Table of Contents

All about ITR 3 for Income Tax Return Filing

When it comes to Income Tax Return Filing in India, the choice of the right ITR form is crucial. Individuals should determine their residential status in India as per the Income Tax Act to correctly select the applicable ITR form (e.g., Resident, Non-Resident, or Resident but Not Ordinarily Resident). By making an informed choice about the correct ITR form, you not only comply with tax regulations but also safeguard your financial interests. You can also understand properly the different forms with the help of a CA for filing Income Tax Return. Here, in this blog, you will understand about the ITR 3 Filing.

Understanding the ITR-3 Form

The ITR-3 form, which stands for Income Tax Return 3, is a critical document in the Indian taxation system. It is designed for individuals and Hindu Undivided Families (HUFs) who have income sources beyond simple salary or pension earnings. Unlike some other Income Tax Return filing forms, ITR-3 is primarily intended for those engaged in business or a profession, making it particularly relevant for self-employed individuals, freelancers, and small business owners. It requires individuals to provide information about their income from various sources, such as business profits, capital gains, house property, and other income. Furthermore, it mandates the submission of a balance sheet and profit and loss account for individuals and HUFs with business or professional income, along with details of capital investments, loans, and advances. In certain cases, individuals filing income tax may also be required to provide audit reports, adding an additional layer of complexity.

Who is eligible for ITR 3 Filing?

Business or Profession:

Individuals and HUFs engaged in a business or profession (e.g. doctors, lawyers, architects, etc.), including self-employment, freelancing, consulting, or any form of entrepreneurship, should file ITR-3.

Income Sources:

Those with income from multiple sources, such as business income, capital gains, house property, and other sources apart from salary or pension, should use ITR-3.

Audit Requirement:

Taxpayers whose total income exceeds the prescribed limits (as per the Income Tax Act) and require their accounts to be audited under income tax laws should use ITR-3. The audit is typically mandatory when the turnover of a business exceeds a specified threshold.

Exemption from Audit:

Even if your income is below the audit threshold, you can voluntarily choose to file ITR-3 if you want to maintain a detailed record of your financial transactions or if you have carried forward losses from previous years that need to be declared.

Complex financial transactions:

If you have engaged in complex financial transactions, such as foreign income, foreign assets, or income eligible for presumptive taxation, ITR-3 is the appropriate form to use.

Investments and Assets:

Individuals and HUFs with investments in unlisted equity shares or unlisted companies should file ITR-3. Additionally, those holding assets outside India or having signing authority in a foreign bank account should use this form.

Income from house property:

If you earn income from more than one house property and have a business or professional income, ITR-3 allows you to report both types of income together.

Tax Compliances:

Taxpayers subject to specific tax compliance requirements, such as transfer pricing regulations or provisions for certain deductions or exemptions, may need to file ITR-3 to fulfill these obligations.

Who is not eligible for ITR 3 Filing?

No Salary Income:

If your salary or pension is your only source of income, then you should not file ITR-3. Instead, you would typically use other ITR forms, such as ITR-1 or ITR-2. So, the form ITR 3 can’t be used for the ITR Filing for Salaried Employees.

Income from Partnership:

An individual or HUF whose source of income is as the partner in a partnership firm that has been engaged in a business or profession is not eligible to file ITR 3.

It’s important to note that the eligibility criteria for ITR-3 may change from year to year due to updates in tax laws and regulations. Therefore, individuals and HUFs should always refer to the latest guidelines provided by the Income Tax Department or consult a tax professional at LegalPillers for accurate and up-to-date information regarding which ITR form to file.

ITR 3 Filing Last Date

The Income Tax Return Last Date to file ITR 3 is generally July 31 but can be extended by the government.

What is the structure of the ITR 3 form?

General Information:

In this segment, you are required to provide your personal particulars, including your name, address, date of birth, email address, and PAN number. Additionally, you’ll specify the assessment year and indicate whether you are filing your return as a self-assessment.

Income Details:

This section necessitates the disclosure of your income from various sources, encompassing salaries, pensions, annuities, family pensions, foreign assets (if any), and other avenues like investments & rental income. You will also calculate your total taxable income and the corresponding tax liability.

Deductions and Taxes Paid:

In this category, you have the opportunity to claim deductions permitted under various sections of the Income Tax Act. Additionally, you must report the taxes you have paid during the financial year, such as advance tax and self-assessment tax.

Computation of Tax Liability:

This section helps you calculate your tax liability based on the taxable income computed. It includes details of your tax computation, such as income tax, surcharge, and any relief claimed.

TDS/TCS Credit:

This division mandates the inclusion of details regarding any Tax Deducted at Source (TDS) or Tax Collected at Source (TCS) credits that apply to you.

Verification and Declaration:

In this final section, you are tasked with validating your return through either a digital signature or by dispatching a physical copy of the signed return to the Centralized Processing Center (CPC). Moreover, you must make a declaration affirming that all the information furnished in the return is accurate and true to the best of your knowledge.

How to file ITR 3?

