Table of Contents

All About ITR-7 for Income Tax Return Filing

ITR-7 is an income tax return form in India for Income Tax Return Filing, designed for entities and individuals who are required to furnish returns under Sections 139(4A), 139(4B), 139(4C), and 139(4D) of the Income Tax Act, 1961. These entities include trusts, charitable institutions, political parties, educational institutions, and other entities mentioned in the sections. ITR-7 serves as a comprehensive tool for reporting income, deductions, and tax liabilities, ensuring compliance with tax laws. It requires detailed information about the entity’s income from various sources, such as business, capital gains, house property, and other avenues, along with a breakdown of deductions claimed under different sections of the Income Tax Act.

Moreover, ITR-7 mandates the submission of audited financial statements and related audit reports, adding an extra layer of transparency and accountability to tax reporting for these entities. Accurate and timely filing of ITR-7 is crucial to meet tax obligations and fulfill legal requirements, and entities should maintain meticulous records and seek professional guidance from CA for filing Income Tax Return, if necessary, to navigate the complexities of tax compliance in India.

Who is eligible for ITR 7 Filing?

Individuals and associations who claim exemptions as per sections 139(4A), 139(4B), 139(4C), and 139(4D) of the Income Tax Act are eligible to file ITR 7. The individuals, companies, or associations who are eligible to file ITR 7 for Income Tax Returns Filing are given below-

- Individuals who receive income from the property if the property is in the name of the trust.

- Individuals who receive income for the purpose of charity or a religious offering.

- Any political party that earns a net income exceeding the non-taxable income.

- Scientific Research Associations

- News Organizations and Companies

- Educational institutions including Schools, Colleges, and Universities

- Medical institutions including hospitals, clinics, etc.

- Organizations that have been mentioned in Section 10(23A) & Section 10(23B).

Who is not eligible for ITR 7 Filing?

Individuals, Hindu Undivided Families (HUFs), firms, Limited Liability Partnerships (LLPs), associations of persons (AOPs), bodies of individuals (BOIs), and other non-corporate entities that do not seek exemptions as per Sections 139(4A), 139(4B), 139(4C), and 139(4D) of the Income Tax Act are not eligible to file the ITR-7 form. For ITR Filing for Salaried Employees, taxpayers can’t use the ITR 7 form.

Income Tax Return last date for ITR 7 Filing

- If accounts are to be audited under the Income-Tax Act then, September 30 of the assessment year will be the due date to file ITR 7.

- In the other case (if there is no need to audit the accounts), July 31 of the assessment year will be the due date to file ITR 7.

What is the structure of the ITR-7 Form?

The ITR-7 form in India is structured to cater to the specific reporting requirements of entities and individuals who are required to furnish returns under Sections 139(4A), 139(4B), 139(4C), and 139(4D) of the Income Tax Act, 1961. It is primarily used by trusts, charitable institutions, political parties, educational institutions, and other entities falling under these sections. Here’s an overview of the structure of the ITR-7 form:

Part A: General Information:

This section collects basic information about the entity or individual filing the return. It includes details such as the name, address, PAN, and contact information.

Schedules:

Depending on the specific nature and activities of the entity, various schedules may need to be attached to the ITR-7 form. These schedules provide additional details and disclosures related to income, expenses, donations, and other financial aspects.

Part B-TI: Total Income Computation:

In this section, you provide details of your income from various sources. This includes:

- Income from Salary or Pension

- Income from House Property

- Income from Capital Gains

- Income from Other Sources

Part B-TTI: Computation of Tax Liability:

This section helps you calculate your tax liability based on the taxable income computed in Part C. It includes details of your tax computation, such as income tax, surcharge, and any relief claimed.

Tax Payments:

This section includes the following details-

- Details of the payment of the advance tax & self-assessment tax.

- Details of TDS on income other than the salary (16A, 16B, 16C)

- Details of TCS

Other Information:

This part includes details related to tax payments, advance tax, self-assessment tax, and tax deducted at source (TDS) during the financial year.

