Table of Contents

All about ITR 1 for Income Tax Return Filing

When it comes about Income Tax Return Filing in India, the choice of the right ITR form is crucial. Individuals should determine their residential status in India as per the Income Tax Act to correctly select the applicable ITR form (e.g., Resident, Non-Resident, or Resident but Not Ordinarily Resident). Among the various ITR forms, the two most commonly used forms are ITR 1 and ITR 2. By making an informed choice about the correct ITR form, you not only comply with tax regulations but also safeguard your financial interests. You can also understand properly about the different forms with the help of a CA for filing Income Tax Return. Here, you can learn about filing ITR 1 (Sahaj).

Understanding the Basics of ITR 1 and ITR 2

Before we delve into the differences, let’s get a clear understanding of ITR 1 and ITR 2. These forms are used for Income Tax Returns Filing in India. ITR 1 is primarily meant for ITR Filing for Salaried Employees and pensioners with a straightforward income structure. On the other hand, ITR 2 is designed for individuals and Hindu Undivided Families (HUFs) with more complex income sources.

Who is eligible to file ITR 1 for FY 2023 – 24?

Here, provide you with a general understanding of who is typically eligible to file ITR 1 for AY 2023 – 24 in India. The ITR-1 form in India is primarily meant for the salaried individuals. Here are the key eligibility criteria for filing ITR-1. It can be filed by the Resident Individual with the following income:

- Total income does not exceed Rs. 50 lakhs.

- From salary, one house property, family pension income

- Agricultural Income up to Rs. 5000/-

- Interest from saving accounts

- Interest from Bank, post office or cooperative society deposits

- Interest from Income Tax Refund

- Interest on Enhanced Compensation

- Any other interest

- Income of spouse or minor is clubbed

Who is not eligible to file ITR 1 for FY 2023 – 24?

An individual is not eligible to file ITR 1 if he/ she:

- is an RNOR i.e. Resident Not Ordinarily Resident and NRI i.e. Non- Resident Indian

- has a total income exceeding Rs. 50 lakhs

- has an agricultural income of more than Rs. 5000/-

- has income from lottery, horse races, legal gambling, etc.

- has taxable long-term & short-term capital gains

- has invested in unlisted equity shares

- has income from business or profession

- is a Director in a company

- has tax deduction under section 194N of the Income Tax Act

- has deferred Income Tax on ESOP that has been received by the employer being an eligible start–up

- owns & has income from more than one house property

- is not covered under the eligibility conditions for ITR 1.

To understand the eligibility criteria for filing ITR 1 properly, you can simply search for ‘Income Tax Return Filing Agents near me’.

Protections under ITR 1

- If your primary source of income is your salary, ITR 1 is a straightforward choice for you. It offers protection by allowing you to report your salary income with ease.

- Individuals who have gained income from the sale of assets like property or stocks may find it challenging to use ITR 1 as it does not provide the necessary protection for these types of income.

- If you have foreign assets, ITR 1 does not provide the protection you need. You might not be able to adequately report foreign income and assets.

- In cases where an audit is likely, ITR 1 might not provide adequate protection. It’s designed for simpler financial structures.

- In cases where an audit is likely, ITR 1 might not provide adequate protection. It’s designed for simpler financial structures.

- For individuals with non-resident income, ITR 1 may not offer sufficient protection or flexibility.

- Income from lotteries, horse racing, and other specified sources can’t be adequately protected in ITR 1.

Filing Due Date

The Income Tax Return last date for filing ITR 1 is typically the same as for other forms which is 31st July 2024, providing protection from penalties for late filing.

