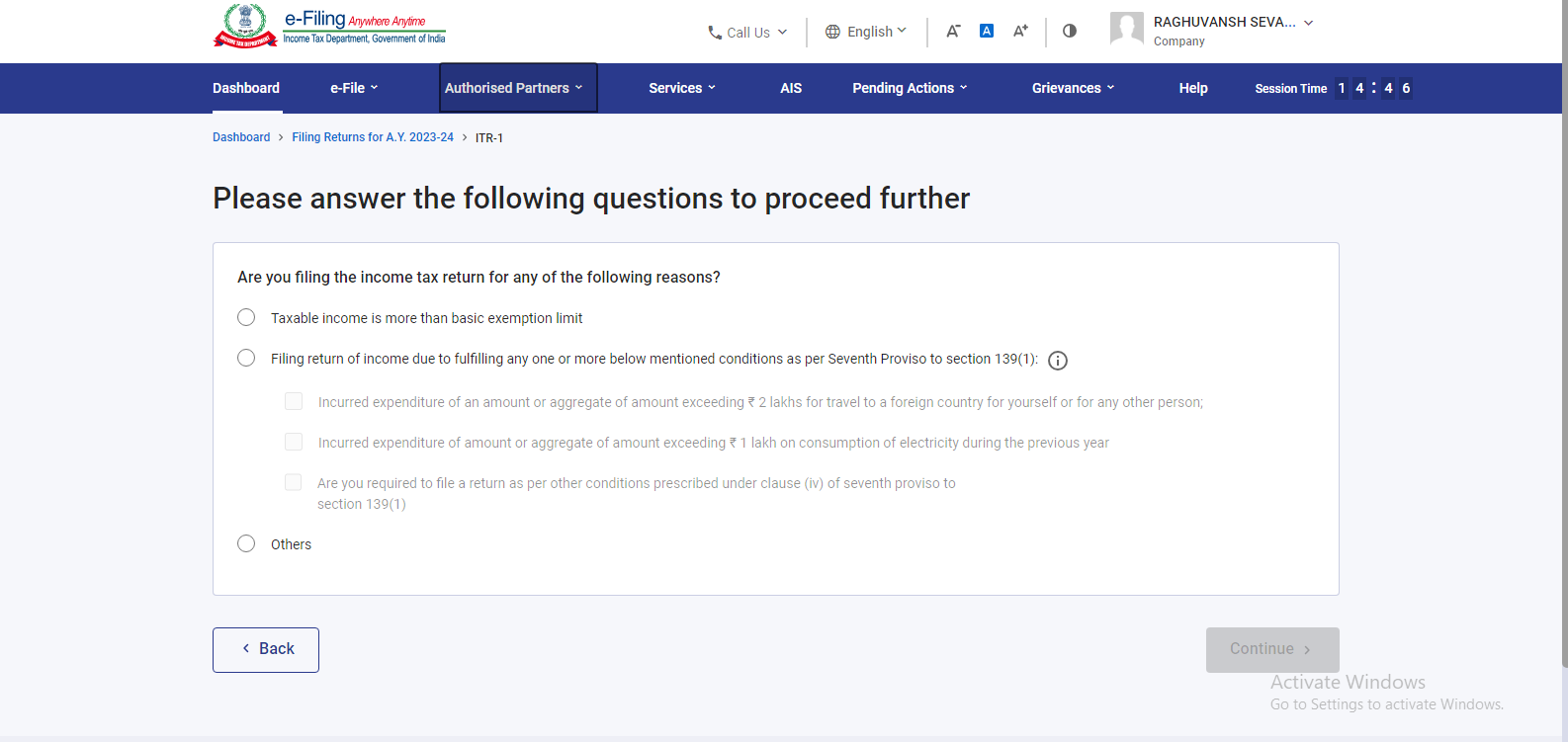

Step 7: Reason for filing ITR

You have to choose the reason for filing the ITR. You have to select the correct option that has applied to your situation-

- Taxable income is more than the basic exemption limit.

- Meets specific criteria & compulsory requirement of filing the ITR

- Others

Step 8: Submit bank account details & other information

You have to add your bank details. If already submitted, then you have to make sure that it has been pre-validated. You have to review the correctness of pre-filled information that has appeared on the new page.

Step 9: Tax Computation summary

Your screen will display the summary of the tax computation according to your given information and you will get to know if you have to pay any tax or you are eligible for a tax refund. Then, you have to enter the place of your residence to preview and submit your ITR.

Step 10: e-verification of ITR

E- Verification of ITR is the most crucial step. Your Income Tax Return will be incomplete until you verify it. You have the option to e-verify the ITR via Aadhaar OTP, Net banking EVC i.e. Electronic Verification Code, or by sending a physical copy of the ITR to CPC Bengaluru.

Step 11: Submission of ITR

At last, you have to click on the ‘Submit’ button to submit your ITR. After submission, you will get the acknowledgment from the Income Tax department at your given email id.

To understand the process of ITR filing, you can seek help from a CA for filing Income Tax Return. By taking the help of Income Tax Filing agents near me, the process of filing ITR becomes more convenient for you.

Conclusion

It is nice that you enter the realme of online ITR filing. The taxpayers need to file Income Tax Return to claim the tax deductions. Let LegalPiller help you simplify the process of filing ITR so that the complications of the tax law did not distract you from your core activities. If it is difficult for you to find ITR Filing agents near me, we can help you by providing the CA near me for ITR Filing.

But as you know a CA has charged high fees for filing ITR, we can provide you the service of ITR filing with less ITR Filing fees by CA which is affordable to you. Choose LegalPillers as your trusted partner for filing the ITR so that your business will stay on the right track.

Comments (1)

adminsays:

January 4, 2024 at 2:02 pm4.5