Verification:

The verification section includes a declaration to be signed by the authorized signatory of the entity, certifying the accuracy of the information provided in the return.

Properly filling out each section and attaching any required schedules and documents is crucial to ensure accurate tax reporting and compliance with the Income Tax Act. Entities and individuals filing ITR-7 should also refer to the latest version of the form and any accompanying instructions provided by the Income Tax Department to meet all tax requirements or you can consult the Income Tax Return filing Agents near me.

How to file ITR 7?

Filing your ITR-7 form in India involves several steps, and you can choose to file it online or offline, depending on your preference and eligibility. You can seek advice by simply searching ‘Income Tax Return Filing near me’. Here’s a general overview of how to file your ITR-7:

Online Filing (E-Filing):

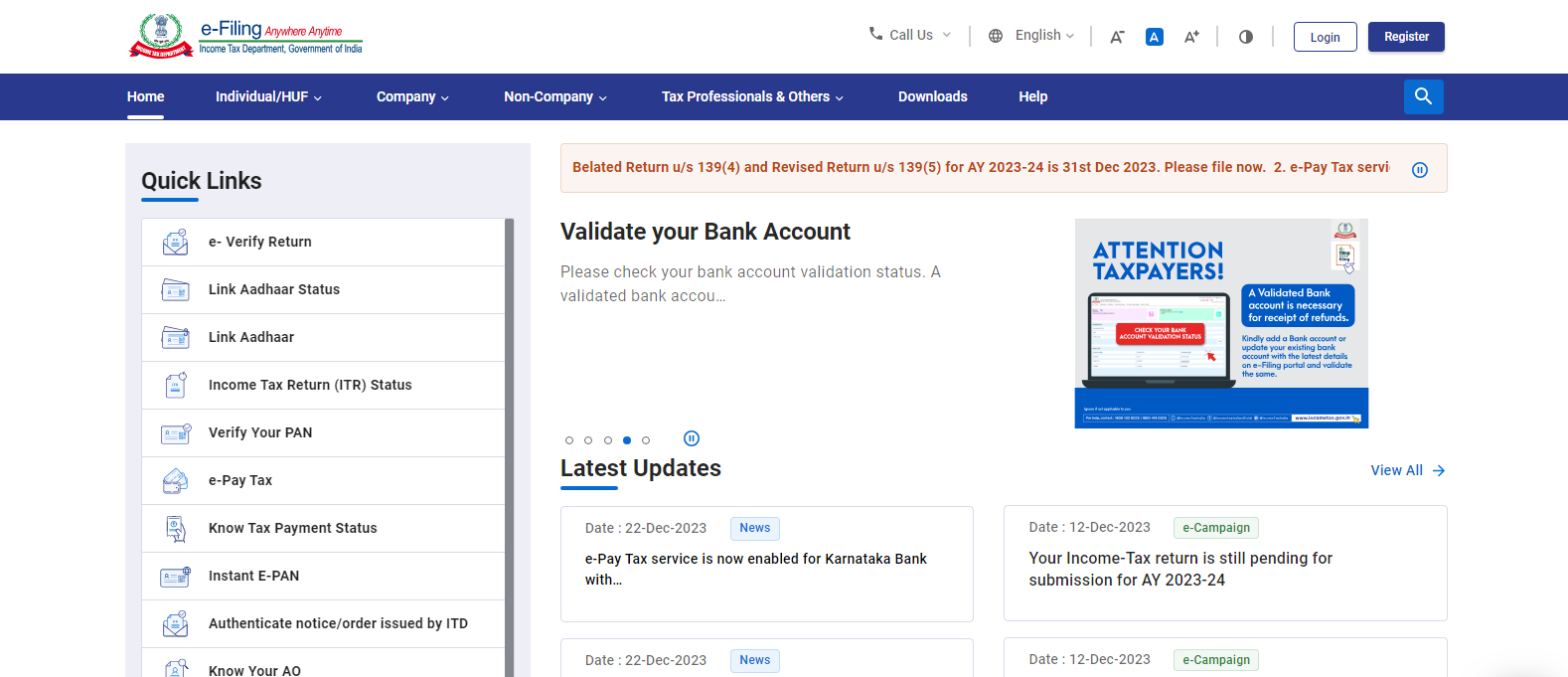

Step 1: Official website of e-filing

Firstly, you have to visit the official website for e-filing of income tax returns which is https://www.incometax.gov.in/iec/foportal/