In India, the process of filing ITR 3 involves a series of steps which have been mentioned below-

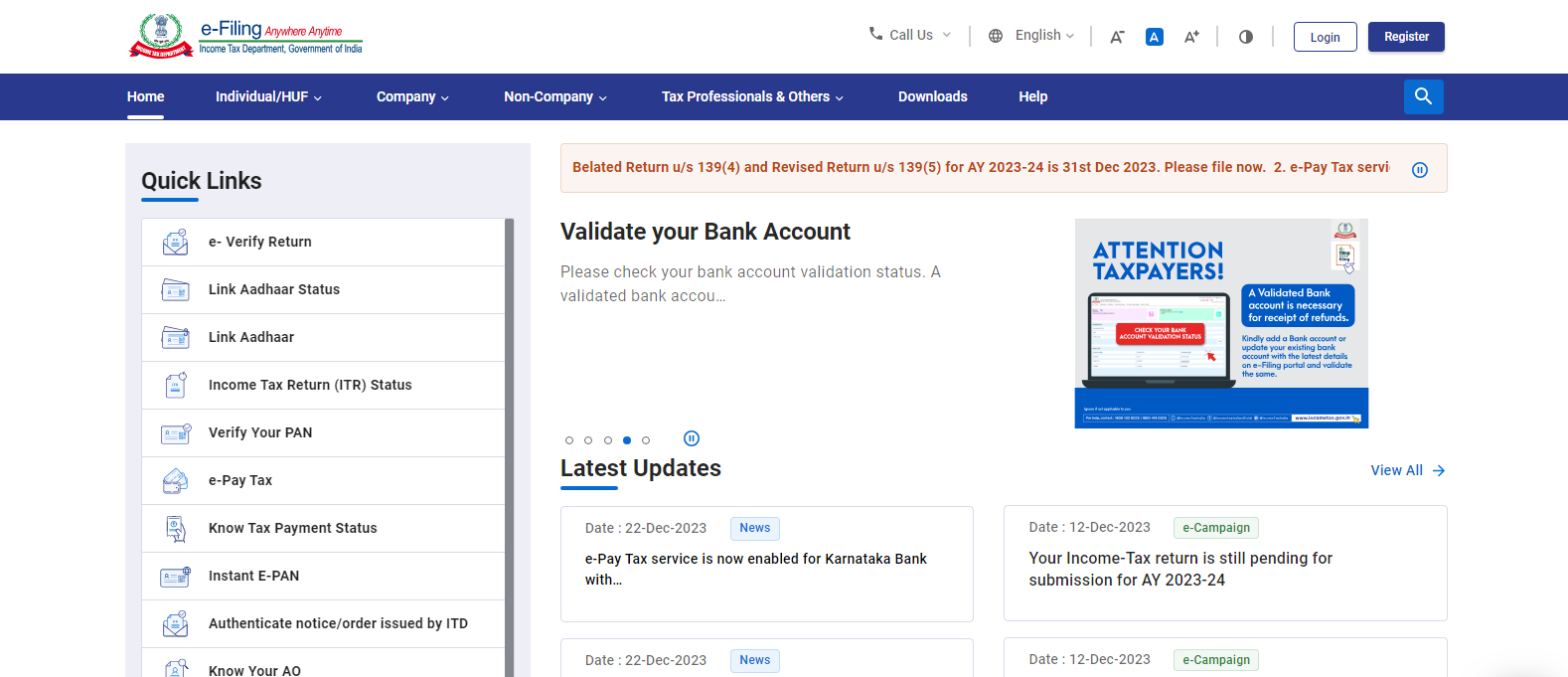

Step 1: Official website of e-filing

Firstly, you have to visit the official website for e-filing of income tax return which is https://www.incometax.gov.in/iec/foportal/

