Table of Contents

All about ITR 6 for Income Tax Return filing

ITR-6 is a significant income tax return form for Income Tax Return filing used in India primarily by companies, encompassing both private and public limited companies, to fulfill their tax obligations and report their financial activities to the Income Tax Department. This comprehensive form plays a crucial role in tax compliance for corporate entities, offering a structured framework to disclose income, deductions, and tax liabilities under the Income Tax Act. ITR-6 consists of multiple sections, each catering to specific types of income and deductions. Companies must accurately report their income from various sources, such as business operations, capital gains, house property, and other avenues.

They can also claim deductions under various sections of the Income Tax Act to reduce their taxable income, thus optimizing their tax liability. Furthermore, ITR-6 mandates the submission of detailed financial statements, including balance sheets, profit and loss statements, and audited reports, ensuring transparency and accountability in tax reporting. Properly completing this form, maintaining precise financial records, and adhering to the specified filing deadlines is essential for companies to prevent penalties and legal complications. Thus, entities and tax professionals responsible for corporate tax compliance must remain up-to-date with the latest tax regulations and guidelines provided by the Income Tax Department to effectively manage corporate tax affairs in India or can consult with CA for filing Income Tax Return.

Who is eligible for ITR 6 Filing?

All the companies, both private and public limited, that have been registered under the Companies ct 2016 or earlier the Companies Act 1956 should have to use form ITR 6 for Income Tax Return filing.

Who is not eligible for ITR 6 Filing?

The ITR-6 form in India is specifically designed for companies, including both private and public limited companies, to file their income tax returns. Therefore, individuals, Hindu Undivided Families (HUFs), firms, Limited Liability Partnerships (LLPs), associations of persons (AOPs), body of individuals (BOIs), and other non-corporate entities are not eligible to file the ITR-6 form.

Here’s a breakdown of who cannot file the ITR-6 form:

-

Individuals

Individuals, including ITR Filing for Salaried Employees, self-employed individuals, and professionals, should use the appropriate ITR form based on their sources of income. For example, individuals with salary income typically use ITR-1, while those with business income use ITR-3 or ITR-4, depending on eligibility.

-

Hindu Undivided Families (HUFs)

HUFs have their own specific ITR forms, typically ITR-2, to file income tax returns.

-

Firms

Firms, which are separate legal entities distinct from their partners, should use the relevant ITR form based on their income and taxation requirements. Most firms use ITR-5, but those eligible for presumptive taxation can use ITR-4.

-

Limited Liability Partnerships (LLPs)

LLPs, as separate legal entities, generally use ITR-5. However, LLPs eligible for presumptive taxation can opt for ITR-4.

-

Associations of Persons (AOPs) and Body of Individuals (BOIs)

AOPs and BOIs are distinct entities with their own specific ITR forms, typically ITR-5 or ITR-7, depending on their characteristics and sources of income.

-

Other Non-Corporate Entities

Entities that do not fall under the category of companies and are not liable for corporate taxation should use the appropriate ITR form as per their tax profile.

-

Companies under Section 11

The companies whose income from property has been held for some charitable or religious can claim exemption as per section 11 but can’t file ITR 6 FOR Income Tax Return.

Income Tax Return last date for ITR 6 Filing

- If accounts are to be audited under the Income-Tax Act then, October 31 of the assessment year

- If the report in Form No. 3CEB is to be furnished then, November 30 of the assessment year

- In the other case (if there is no need to audit the accounts), July 31 of the assessment year

What is the structure of the ITR-6 Form?

The ITR-6 form in India is structured to accommodate the reporting requirements of companies, both private and public limited companies, for filing their income tax returns. It provides a systematic framework to report detailed financial information, including income, deductions, and tax liabilities. Here’s a general overview of the structure of the ITR-6 form:

Part A: General Information:

This section includes basic details about the taxpayer, including name, PAN (Permanent Account Number), address, contact information, and the assessment year for which the return is being filed.

Part A-BS: Balance sheet:

Here, the taxpayer has to report their financial position using a balance sheet of 31st March of the specified AY.

Part A: Manufacturing Account:

It includes details of the manufacturing account for the financial year 2023-24.

Part A: Trading Account:

It consists of the information on trading accounts for FY 2023-24.

Part A- P&L: Profit & Loss Account:

Here, you have to report about the Profit & Loss Account for FY 2023-24.

Part A: Manufacturing Account Ind- AS:

Details of the manufacturing account for companies whose financial statements are drawn up in compliance with the Indian Accounting Standards.

Part A: Trading Account Ind- AS:

Details of the trading account for companies whose financial statements are drawn up in compliance with the Indian Accounting Standards.

Part A: P & L Ind- AS:

Details of the profit and loss account for companies whose financial statements are drawn up in compliance with the Indian Accounting Standards.

Part A- OI: Other Information:

It includes the other financial information of the taxpayer’s income

Part A- QD: Quantitative Details:

Here, you have to provide the quantitative details of the various aspects of income.