Structure of form ITR 1

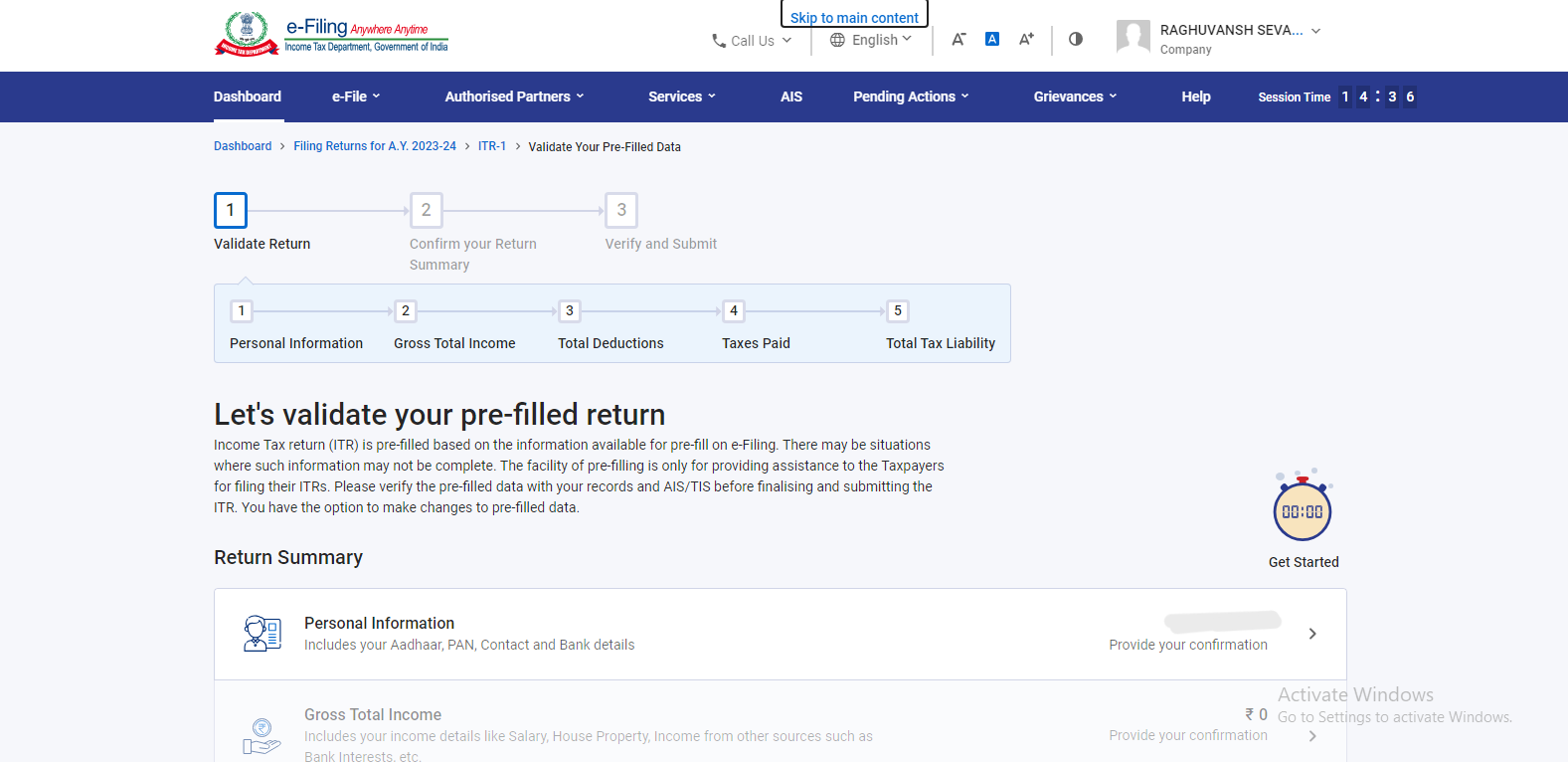

The ITR 1 form of filing Income Tax consists of 5 sections. To reduce the complexities of tax law and understand the structure accurately you can get help from Income Tax Return Filing near me. Here is the general structure of ITR 1-

Personal Information

This section consists of the basic details of the taxpayer including full name, PAN Number, Aadhaar Number, contact information, and bank account details.

Gross Total Income

Under this section, you have to enter and verify income from all the sources like salary, family pension, house property, and other sources including income from interests. Additionally, you have to give the details of any exempt income (if any)

Total deductions

In this section, you should claim for the various deductions under the different sections of the Income Tax Act.

Tax paid

It displays the tax payments that have been made by you from all the sources including TDS, TCS, Advance Tax, and Self–Assessment Tax.

Total Tax Liability

Under this section, you will find the computed tax liability based on the information that has been provided by you in the previous sections. If the amount is negative then you can claim it as a refund and if it is positive then you have to pay the tax.

How to file ITR 1?

The steps for filing ITR 1 are mentioned below:

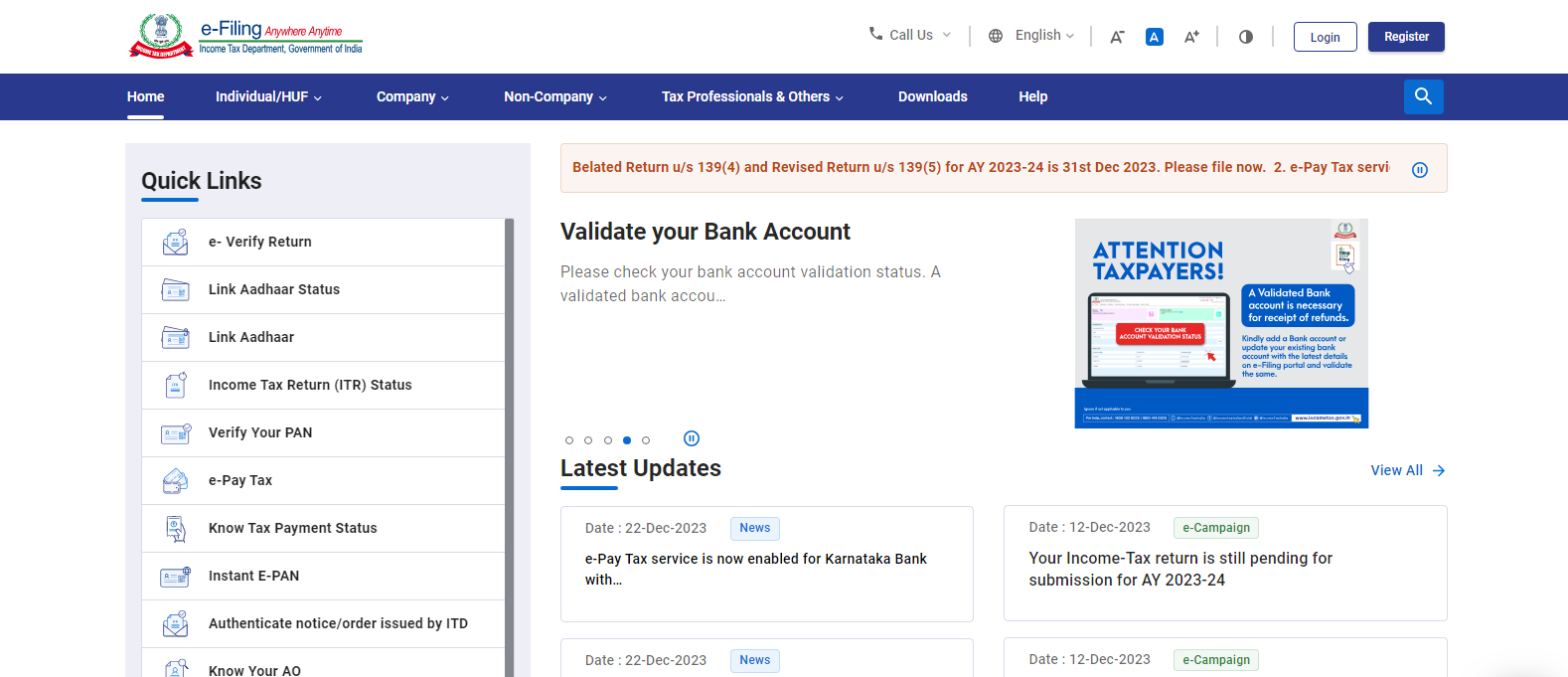

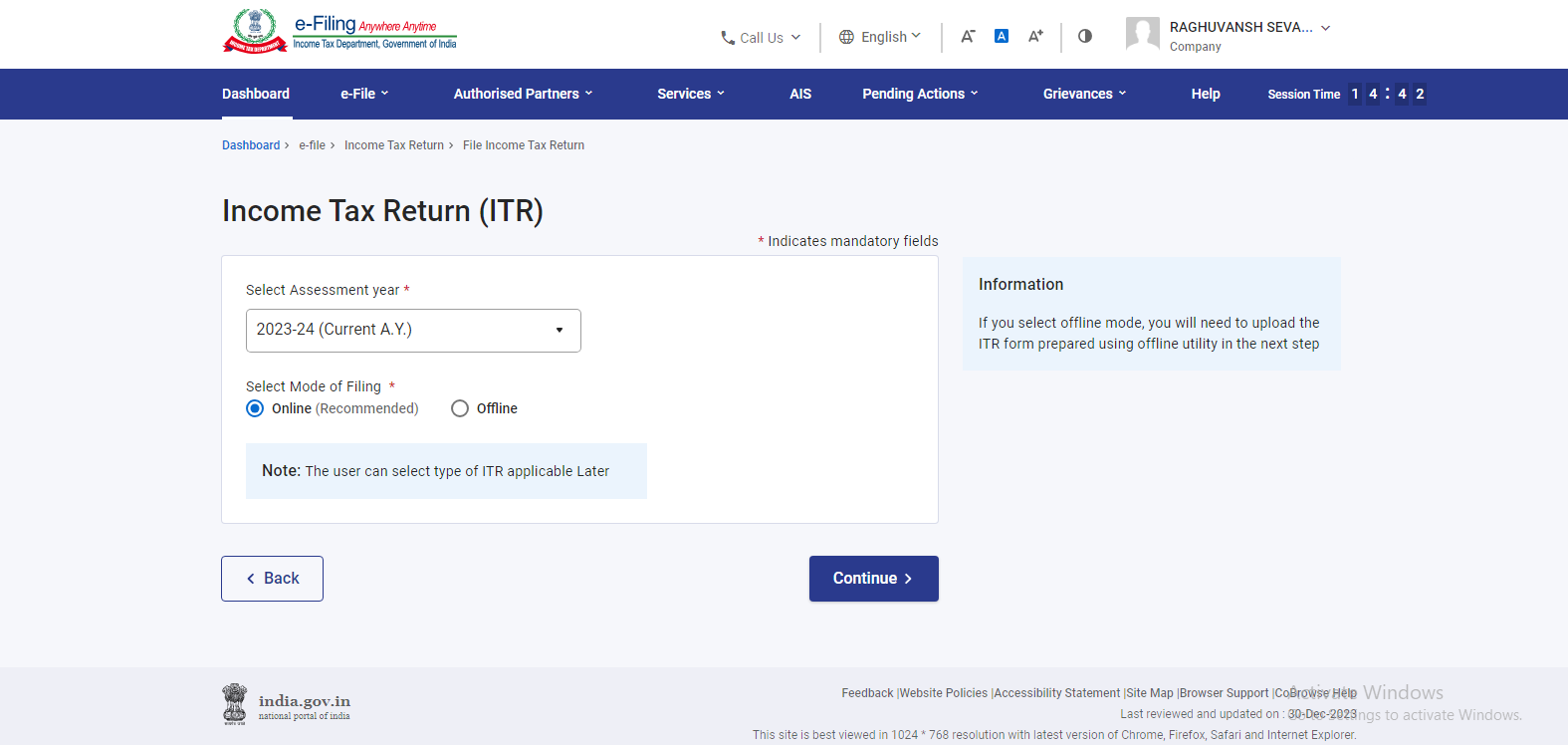

Step 1: Official website of e-filing

Firstly, you have to visit the official website of e-filing of income tax return which is https://www.incometax.gov.in/iec/foportal/