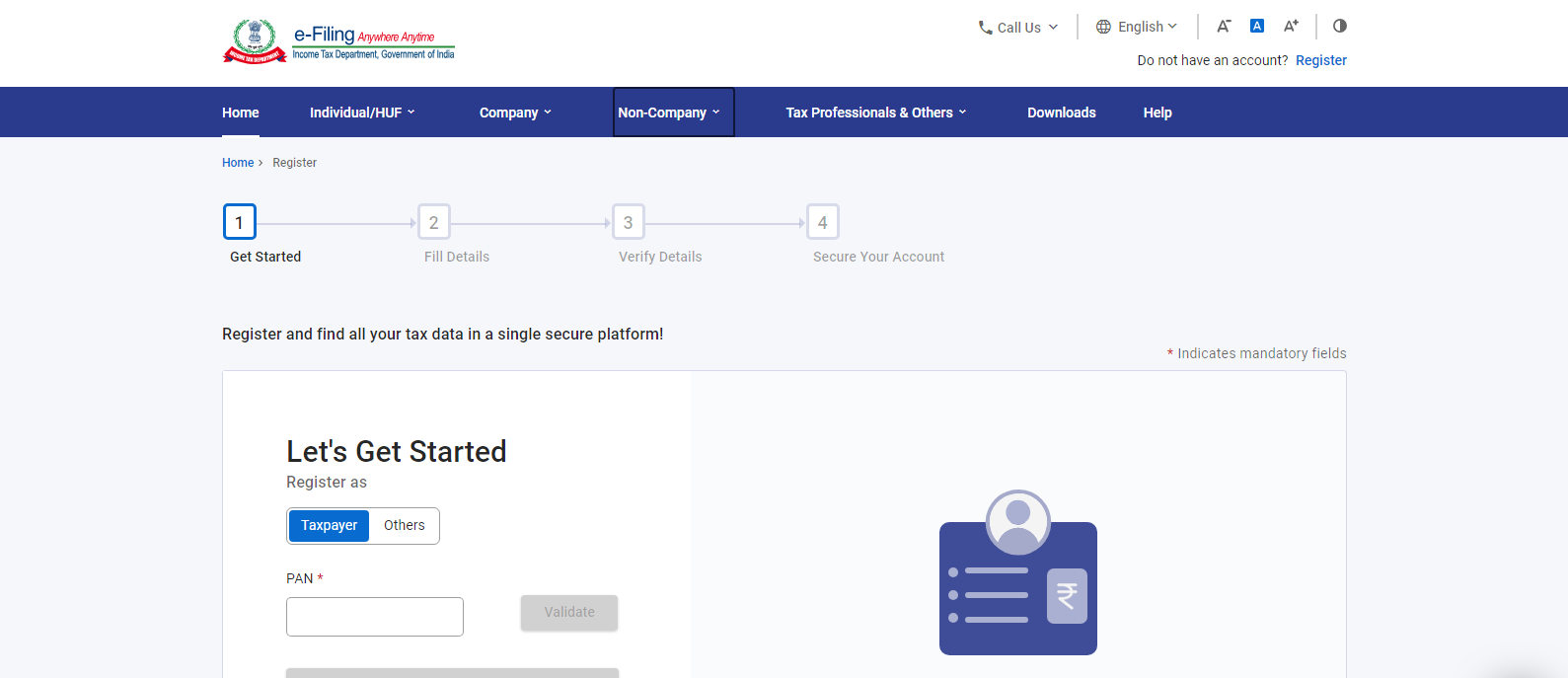

Step 2: Register/ Login

If you are a first-time user you have to register yourself

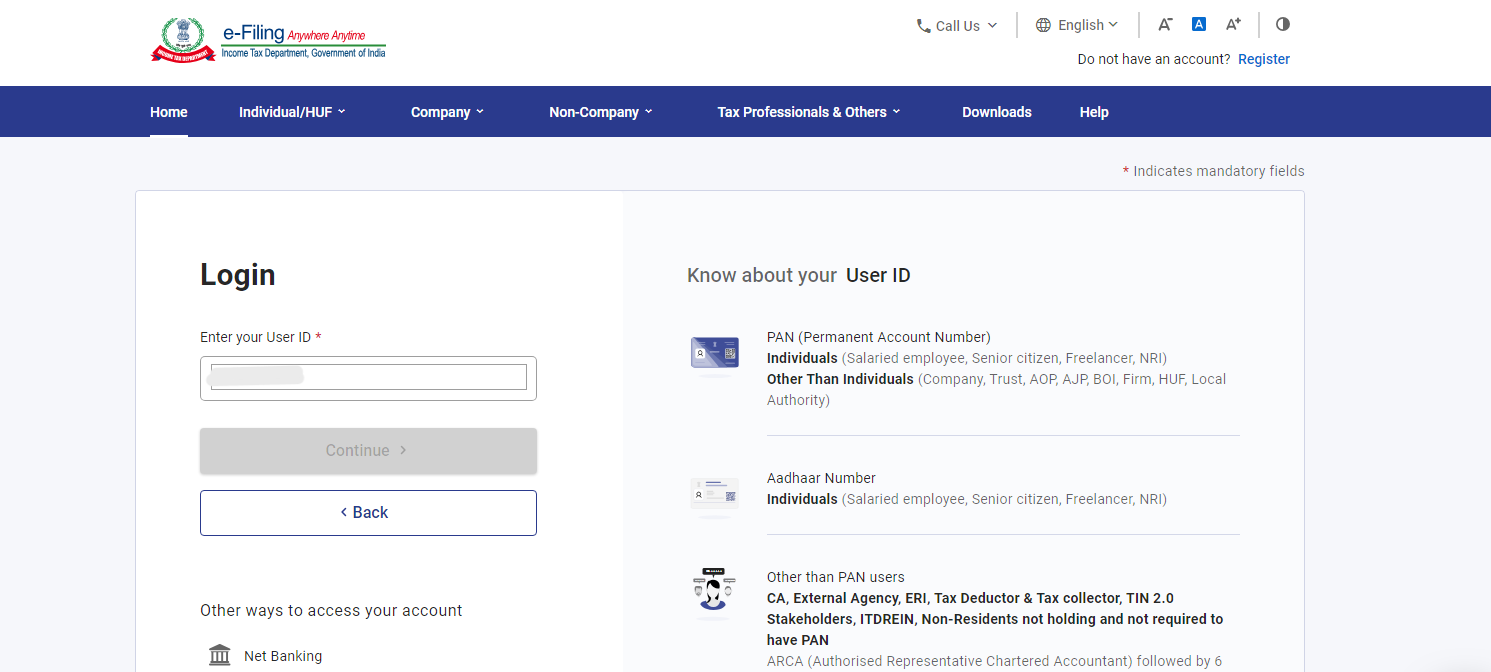

If you are a repeat user you have to log in to the website-

- You have to enter your PAN as your user id and then click ‘Continue’.

- You have to check the security message given in the tick box.

- Then, you have to enter your password & click on the ‘Continue’ button.