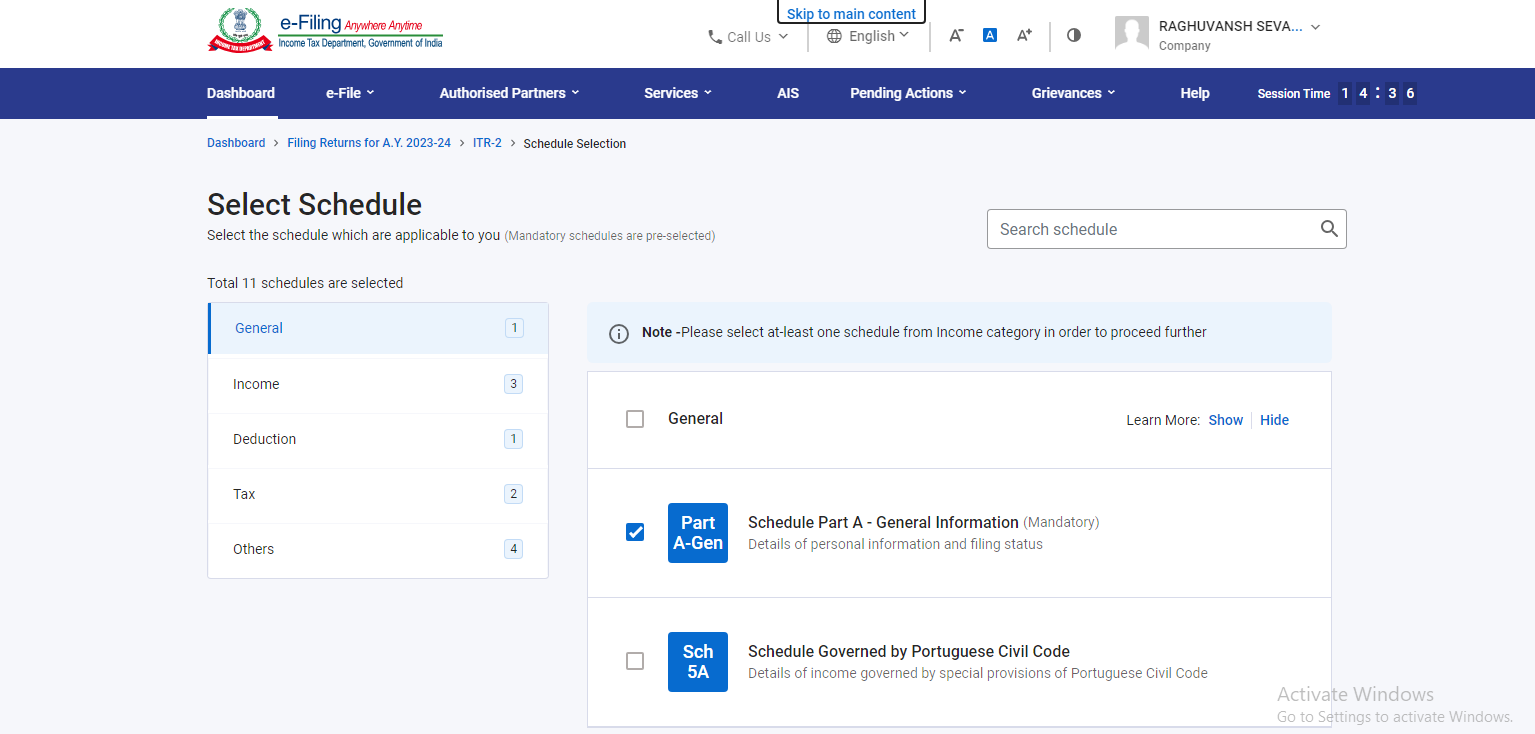

Schedules:

Several schedules may be attached to the ITR-6 form, depending on the entity’s specific circumstances. There are a total of 42 schedules.

Part B-TI: Total Income Computation:

In this section, you provide details of your income from various sources. This includes:

- Income from Salary or Pension

- Income from House Property

- Income from Capital Gains

- Income from Other Sources

Part B-TTI: Computation of Tax Liability:

This section helps you calculate your tax liability based on the taxable income computed in Part C. It includes details of your tax computation, such as income tax, surcharge, and any relief claimed.

Tax Payments:

This section includes the following details-

- Details of the payment of the advance tax & self-assessment tax.

- Details of TDS on income other than the salary (16A, 16B, 16C)

- Details of TCS

Other Information:

This part includes details related to tax payments, advance tax, self-assessment tax, and tax deducted at source (TDS) during the financial year.

Verification:

The entity or its authorized signatory must sign and verify the ITR-5 form, declaring the accuracy of the information provided.

Properly filling out each section of the ITR-6 form and attaching the necessary schedules and documents is essential for accurate tax reporting and compliance with the Income Tax Act. Companies should also refer to the latest version of the ITR-6 form and any accompanying instructions provided by the Income Tax Department to ensure they meet all tax requirements. For proper understanding, you can easily search as ‘Income Tax Return filing near me’.

How do I file my ITR-6 form?

Filing your ITR-5 form in India involves several steps, and you can choose to file it online or offline, depending on your preference and eligibility. Here’s a general overview of how to file your ITR-5:

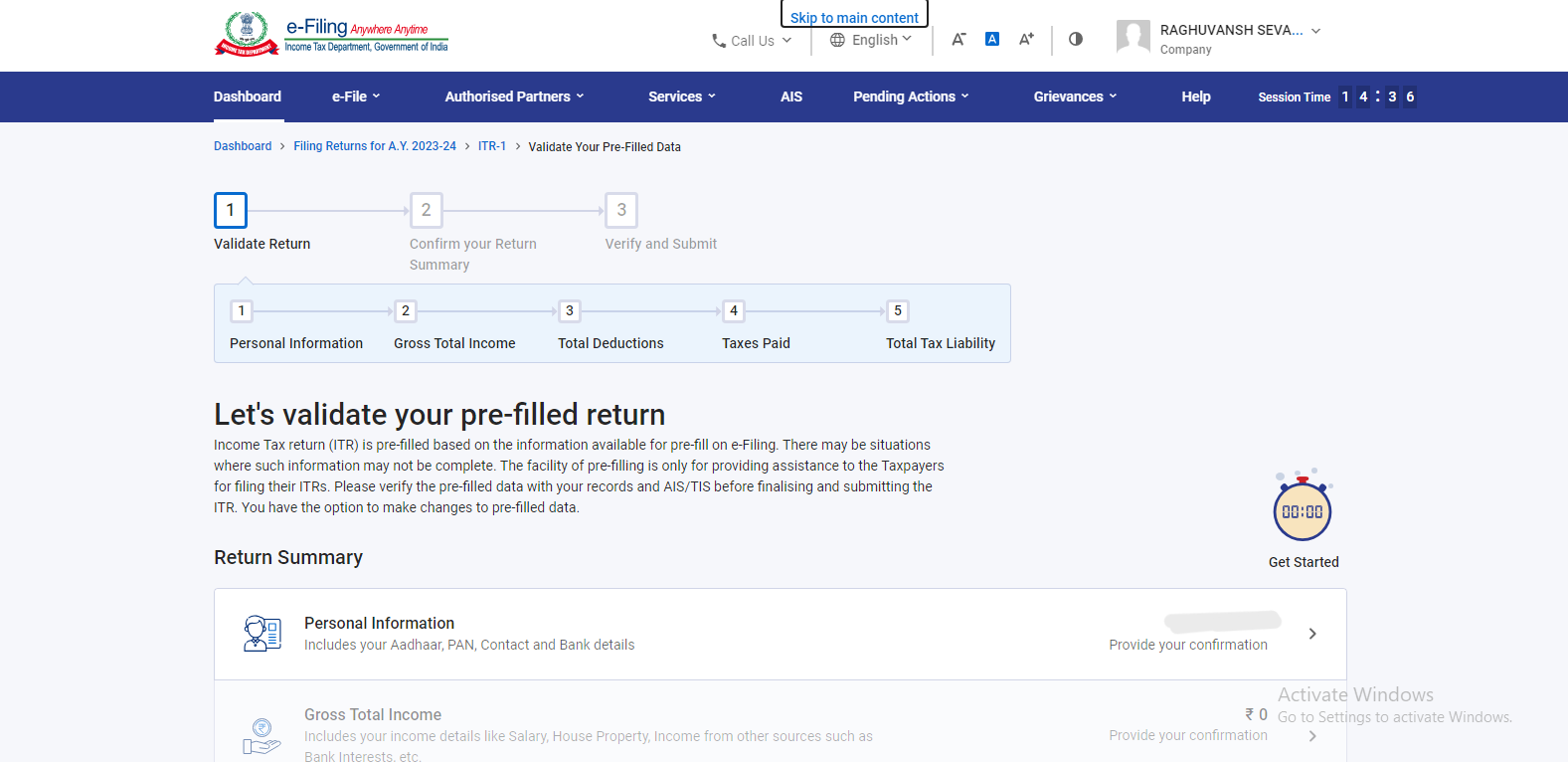

Online Filing (E-Filing):

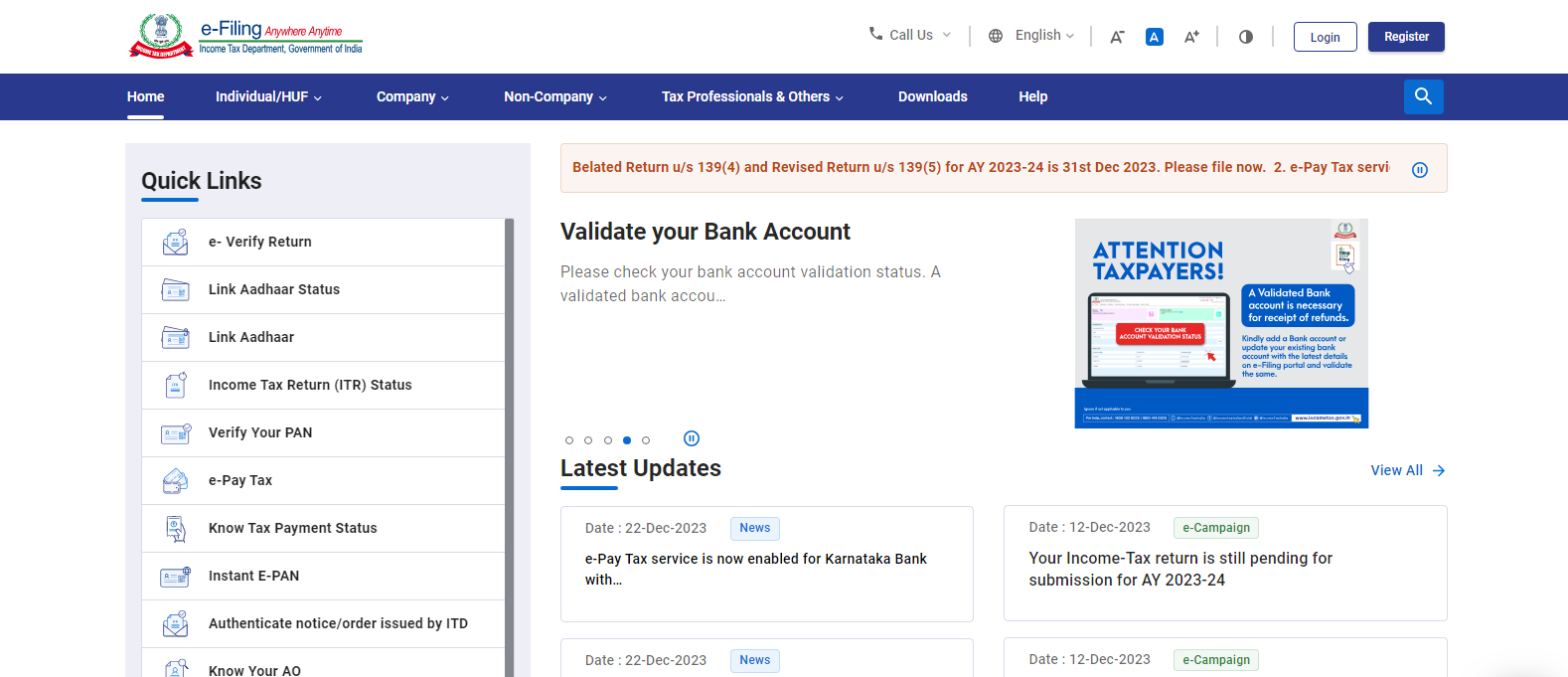

Step 1: Official website of e-filing

Firstly, you have to visit the official website for e-filing of income tax returns which is https://www.incometax.gov.in/iec/foportal/