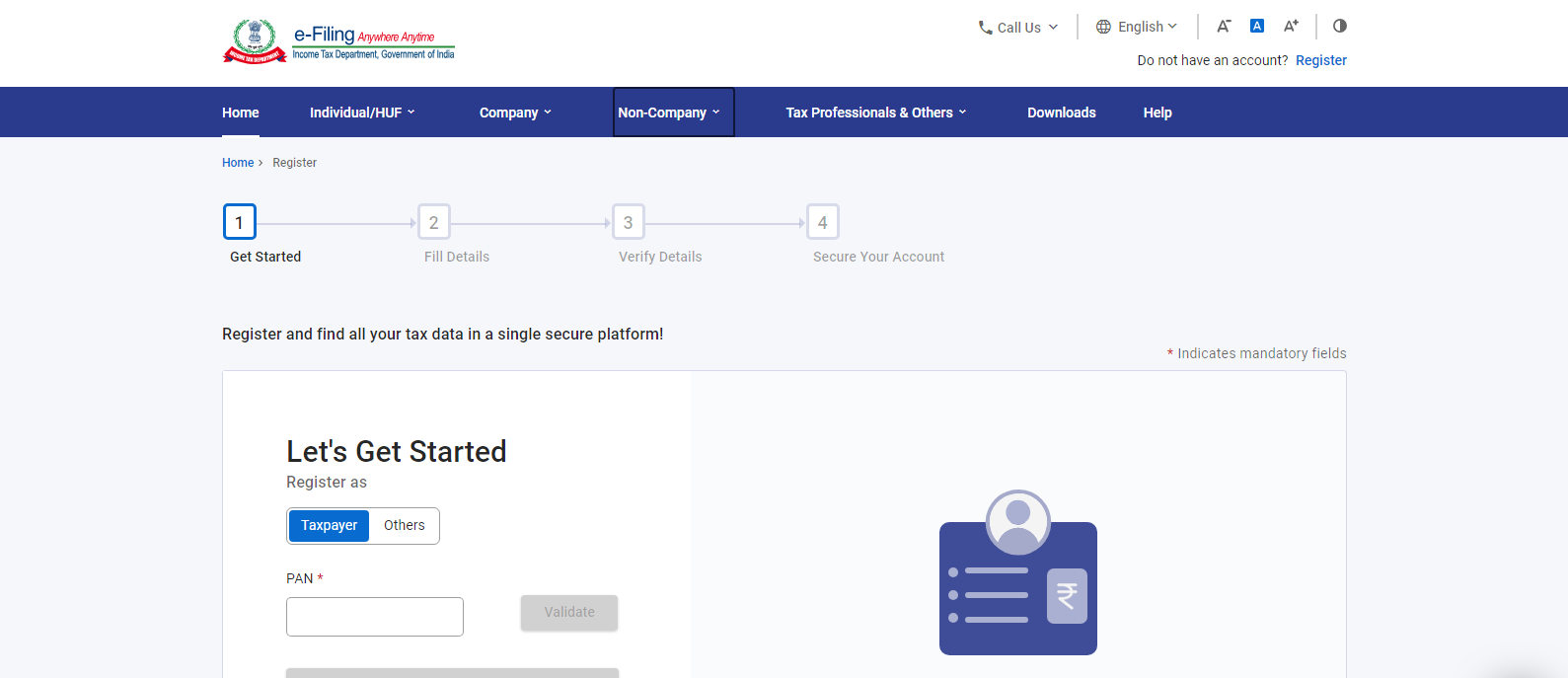

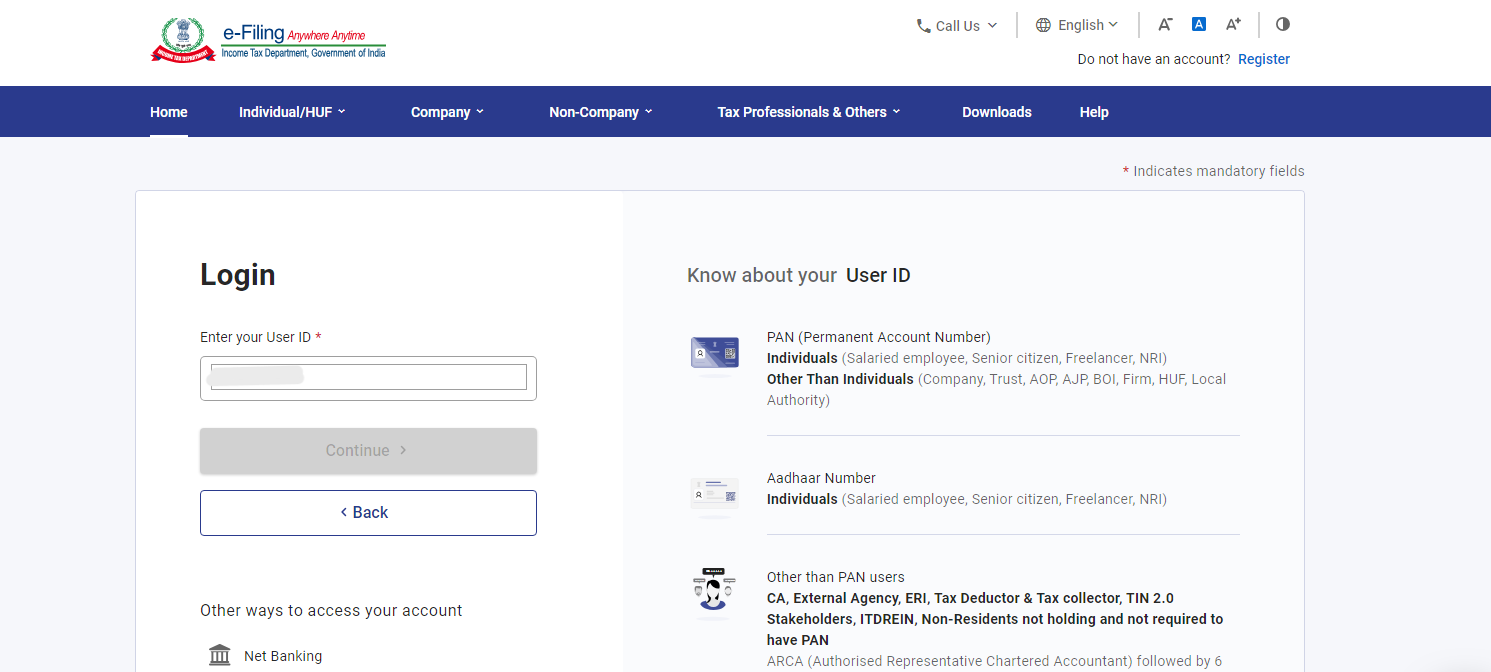

Step 2: Register/ Login

If you are a first time user you have to register yourself

If you are a repeat user you have to log in to the website-

- You have to enter your PAN as your user id and then click ‘Continue’.