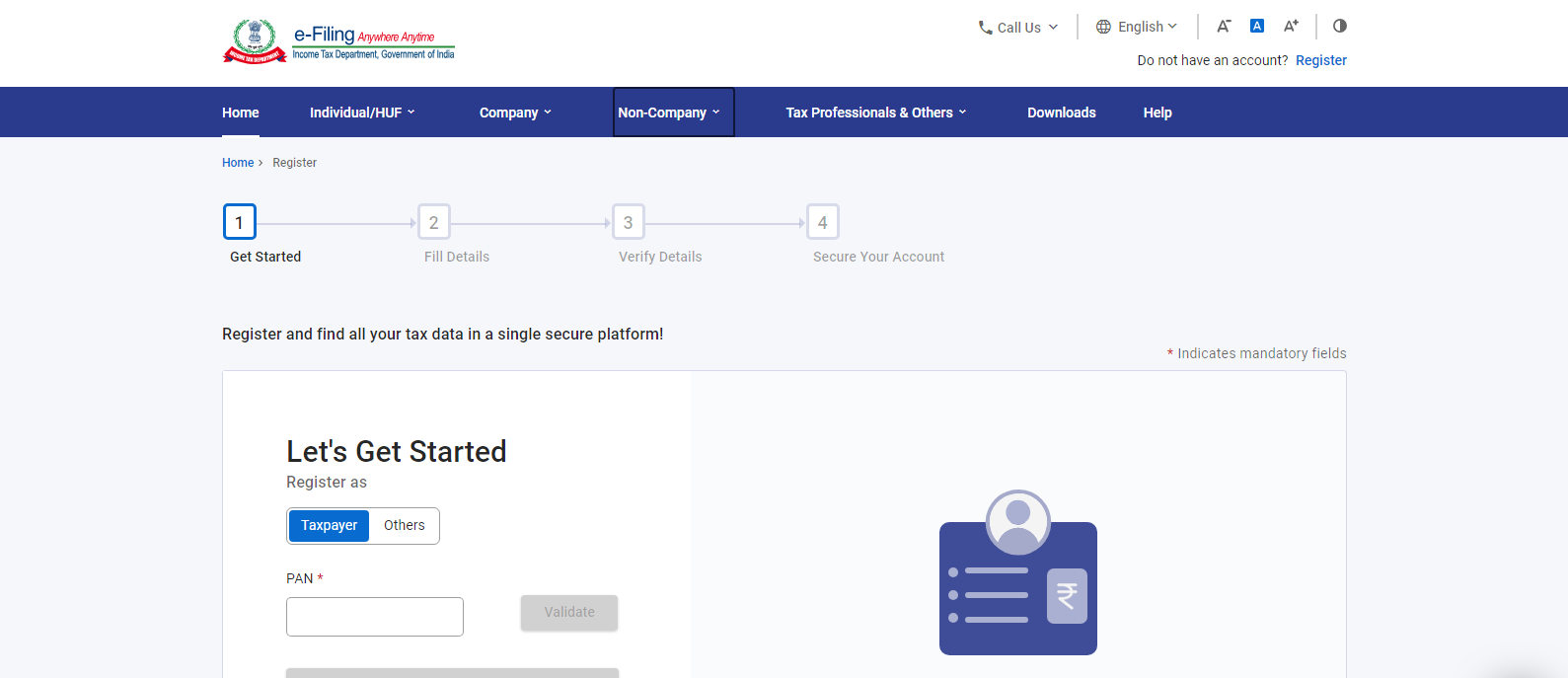

Step 2: Register/ Login

If you are a first-time user you have to register yourself

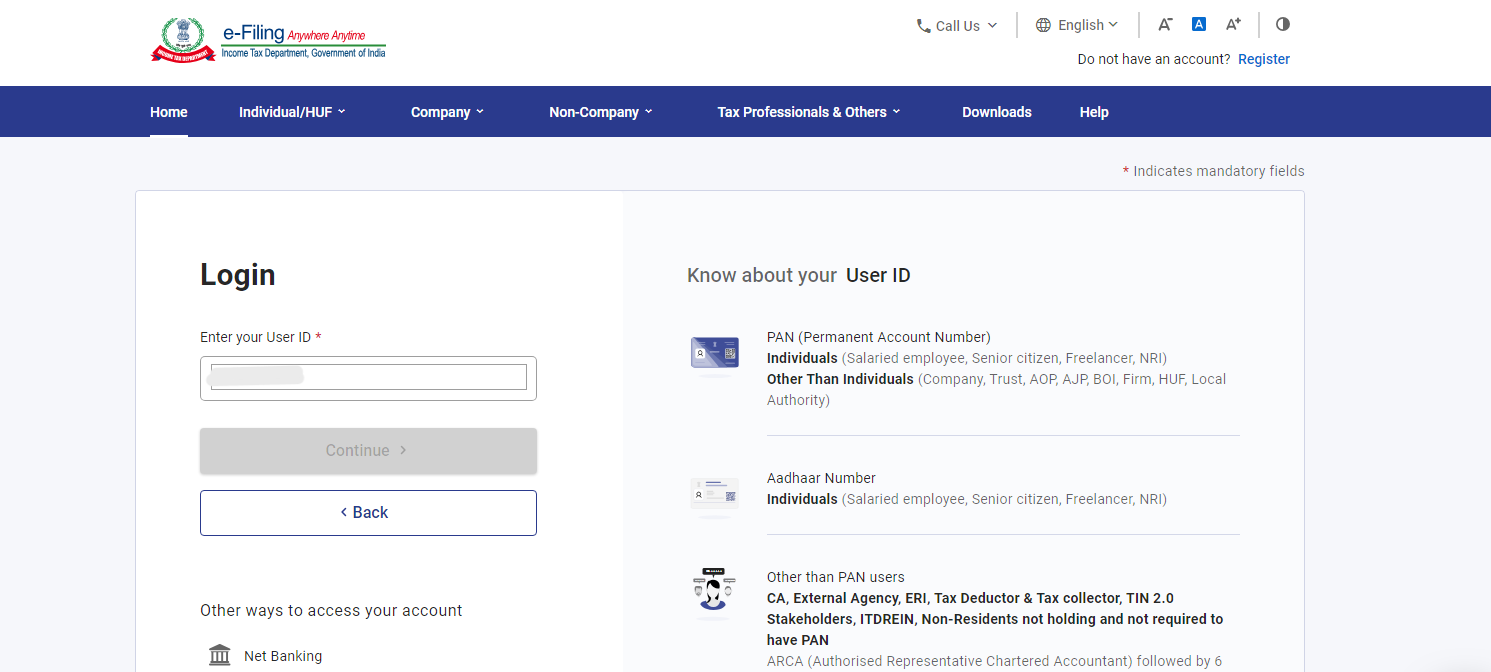

If you are a repeat user then you have to log in to the website-

- You have to enter your PAN as your user id and then click ‘Continue’.

- You have to check the security message given in the tick box.

- Then, you have to enter your password & click on the ‘Continue’ button.