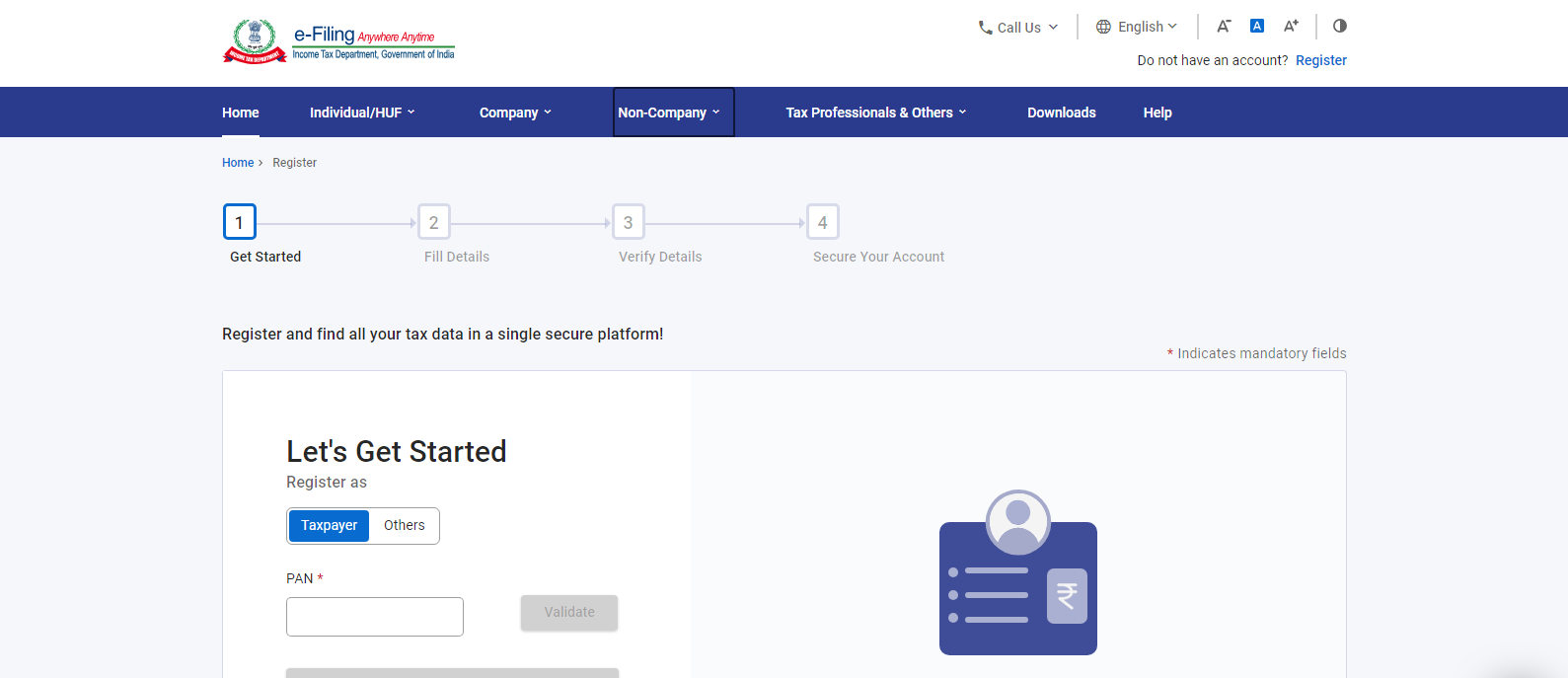

Step 2: Register/ Login

If you are a first-time user you have to register yourself

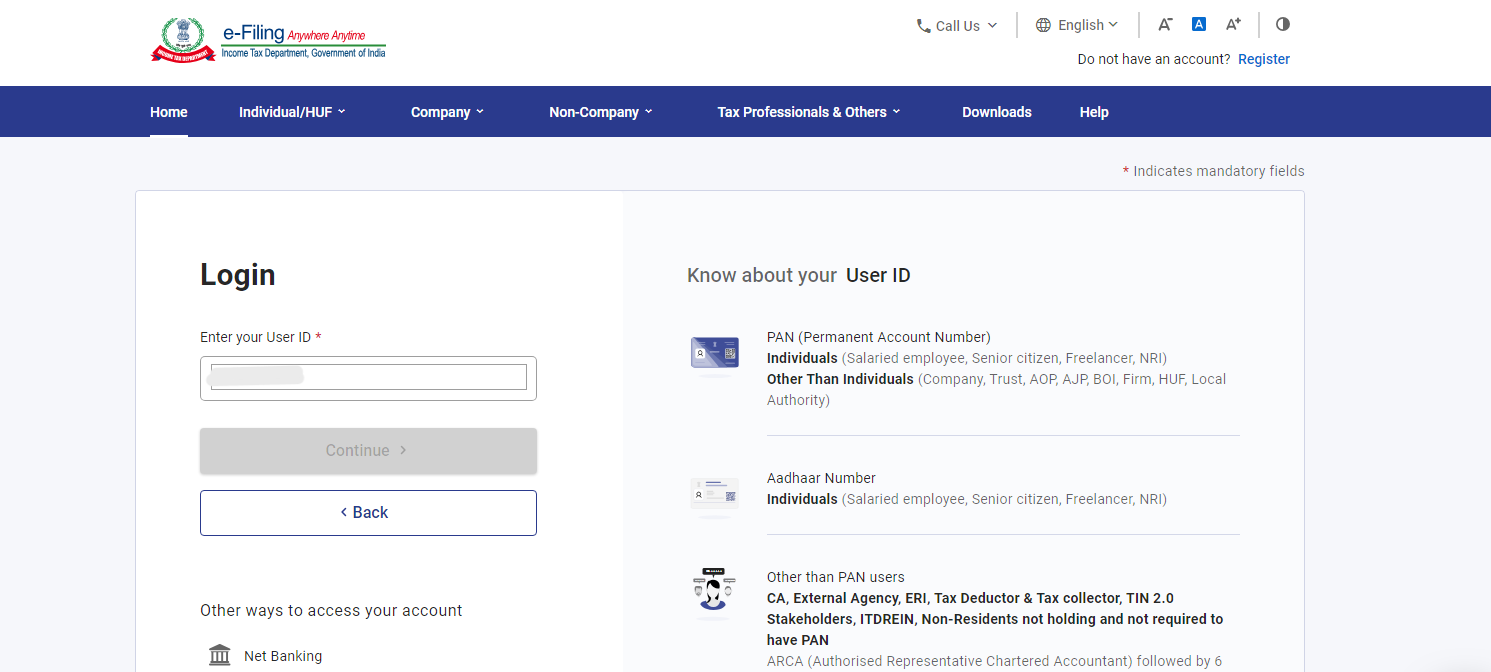

If you are a repeat user you have to log in to the website-

- You have to enter your PAN as your user id and then click ‘Continue’.

- You have to check the security message given in the tick box.

- Then, you have to enter your password & click on the ‘Continue’ button.