- You have to check the security message given in the tick box.

- Then, you have to enter your password & click on the ‘Continue’ button.

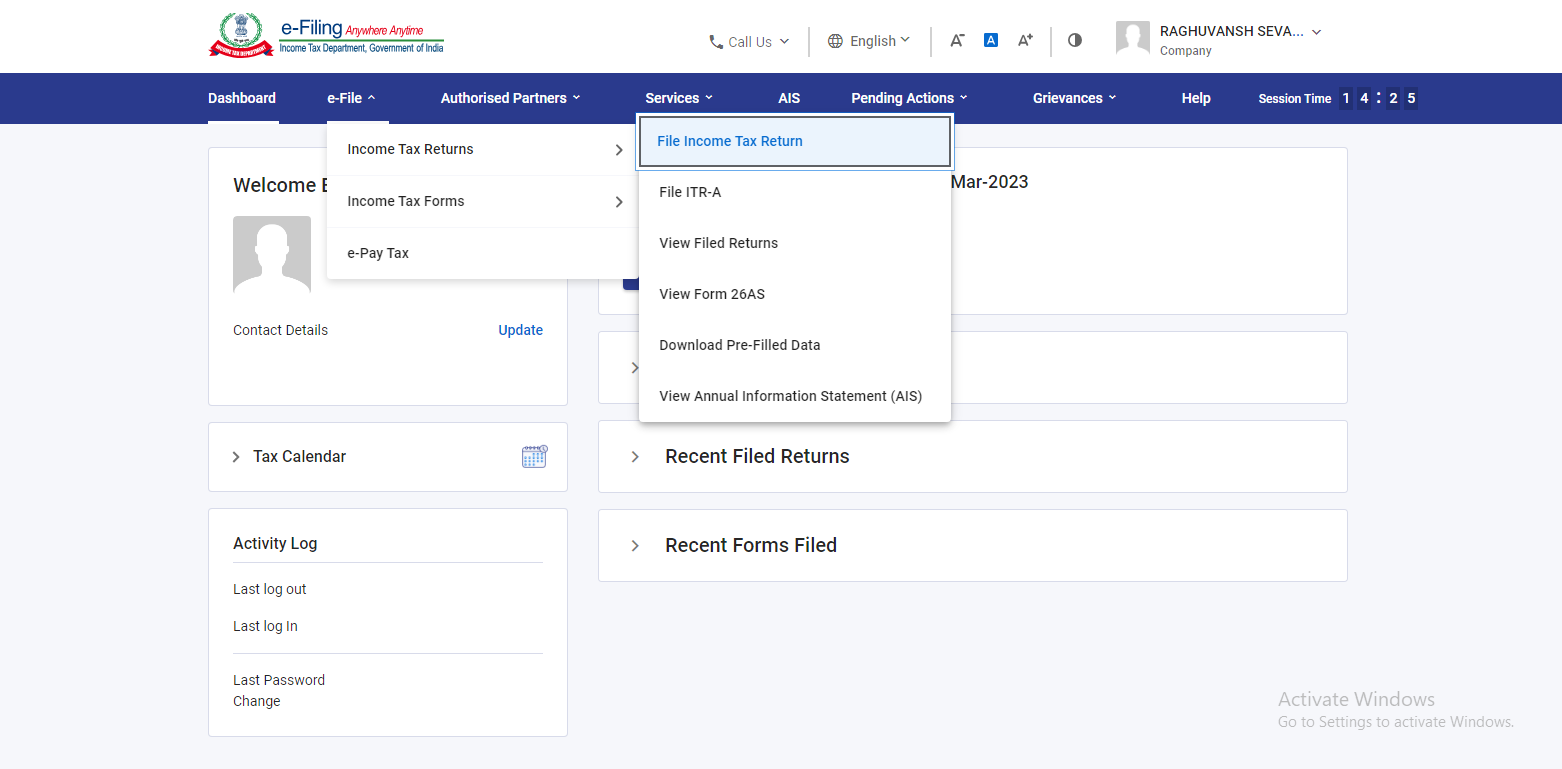

Step 3: Selecting the option of ‘File Income Tax Returns’

After logging in, you will see the e-file menu on the menu bar. When you click on the e- file menu then, you will get the option of ‘Income Tax Returns’ on clicking you will see the option of ‘File Income Tax Return’ and you have to click on that option.