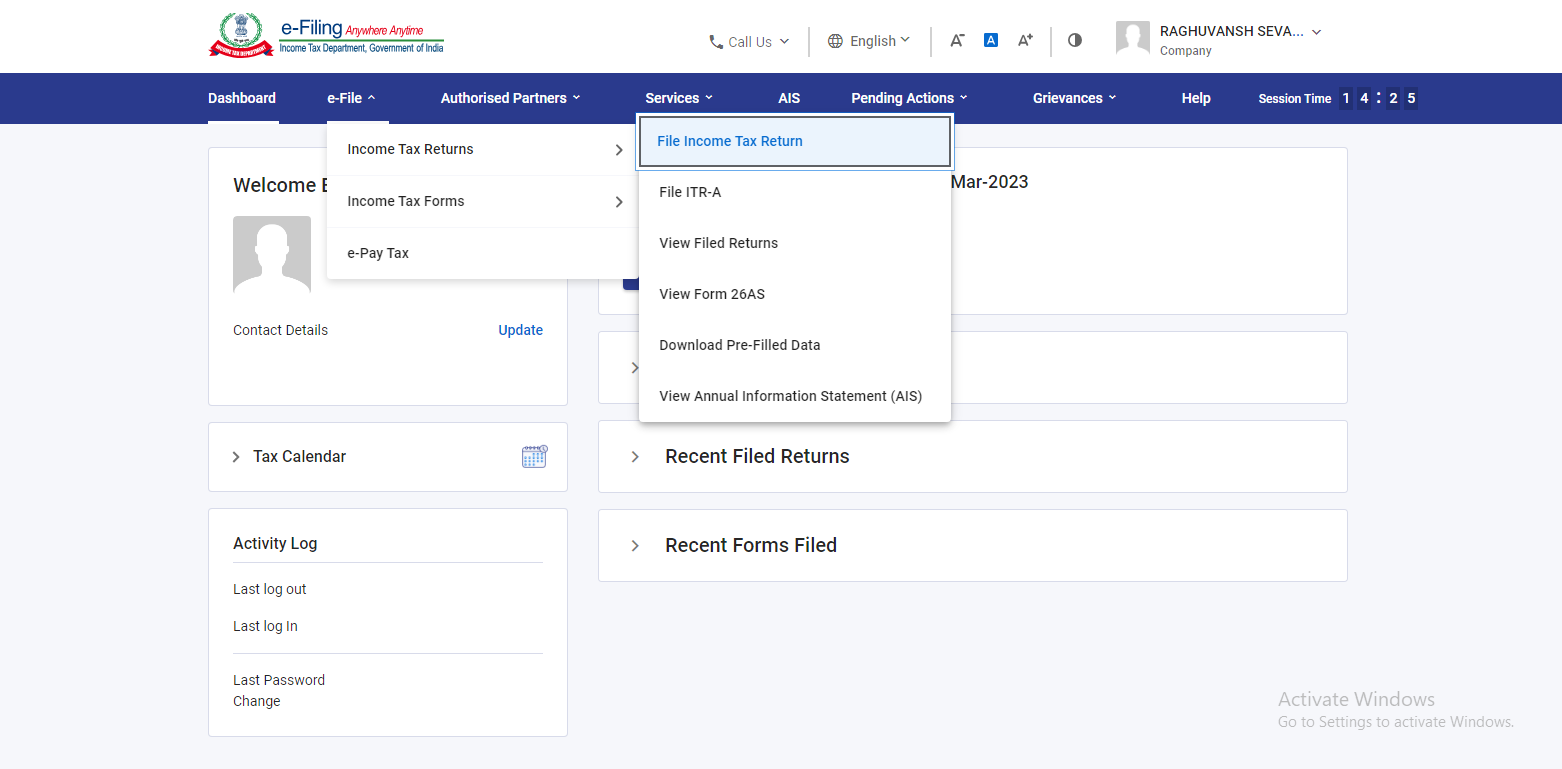

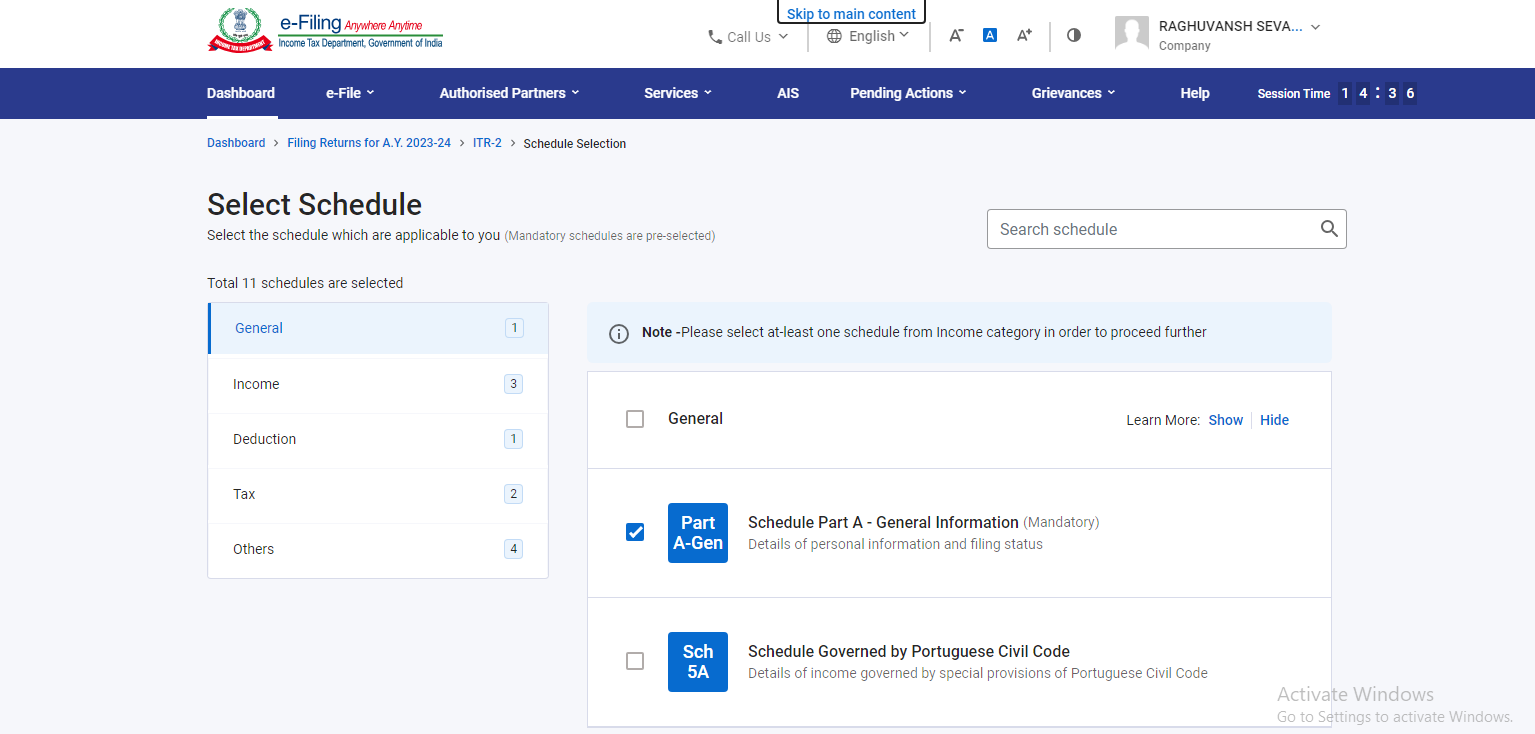

Step 3: Selecting the option of ‘File Income Tax Returns’

After logging in, you will see the e-file menu on the menu bar. When you click on the e–file menu then, you will get the option of ‘Income Tax Returns’ on clicking you will see the option of ‘File Income Tax Return’ and you have to click on that option.