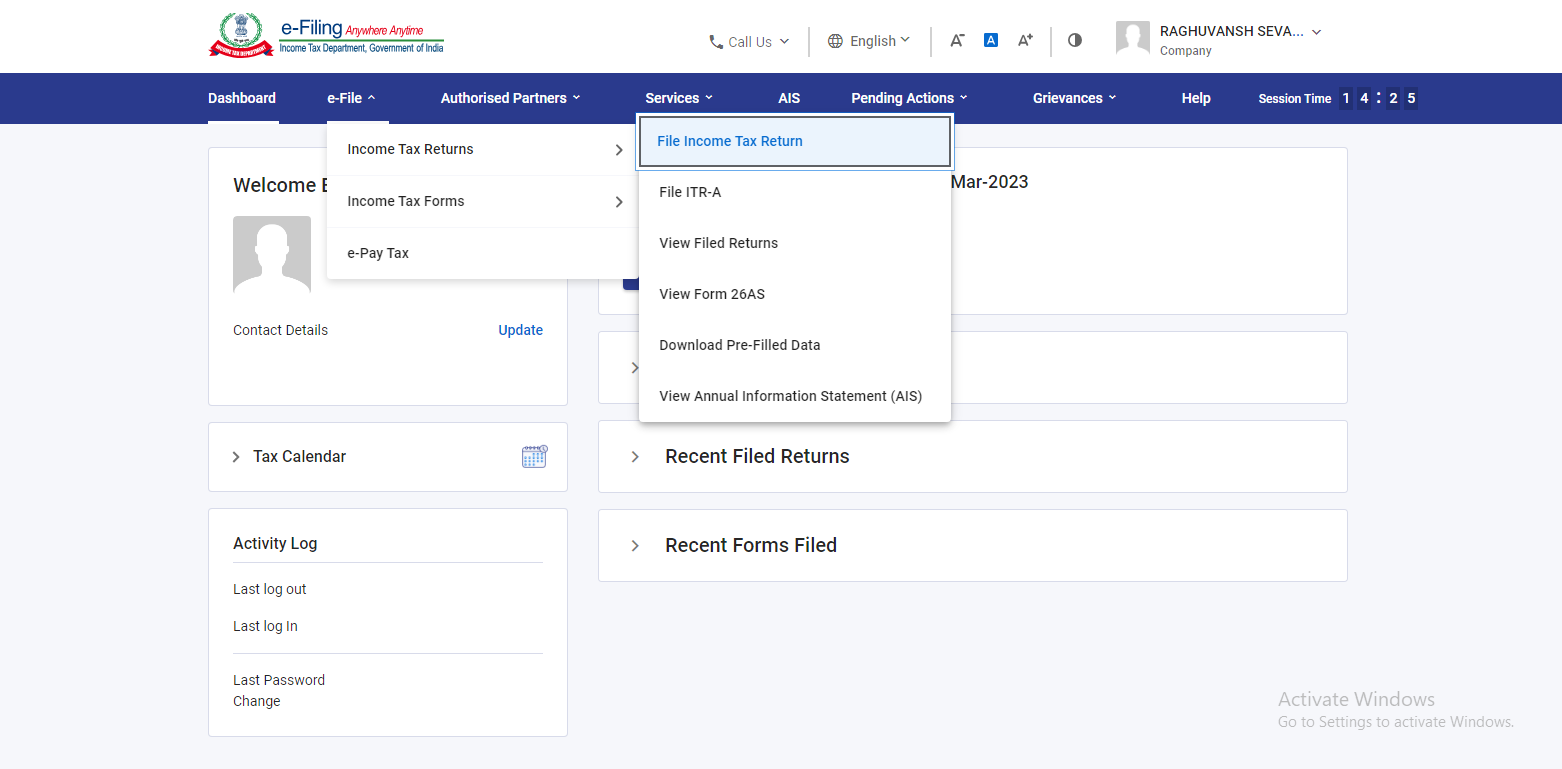

Step 3: Selecting the option of ‘File Income Tax Returns’

After logging in, you will see the e-file menu on the menu bar. When you click on the e–file menu then, you will get the option of ‘Income Tax Returns’ on clicking you will see the option of ‘File Income Tax Return’ and you have to click on that option.