Step 4: Select the assessment year

Then, you will be redirected to the page of Income Tax return where you have to select the ‘assessment year’ and the ‘mode of filing’ for which you wish to file the income tax return and then you have to click on ‘Continue’

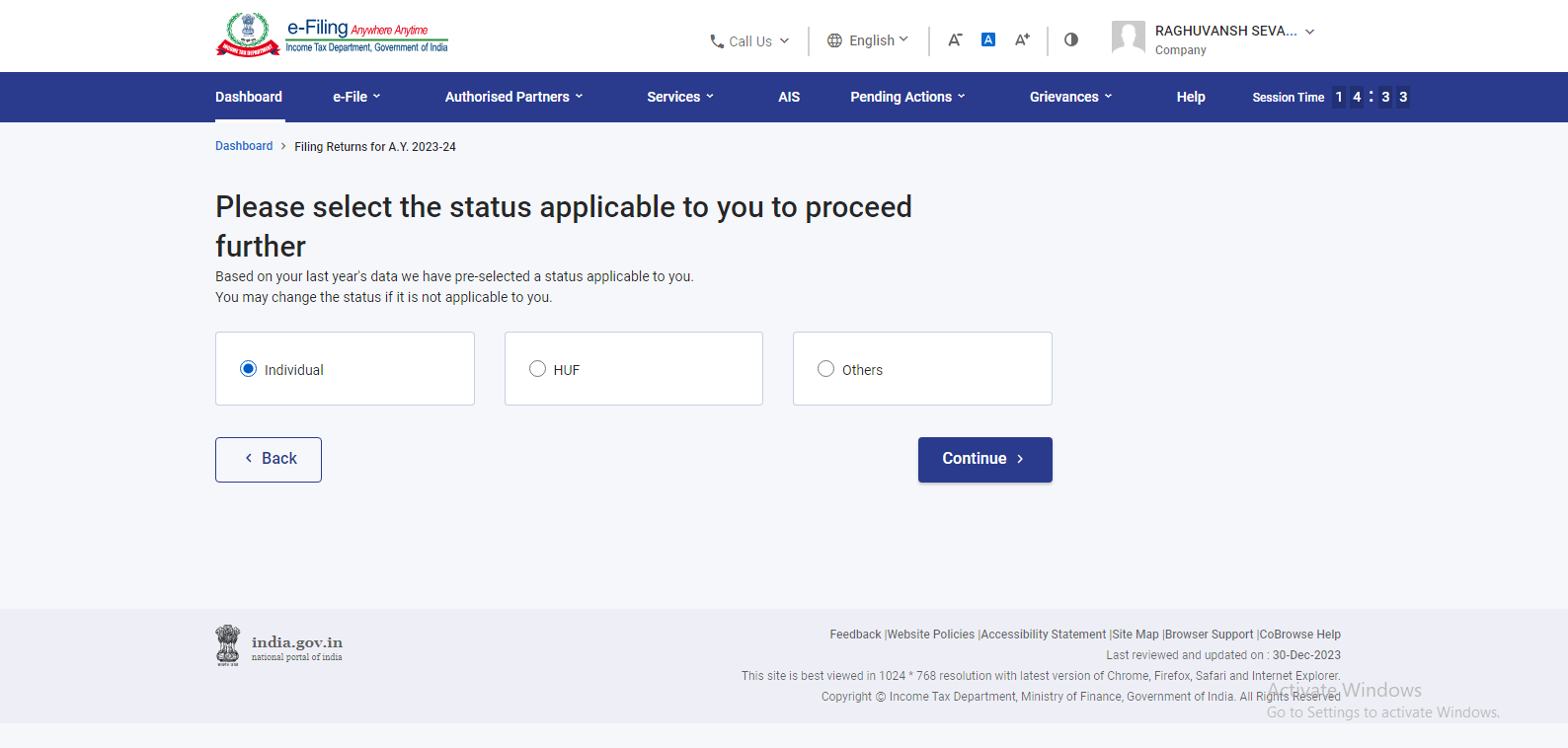

Step 5: Select the status

Then, you have to select the status of filing ITR as Individual and click on ‘Continue’