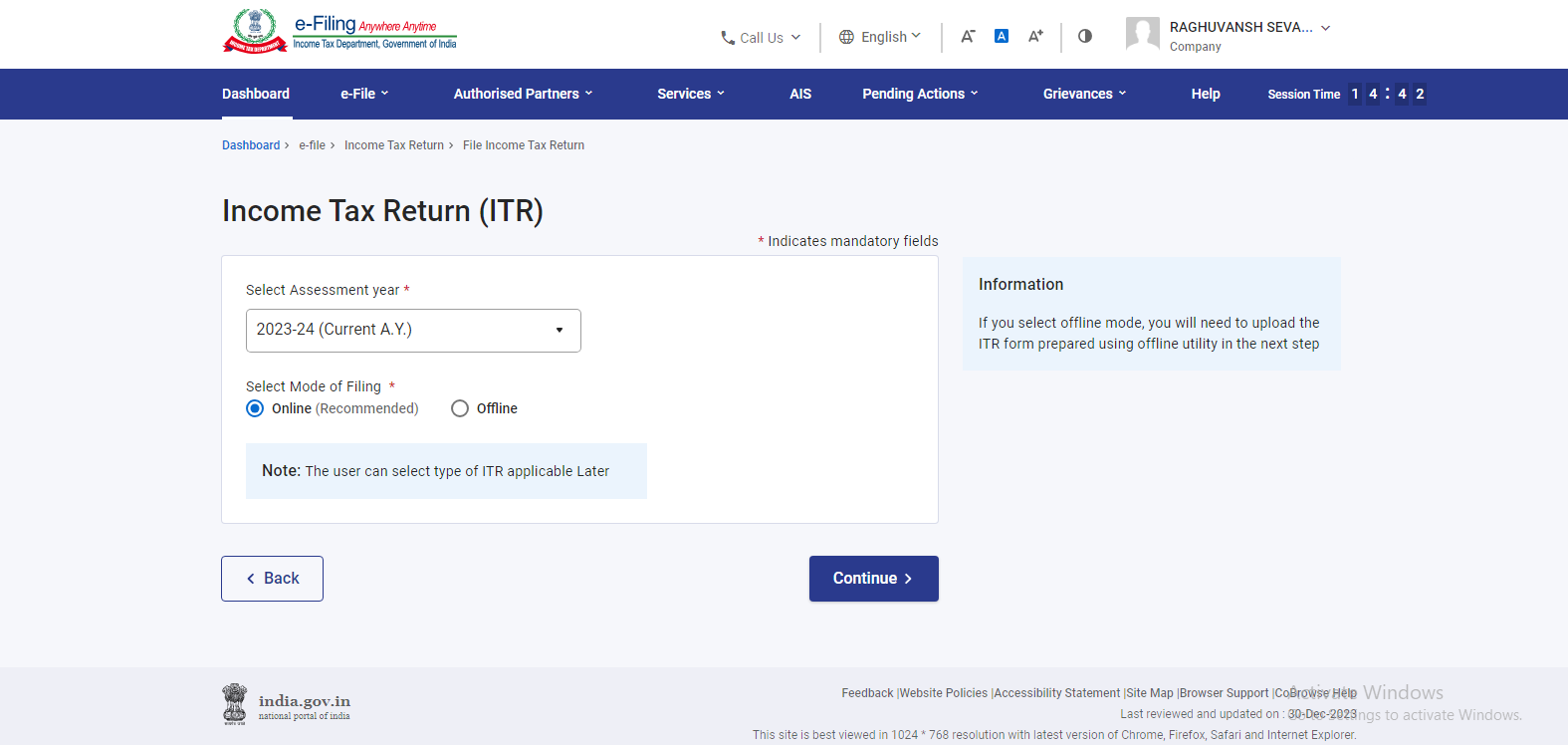

Step 4: Select the assessment year

You will be redirected to the page of Income Tax return where you have to select the ‘assessment year’ and the ‘mode of filing’ for which you wish to file the income tax return and then you have to click on ‘Continue’

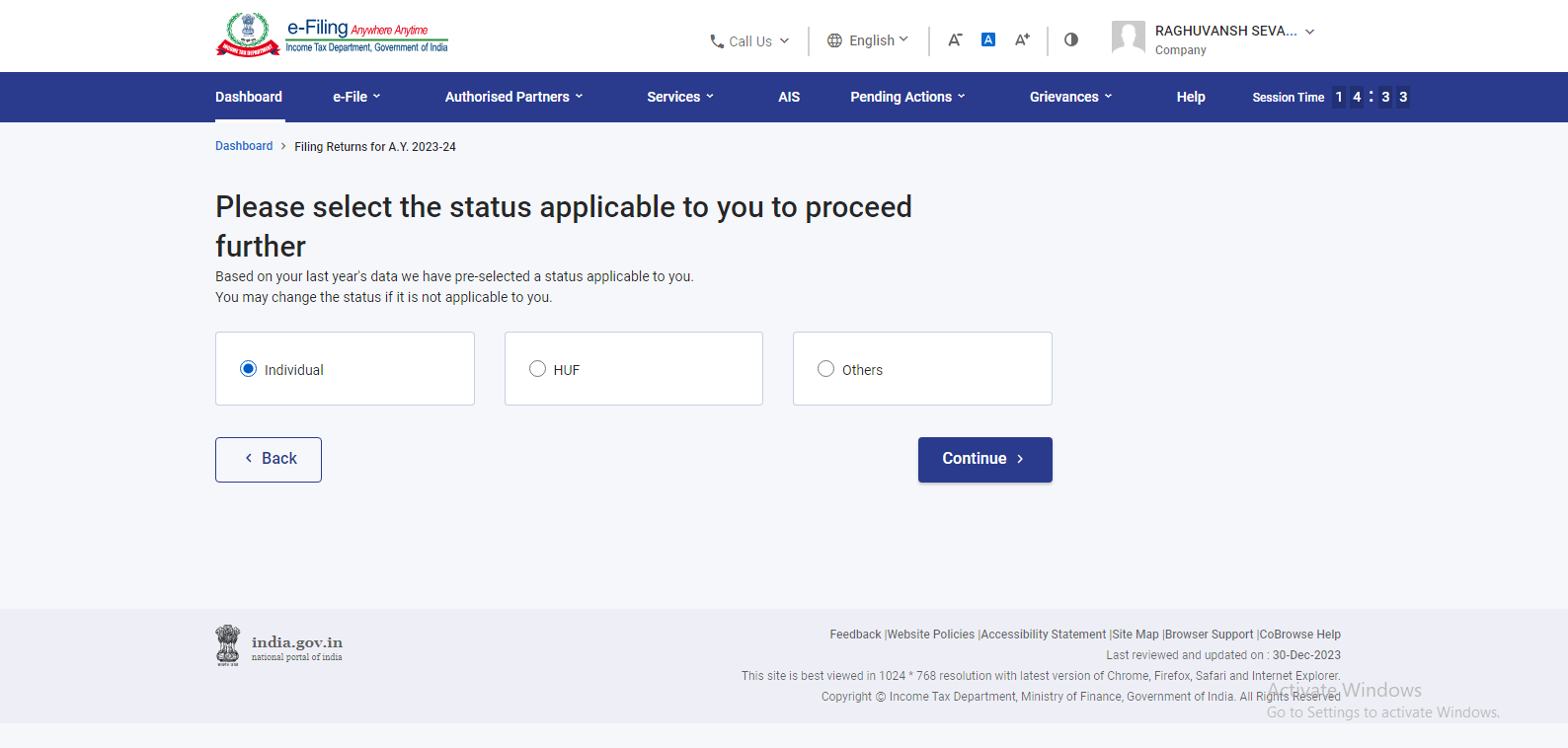

Step 5: Select the status

Then, you have to select the status of filing ITR as Individual and click on ‘Continue’