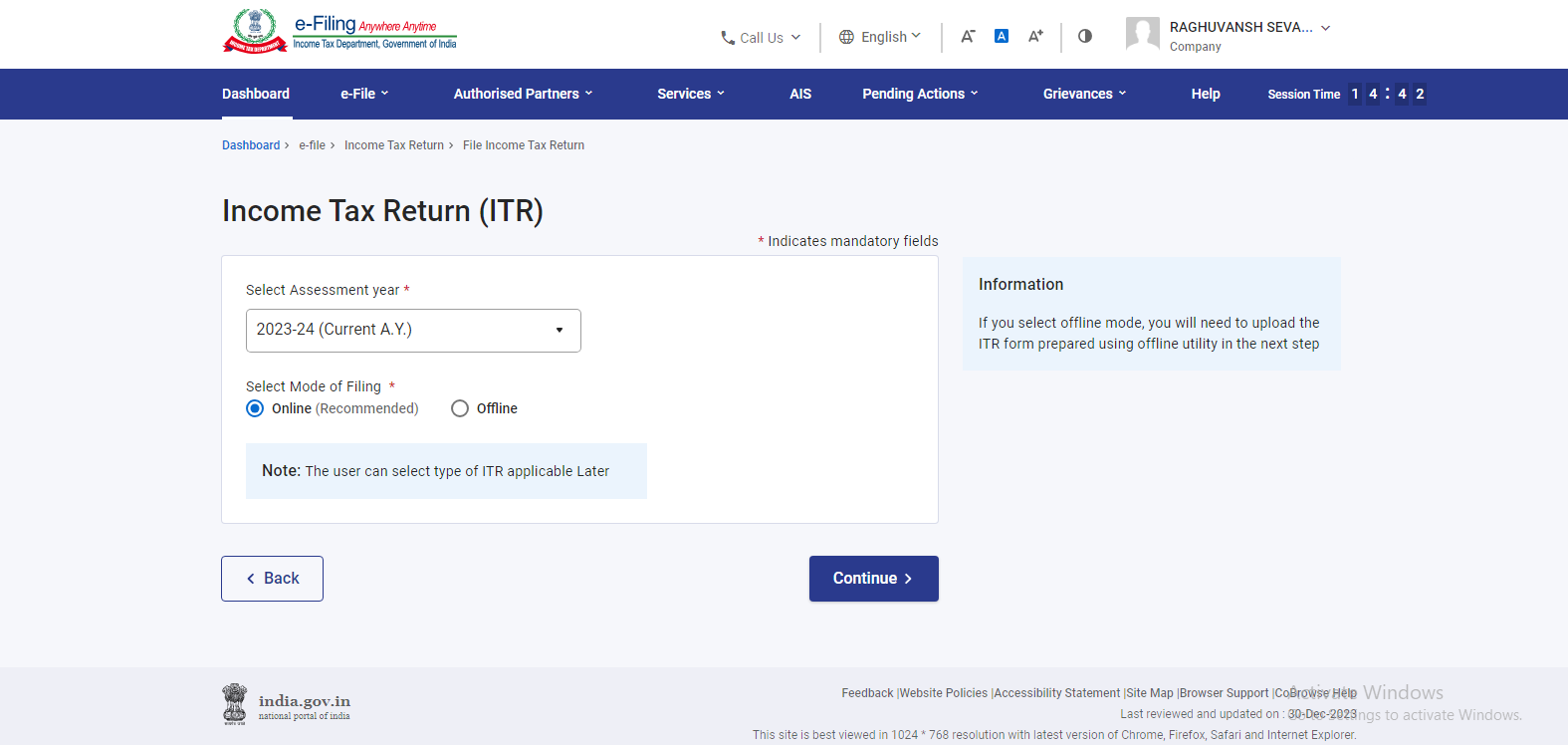

Step 4: Select the assessment year

Then, you will be redirected to the page of Income Tax return where you have to select the ‘assessment year’ and the ‘mode of filing’ for which you wish to file the income tax return, and then you have to click on ‘Continue’

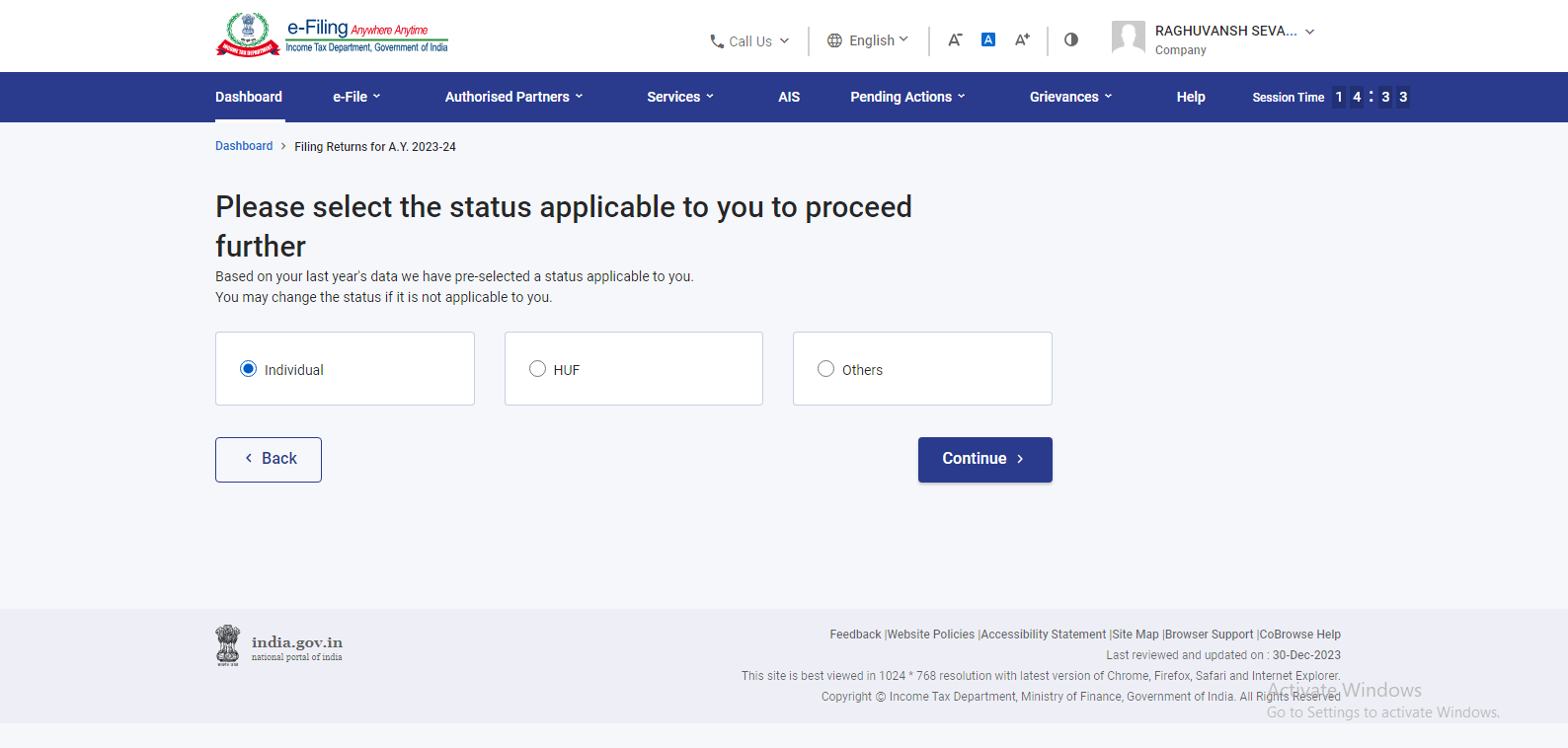

Step 5: Select the status

Then, you have to select the status of filing ITR among Individual, HUF, or others and click on ‘Continue’