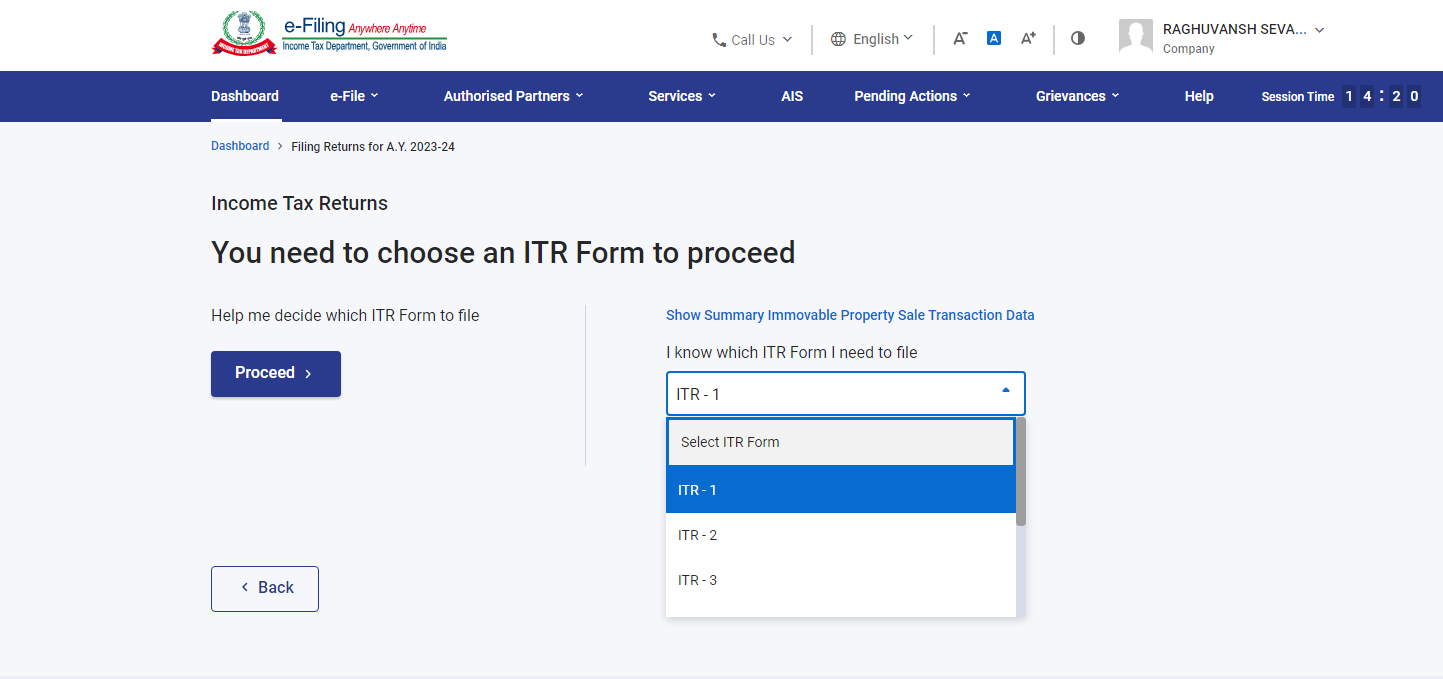

Step 6: Select the ITR type

After that, you have to select the ITR form and you have to choose ITR 1 then you have to fill the following details-

-

Personal information:

Your basic details including your full name, PAN, Aadhaar Number, contact details, and bank account details.

-

Gross total income:

You have to enter & verify your total income from all the sources along with the details of exempt income.

-

Total deductions:

The information about the deductions that you need to be claimed under the different sections.

-

Tax paid:

Reflects the tax paid by you from all the sources but not been limited to TDS, TCS, Advance Tax & Self-assessment

-

Total tax liability:

This section reflects the total tax liability as per the information provided by you previously. If the amount is negative then it can be claimed as the refund and if the amount is positive then you have to pay this as tax

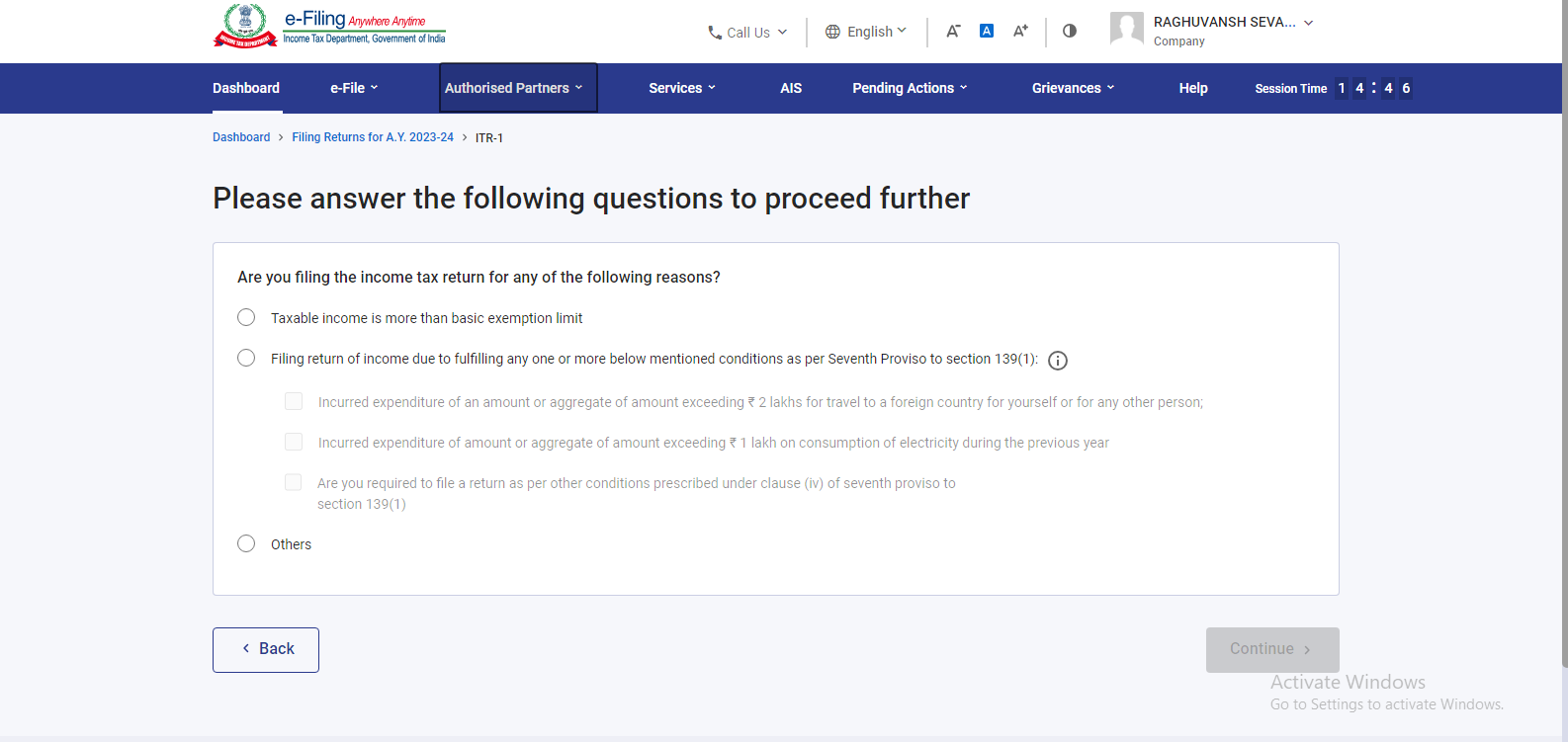

Step 7: Reason for filing ITR

Then, you have to choose the reason for filing the ITR. You have to select the correct option that has applied to your situation-

- Taxable income is more than the basic exemption limit.