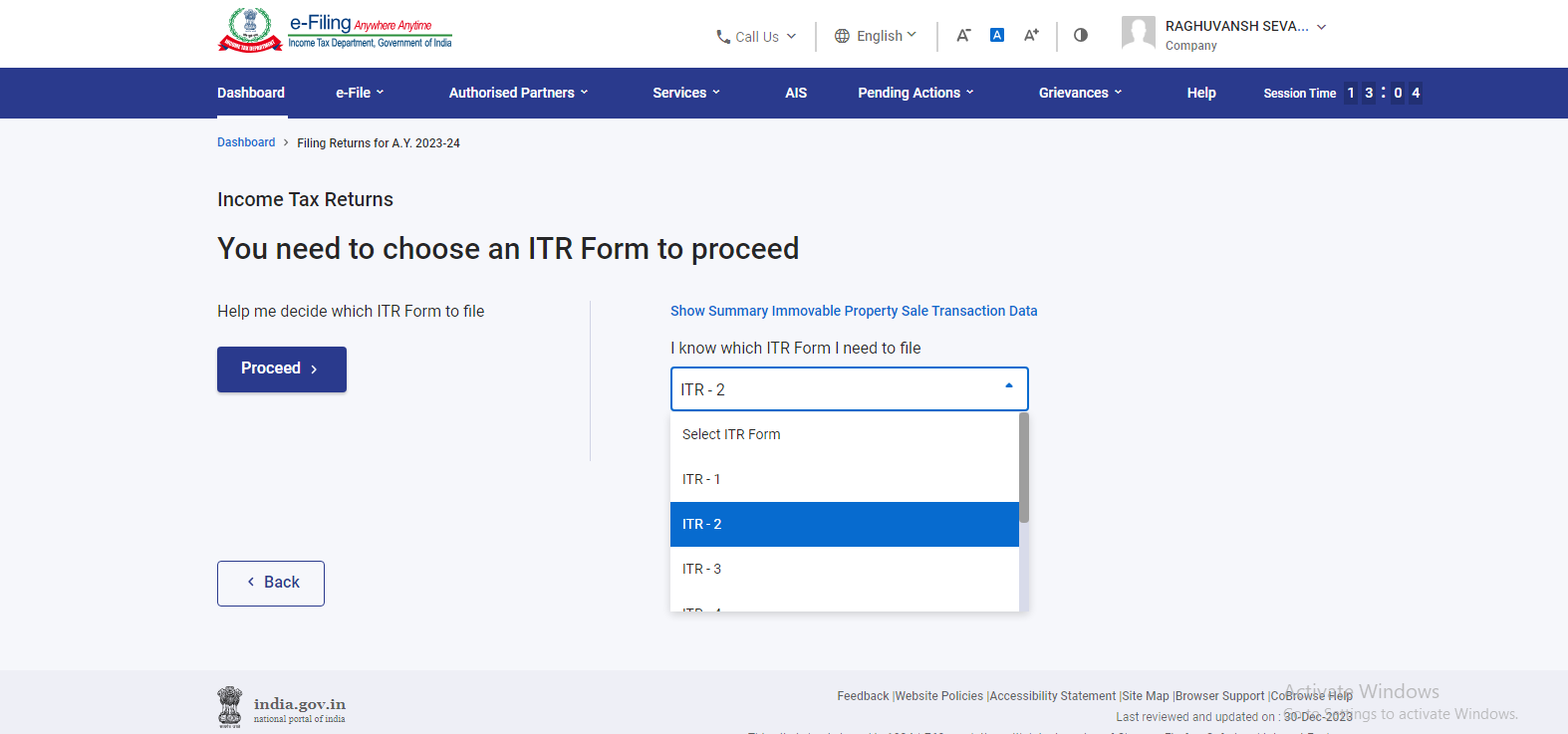

Step 6: Select the ITR type

After that, you have to select the type of ITR form where you have to choose the ITR 3

Step 7: Fill in the Online Form

Then, fill in the relevant schedules and the details in the ITR 3 form including your income from different sources and your claim of deductions under different sections of the Income Tax Act.

Step 8: Preview of ITR 3 form

You have to preview your ITR 3 form and verify all the information that has been provided in the form. If everything is correct then you have to click on the button ‘Submit’.

Step 9: e-verification of ITR

E- Verification of ITR is the most crucial step. Your Income Tax Return will be incomplete until you verify it. You have the option to e-verify the ITR via Aadhaar OTP, Net banking EVC i.e. Electronic Verification Code, or by sending a physical copy of the ITR to CPC Bengaluru.

Step 10: Submission & Acknowledgment

Once your ITR is successfully submitted and verified, you will receive an acknowledgment from the Income Tax Department.

Documents Required for ITR 3 Filing

Personal Information:

- PAN (Permanent Account Number) card.

- Aadhar card.

- Address proof (e.g., Aadhar card, passport, utility bill, etc.)

- Bank account details (account number, IFSC code)

Income Details:

- Salary and income details (if applicable)

- Business income details, including profit and loss statements and balance sheets

- Income from more than one house property (rental income or interest on a home loan)

- Capital gains details (if applicable)

- Any other sources of income (e.g., interest income, dividends, etc.)

Deductions and Exemptions:

- Details of eligible deductions under sections like 80C, 80D, 80G, etc.