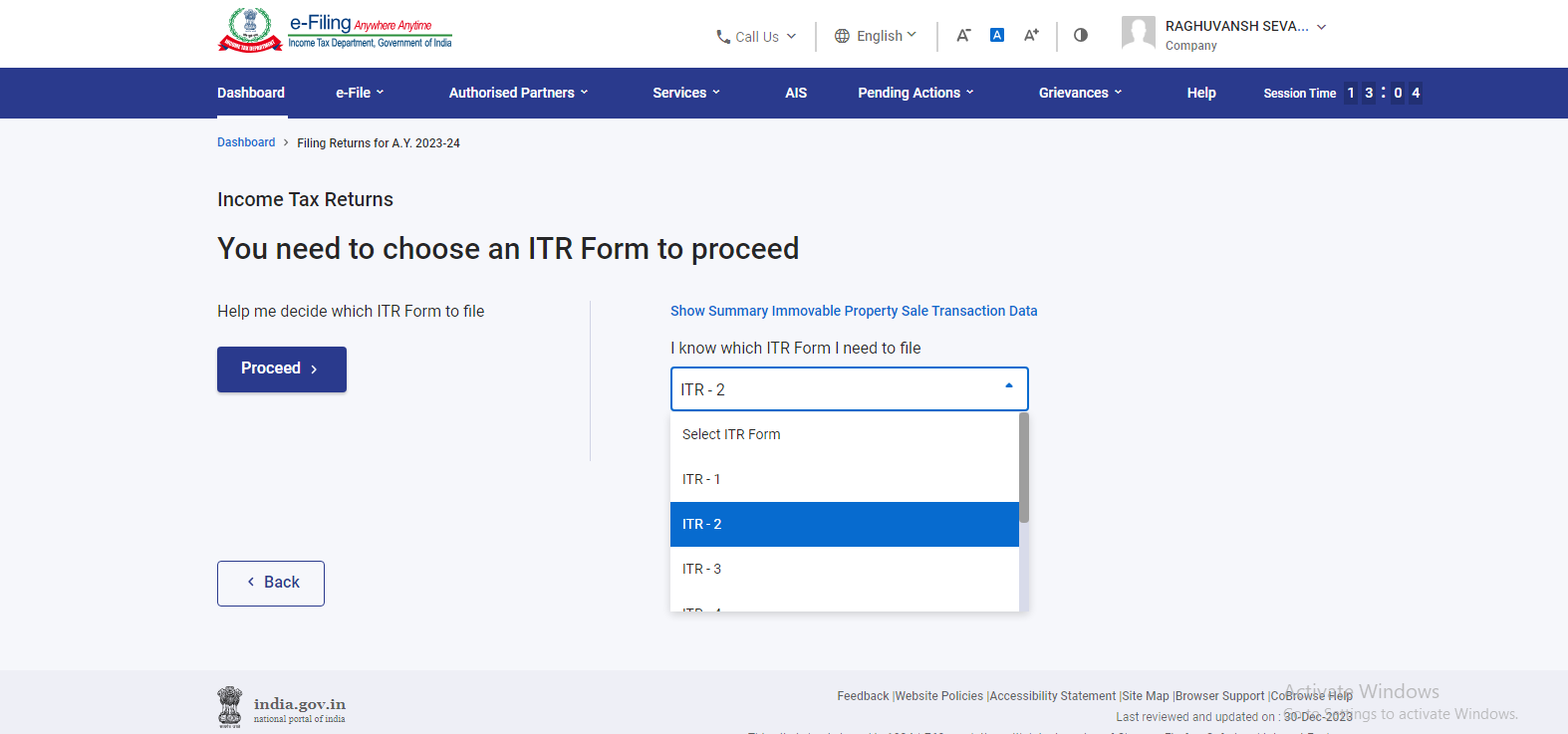

Step 6: Select the ITR type

After that, you have to select the type of ITR form where you have to choose the ITR 6

Step 7: Fill in the Online Form:

After which, you have to enter the details from the filled-out ITR 6 form into the online form on the e-filing portal including schedules. Double-check for accuracy.

Step 8: Submit bank account details

Then, you have to add your bank details. If already been submitted, then you have to make sure that it has been validated. You have to review the correctness of pre-filled information that has been appeared on the new page.

Step 9: Upload Digital Signature:

Then, you have to upload your digital signature for electronic verification.

Step 10: e-verification of ITR

After that, the e-verification of ITR is the most crucial step. Your Income Tax Return will be incomplete until you verify it. You have the option to e-verify the ITR via Aadhaar OTP, Net banking EVC i.e. Electronic Verification Code, or by sending a physical copy of the ITR to CPC Bengaluru.

Step 11: Submission of ITR

At last, you have to click on the ‘Submit’ button to submit your ITR. After submission, you will get the acknowledgment from the Income Tax department.

Offline Filing (Physical Submission):

-

Obtain a physical copy of the ITR-6 Form

Visit the Income Tax Department’s website or a local tax office to obtain a physical copy of the ITR-6 form.

-

Fill Out the Form

Carefully fill out the ITR-6 form, providing all the required information about your company’s income and deductions.

-

Verify Information

Double-check all the details on the form for accuracy and completeness.

-

Calculate Tax

Calculate your company’s tax liability based on the income and deductions you have reported.

-

Attach Documents

Attach all the necessary documents, such as financial statements, bank statements, and proof of deductions.

-

Sign the Form

Sign the physical copy of the ITR-6 form.

-

Submit the Form

Submit the signed ITR-6 form along with all supporting documents to the nearest Income Tax Office or designated centers.

Whether filing online or offline, it’s crucial to keep a copy of the filed return and any acknowledgment or ITR-V (if applicable) for future reference. Additionally, always file your company’s income tax return within the specified due date to avoid penalties and interest charges. If your company has complex financial situations or needs assistance, consider consulting a tax professional or CA near me for ITR filing for guidance during the filing process.

It’s essential for taxpayers to correctly identify their entity type and sources of income to choose the appropriate ITR form for filing their income tax returns. Using the wrong form can lead to filing errors and potential issues with tax authorities. If there is any confusion about the correct form to use, it is advisable to consult an Income Tax Return filing agents near me or seek guidance from the Income Tax Department to ensure compliance with tax regulations.

Details Required for ITR 6 Filing

Filing the ITR-6 form for your company in India requires you to gather various details to accurately report your company’s income and deductions. Here’s a list of documents and details typically required for filing ITR-6:

-

PAN Card

The details of the Permanent Account Number (PAN) card of the company are essential for filing income tax returns.

-

Audited Financial Statements

You need to provide the audited financial statements, including the balance sheet, profit and loss statement, and audit report.