- Meets specific criteria & compulsory requirement of filing the ITR

- Others

Step 8: Submit bank account details & other information

After which, you have to add your bank details. If already been submitted, then you have to make sure that it has been pre-validated. You have to review the correctness of pre-filled information that has appeared on the new page.

Step 9: Tax Computation summary

Then, your screen will display the summary of the tax computation according to your given information and you will get to know if you have to pay any tax or if you are eligible for a tax refund. Then, you have to enter the place of your residence to preview and submit your ITR.

Step 10: e-verification of ITR

After that, e-verification of ITR is the most crucial step. Your Income Tax Return will be incomplete until you verify it. You have the option to e-verify the ITR via Aadhaar OTP, Net banking EVC i.e. Electronic Verification Code, or by sending a physical copy of the ITR to CPC Bengaluru.

Step 11: Submission of ITR

At last, you have to click on the ‘Submit’ button to submit your ITR. After submission, you will get the acknowledgment from the Income Tax department at your given email ID.

Documents required for filing ITR 1

Form 16:

- If you are a salaried individual, your employer provides this document, which includes details of your salary, TDS deductions, and other allowances.

- Salary slips or income certificates from your employer.

TDS Certificates:

- You have to fill the form 26AS for the verification of TDS on your salary and other sources of income.

Receipts:

- If you are not able to submit the proof of such exemptions and deductions to your employer on time then you should keep these receipts handy so that you can claim them directly on your Income Tax Return.

PAN Card:

- Your PAN Card is mandatory for the identification.

Bank Investment Certificates:

- Details of interest that has been earned from the bank accounts including bank passbooks or fixed deposit certificates

Conclusion:

The choice of correct ITR forms is crucial for protecting your financial interests. The key differences in taxpayer protection between these forms make it evident that selecting the right form is essential for accurate and compliant income tax return filing. You can make the correct choice of forms with the help of ITR filing agents near me. Assess your income sources and financial complexities carefully before making your choice to ensure maximum protection and peace of mind during the tax season. Make an informed decision to safeguard your financial interests effectively.

At LegaPiller, we will help you with the best CA near me for ITR filing who gives you the right suggestions to file the ITR properly. Make LegalPillers your trusted partner and simplify your ITR filing process. As you know ITR Filing fees by CA is very high but we provide this service with affordable fees.

(FAQs) about ITR 1 (Income Tax Return Form 1) along with their answers:

What is ITR 1?

ITR 1, also known as Sahaj, is an income tax return form for individuals with a simple income structure.

Who can use ITR 1?

Salaried individuals and pensioners who have income from salary, one house property, and other sources (excluding income from lottery and horse racing) can use ITR 1.

What is the due date for filing ITR 1?

The due date for filing ITR 1 varies each year but is generally around July 31.

Can I file ITR 1 if I have capital gains income?

No, ITR 1 is not meant for individuals with capital gains income.

Is ITR 1 applicable for NRIs (Non-Resident Indians)?

No, ITR 1 is not meant for Non-Resident Indians.

Can I use ITR 1 for reporting rental income from multiple properties?

No, ITR 1 is suitable for individuals with income from only one house property.

Can I file ITR 1 if I have foreign assets?

No, ITR 1 does not provide provisions for reporting foreign assets.

Is ITR 1 eligible for individuals with business income?

No, ITR 1 is not suitable for individuals with business income.

What is the penalty for late filing of ITR 1?

The penalty for late filing can vary, but it’s usually calculated as per Section 234F of the Income Tax Act.

Can I revise my ITR 1 after filing it?

Yes, you can revise your ITR 1 within a specified time frame if you need to make corrections.

Is e-filing mandatory for ITR 1?

E-filing is mandatory for individuals with income above a certain threshold.

Can I claim deductions under Section 80C in ITR 1?

Yes, you can claim deductions under Section 80C for investments like LIC premiums, PPF, and more.

Do I need to attach any documents with ITR 1?

No, you do not need to attach any documents when filing ITR 1. Keep them for reference if required.

Can I file ITR 1 if I receive income from freelancing or consultancy work?

No, ITR 1 is not suitable for individuals with such income. You should consider a form like ITR 4.

What is the exemption limit for using ITR 1?

There is no specific exemption limit for using ITR 1. It’s more about the type and complexity of your income.

Can I file ITR 1 for the previous financial year?

You can file ITR 1 for the previous financial year if you haven’t filed it yet.

Is Aadhaar number mandatory for filing ITR 1?

As of my last update in September 2021, an Aadhaar number was not mandatory but highly recommended. Please check the latest requirements.

Can I file ITR 1 if I have foreign income?

No, ITR 1 is not suitable for individuals with foreign income.

What is the difference between ITR 1 and ITR 2?

ITR 2 is for individuals with more complex income structures, including capital gains and foreign assets.

Can I claim a refund through ITR 1?

Yes, if you are eligible for a refund, you can claim it by filing ITR 1.

Leave a Reply