- Investment proof for deductions (e.g., investment receipts, insurance premium receipts)

- Form 16 (if applicable, for salaried individuals)

- TDS (Tax Deducted at Source) certificates

Bank Statements:

- Bank statements for all your accounts for the financial year.

- Statements for savings accounts, fixed deposits, and any other financial transactions

Investment and Asset Details:

- Details of investments in shares, mutual funds, and other securities

- Details of foreign assets (if applicable)

- Details of assets and liabilities, including property and loans

Business and profession-specific documents:

- Books of accounts, including cash flow statements, profit and loss statements, and balance sheets

- Audit reports (if applicable)

- TDS certificates received from clients or customers

- Invoices and receipts for business transactions

Tax Payment Details:

- Challans or receipts of advance tax or self-assessment tax paid

- Proof of taxes deducted at source (TDS) and deposited

- Other Relevant Documents:

- Any notices or communications received from the Income Tax Department

- Previous years’ tax returns (for reference and carry-forward of losses)

Form 26AS:

- This form shows the details of the tax deducted from your income and deposited against your PAN. It can be downloaded from the income tax portal.

Digital Signature (if e-filing with a digital signature):

- If you choose to e-file with a digital signature, you’ll need your digital signature certificate.

Bank Account Details for the Refund:

- If you’re expecting a refund, provide accurate bank account details for the refund to be credited.

Make sure that the records and supporting documents for all the income, deductions, and investments that you have to report in your ITR-3 form are maintained properly. It is advisable to keep these documents safe for several years, as the Income Tax Department may ask for verification or an audit in the future. Additionally, consider seeking guidance from a CA near you for ITR filing to ensure that your tax return is accurate and complies with current tax laws and regulations.

Conclusion

ITR-3, also known as the Income Tax Return Form 3, is a specific form used by individuals and Hindu Undivided Families (HUFs) in India to file their income tax returns. It is primarily designed for individuals and HUFs who have income from business or profession.

ITR-3 serves as a crucial tool for taxpayers in India to report their income, deductions, and tax liability accurately, especially when they are engaged in business or professional activities. It helps taxpayers comply with their tax obligations and ensures that the government can assess and collect taxes effectively. It’s important to note that the specific requirements and regulations related to ITR-3 may change from year to year, so it’s essential to refer to the latest guidelines and consult the Income Tax Return Filing Agents near you for accurate and up-to-date information.

So, avoid the criteria of ‘ITR Filing Agents near me’ as LegalPillers is here to help you with the best CA and affordable ITR Filing fees by CA. Contact us for the best suggestions for filing ITR & correct information about different ITR forms.

(FAQs) about ITR-3 Filing (Income Tax Return Form 3) in India

-

What is ITR-3?

- ITR-3 is an income tax return form used by individuals and Hindu Undivided Families (HUFs) with income from business or profession.

-

Who can file ITR-3?

- Individuals and HUFs with income from a business or profession can file ITR-3

-

What are the modes of filing ITR-3?

- ITR-3 can be filed online (e-filing) on the official income tax website or physically by submitting a hard copy of the form.

-

What documents are required to file ITR-3?

- Documents such as PAN cards, Aadhaar cards, bank statements, income statements, and TDS certificates are typically required.

-

Can a salaried individual use ITR-3?

- No, salaried individuals should use ITR-1 or ITR-2, depending on their other income sources.

-

What is the due date for filing ITR-3?

- The due date varies each year but is generally July 31st, and it can be extended by the government.

-

What if I miss the deadline for filing ITR-3?

- Late filing can result in penalties and interest on tax dues.

-

Is it mandatory to e-file ITR-3?

- E-filing is mandatory for individuals with taxable income above a specified limit.

-

How is income from business or profession calculated for ITR-3?

- Income is calculated based on profit and loss statements, including revenue, expenses, and deductions.

-

Can I claim deductions in ITR-3?

- Yes, you can claim deductions under various sections of the Income Tax Act.

-

Is it necessary to maintain books of accounts for ITR-3?

- Individuals and HUFs with income from business or profession must maintain books of accounts.

-

Can I revise my ITR-3 after filing?

- Yes, you can revise ITR-3 within the specified time frame if you discover any errors or omissions.

-

Do I need to disclose foreign assets in ITR-3?

- Yes, if you have foreign assets, they should be disclosed as per the Foreign Assets and Income Reporting requirements.

-

What if ITR-3 shows a tax liability?

- You need to pay the tax liability before filing the return.

-

Can I file ITR-3 if I have exempt income?

- Yes, you should report all sources of income, including exempt income.

-

What is the penalty for incorrect information in ITR-3?

- Providing incorrect information can lead to penalties and legal consequences.

-

Can I file ITR-3 for multiple businesses?

- Yes, you can include income from multiple businesses or professions in a single ITR-3 form.

-

Can I file ITR-3 if I have losses in my business or profession?

- Yes, you can file ITR-3 even if you have incurred losses, but you need to follow the prescribed guidelines for reporting and carrying forward losses.

-

Is a tax audit required with ITR-3?

- A tax audit may be required if your business turnover exceeds the specified limit.

-

Where can I get help with filing ITR-3?

- You can seek assistance from a tax consultant, use online tax filing platforms, or refer to the official income tax website for guidance.

Leave a Reply