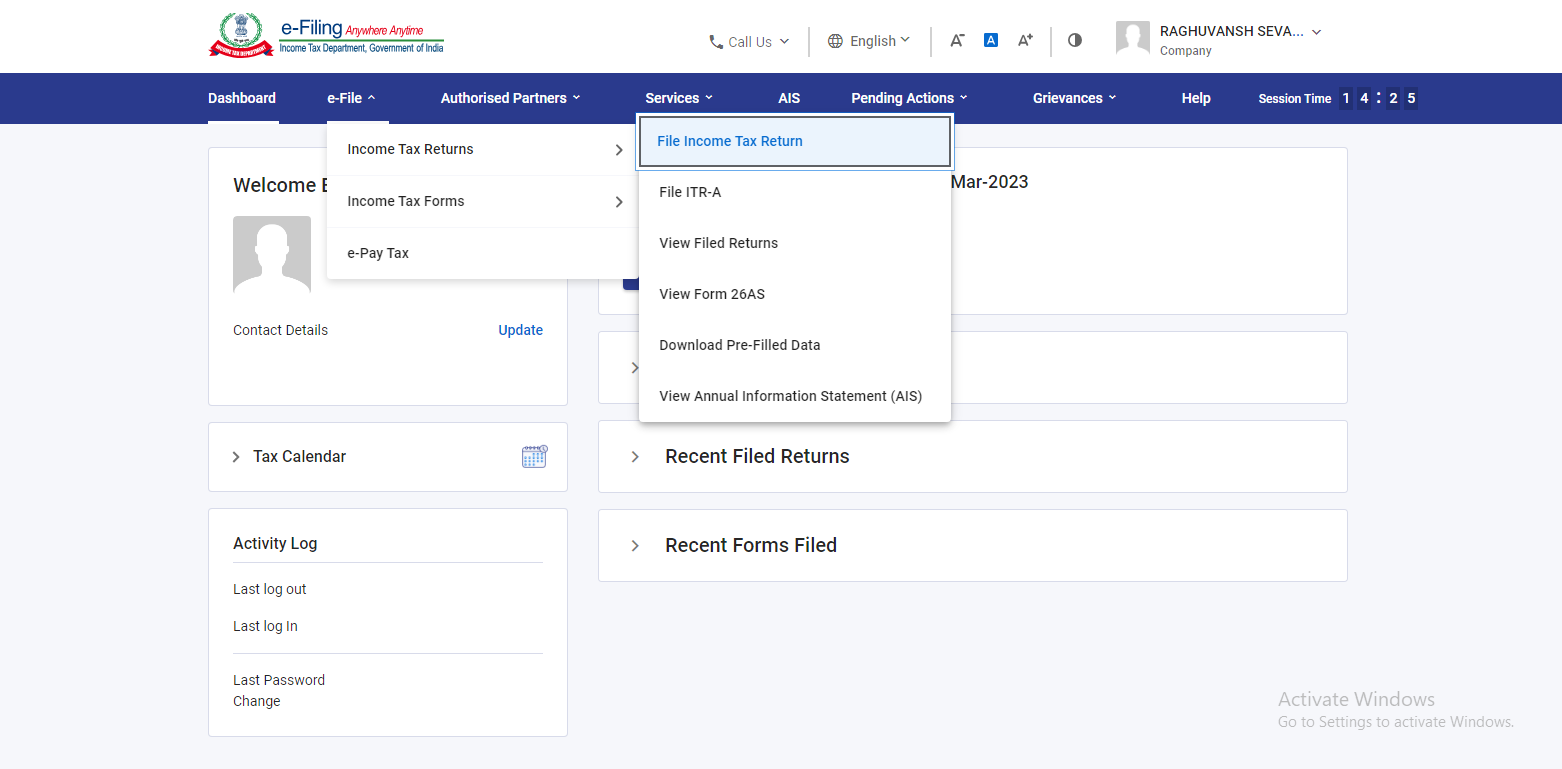

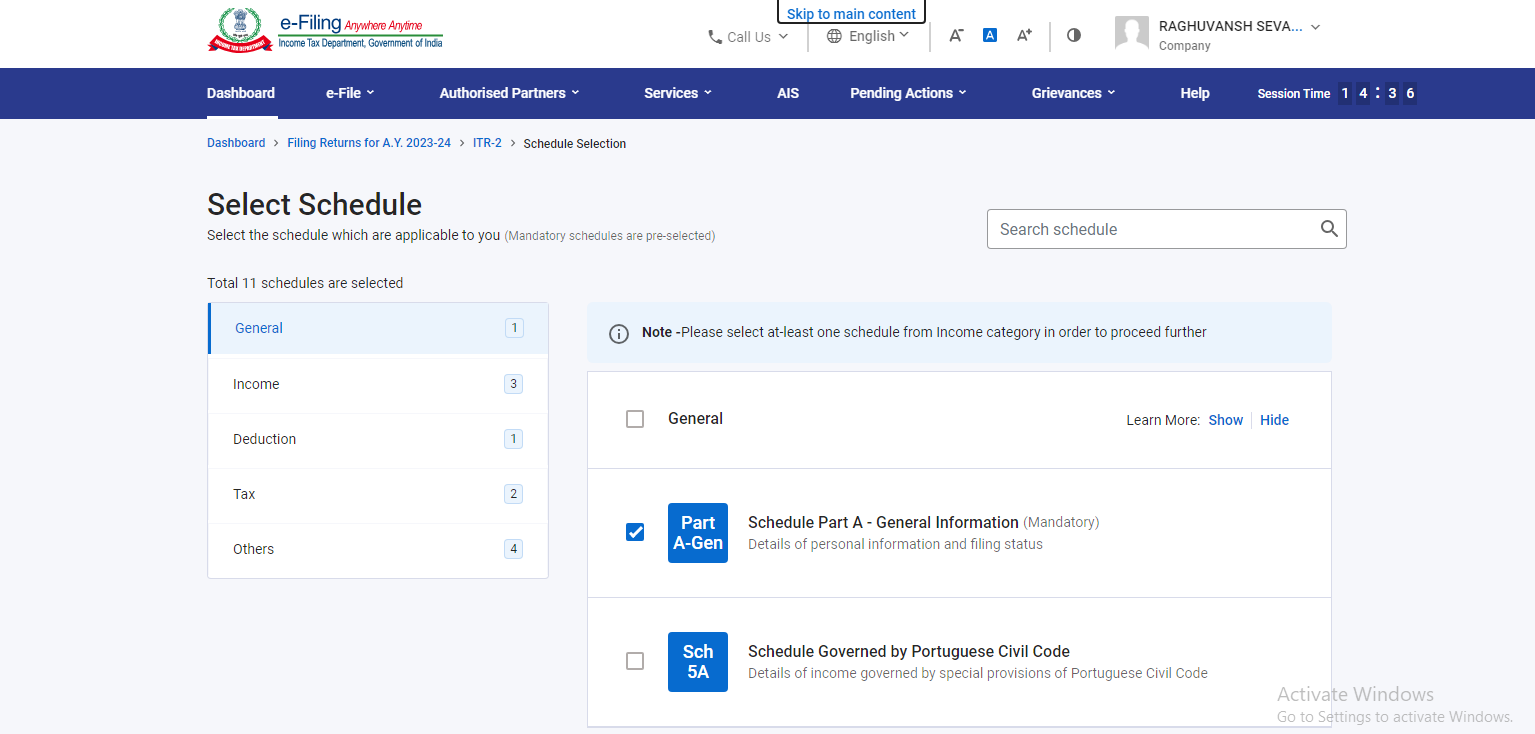

Step 3: Selecting the option of ‘File Income Tax Returns’

After logging in, you will see the e-file menu on the menu bar. When you click on the e-file menu then, you will get the option of ‘Income Tax Returns’ on clicking you will see the option of ‘File Income Tax Return’ and you have to click on that option.