-

Bank Statements

Gather bank statements for all the company’s bank accounts for the financial year. These statements help in verifying income and deductions.

-

Form 26AS

Obtain Form 26AS, which is an annual tax statement showing details of Tax Deducted at Source (TDS) and other tax-related information. You can access Form 26AS online through the Income Tax Department’s website.

-

Income Details

- Report income earned by the company from various sources, such as business operations, capital gains, house property, and other avenues.

- Specify the nature of income, such as trading income, interest income, rent income, dividend income, etc.

-

Deduction Details

- Claim deductions under various sections of the Income Tax Act to reduce the company’s taxable income. Common deductions include those under Sections 80C, 80D, 80G, and others.

- Provide accurate details of the deductions claimed.

-

Advance Tax and Self-Assessment Tax Payments

Include details of advance tax and self-assessment tax payments made during the financial year, including challans and receipts.

-

GST information (if applicable)

- Provide Goods and Services Tax (GST) information, including GSTIN (GST Identification Number) and GST-related documents, if the company is registered under GST.

- Provide Goods and Services Tax (GST) information, including GSTIN (GST Identification Number) and GST-related documents, if the company is registered under GST.

-

Bank Account Details

Bank account details of the company, including account numbers and IFSC codes, for receiving income tax refunds, if applicable.

10. Authorized Signatory Information

Details of the authorized signatory who will sign and verify the ITR-6 form on behalf of the company.

Ensure that fill these details properly, as they are essential for accurate tax reporting and compliance with the Income Tax Act.

Documents required for ITR 6 Filing

- There is no need to submit or affix any extra documents, paperwork, or TDS certificates with the Return form.

- If you affix any document with the Return form, you will get those documents back.

- It is a suggestion for the taxpayers to match the taxes deducted, collected, or paid by them with their Tax Credit Statement Form 26AS.

You should keep copies of the filed return, acknowledgment, and any other relevant documents for future reference and to fulfill tax laws and regulations. If your company has complex financial transactions or needs assistance, consider consulting a tax professional or ITR Filing agents near me for guidance during the filing process.

Conclusion

The ITR-6 form in India is a vital tool for companies for ITR filing, including both private and public limited companies, to fulfill their income tax obligations and report their financial activities to the Income Tax Department.

It offers a structured framework for reporting income, claiming deductions, and calculating tax liabilities in compliance with the Income Tax Act. Accurate and timely filing of ITR-6 is crucial for companies to meet their tax responsibilities and adhere to tax regulations. Companies should gather and maintain the necessary financial documents, including audited financial statements, bank statements, and proof of income and deductions, to ensure accurate tax reporting. Seeking professional assistance, when necessary, can help ensure precise filing and compliance with tax laws, allowing companies to effectively manage their tax affairs in India.

LegalPillers is just one click away from you. Generally, ITR Filing fees by CA are very high. LegalPillers is here to reduce the tension of filing an ITR and provide you the best service to file an ITR with affordable fees. Contact us and reduce your tax law-related tension.

(FAQs) related to ITR 6 Filing (Income Tax Return-6) in India:

What is ITR-6?

- ITR-6 is an income tax return form used by companies, both private and public limited companies, to file their income tax returns in India.

-

Who can file ITR-6?

- ITR-6 is specifically designed for companies, including those liable for corporate taxation, to report their financial activities and fulfill their tax obligations.

-

Is Aadhaar linking mandatory for ITR 6 filing?

- Yes, linking Aadhaar with PAN is mandatory for filing income tax returns, including ITR-6.

-

What is the due date for ITR 6 Filing?

- The due date for filing ITR-6 varies each year and can be extended by the Income Tax Department. It is typically on or before July 31st of the assessment year.

-

Can I file ITR-6 electronically?

- Yes, ITR-6 can be filed electronically through the Income Tax Department’s e-filing portal.

-

What are the key sections of ITR-6?

- ITR-6 includes sections for general information, income details, deductions, computation of tax payable, and other financial disclosures.

-

What documents are needed for ITR 6 Filing?

- Documents include PAN card, Aadhaar card, audited financial statements, bank statements, Form 26AS, income and deduction proofs, and relevant financial records.

-

Can ITR-6 be revised after filing?

- Yes, you can file a revised return using ITR-6 if you discover errors or omissions in your original filing.

-

What is Form 26AS, and why is it important for ITR-6?

- Form 26AS is an annual tax statement that shows details of Tax Deducted at Source (TDS) and other tax-related information. It is essential for cross-verification while filing ITR-6.

-

Is GST information required for ITR-6?

- If applicable, GST information may need to be provided, especially for companies registered under GST.

-

Is a tax audit required for companies ITR 6 Filing?

- A tax audit may be required for companies meeting specified turnover or gross receipts thresholds under the Income Tax Act.

-

What is the penalty for late filing of ITR-6?

- Late filing can attract penalties and interest as per the Income Tax Act. The penalty amount depends on the delay period.

-

Can ITR-6 be filed offline (physically)?

- No, ITR-6 can only be filed electronically. Offline filing is not available for this form.

-

What is the role of an authorized signatory in ITR-6?

- The authorized signatory is responsible for signing and verifying the ITR-6 form on behalf of the company.

-

What is the consequence of providing incorrect information in ITR-6?

- Incorrect information can lead to penalties, fines, or legal consequences, so accuracy is crucial.

-

Is it advisable to seek professional help for ITR 6 Filing?

- Companies with complex financial transactions or doubts about tax compliance may benefit from consulting a tax professional or chartered accountant.

-

Can a company file ITR-6 if it has income from other sources besides business operations?

- Yes, companies can report income from various sources in ITR-6, but they should provide accurate details in the relevant sections.

-

Is there a difference between ITR-6 and ITR-7?

- Yes, ITR-6 is for companies, while ITR-7 is for entities that do not fall under the definition of companies but are liable to file returns under specific sections of the Income Tax Act.

-

Where can I get the latest version of the ITR-6 form and instructions for filing?

- The latest version of the ITR-6 form and filing instructions can be found on the official website of the Income Tax Department of India.

-

Can a foreign company operating in India use ITR-6 for tax filing?

- Foreign companies operating in India should file their tax returns using the appropriate form based on their tax status and income sources in India. ITR-6 is generally for Indian companies.

Leave a Reply