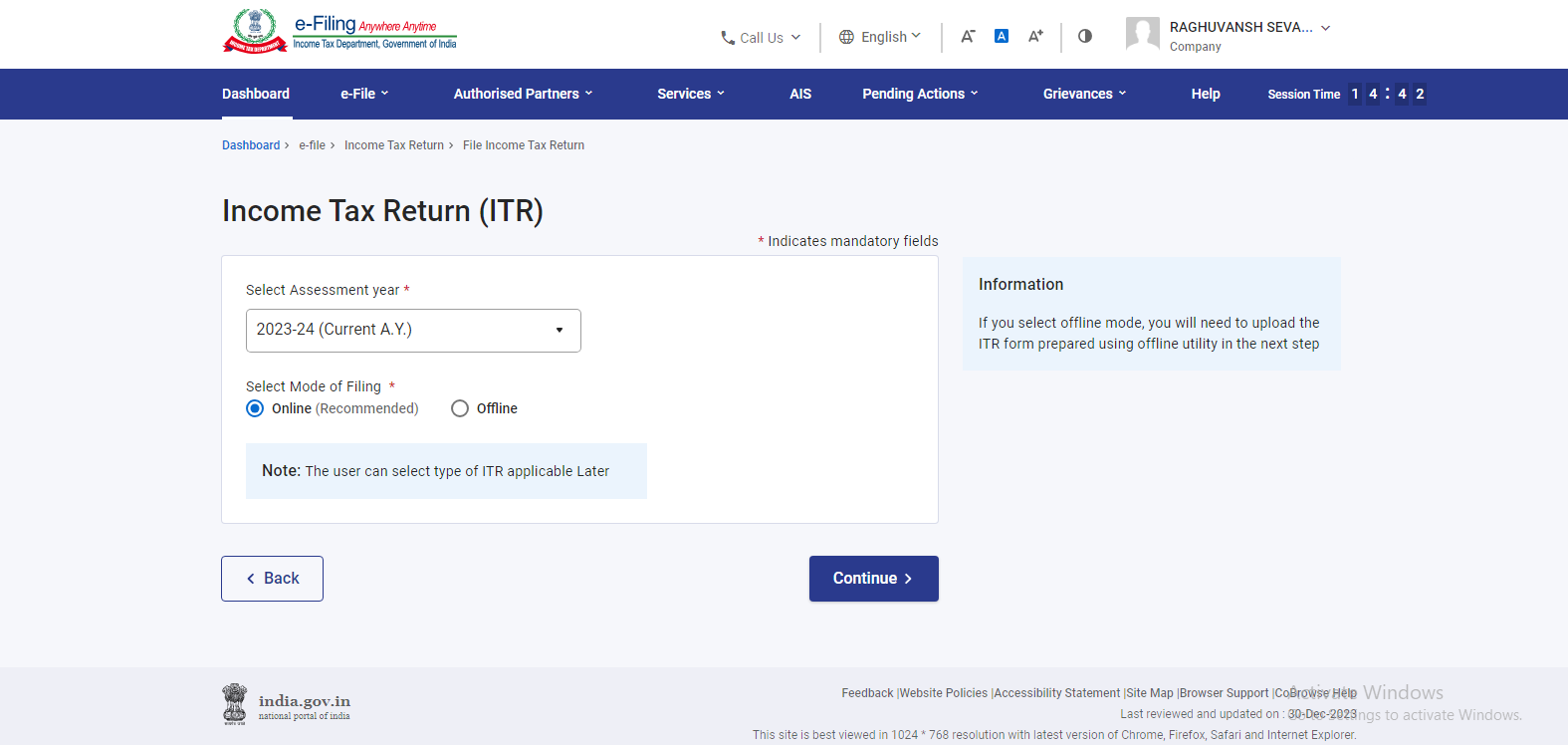

Step 4: Select the assessment year

After that, you will be redirected to the page Income Tax Return where you have to select the ‘assessment year’ and the ‘mode of filing’ for which you wish to file the income tax return, and then you have to click on ‘Continue’

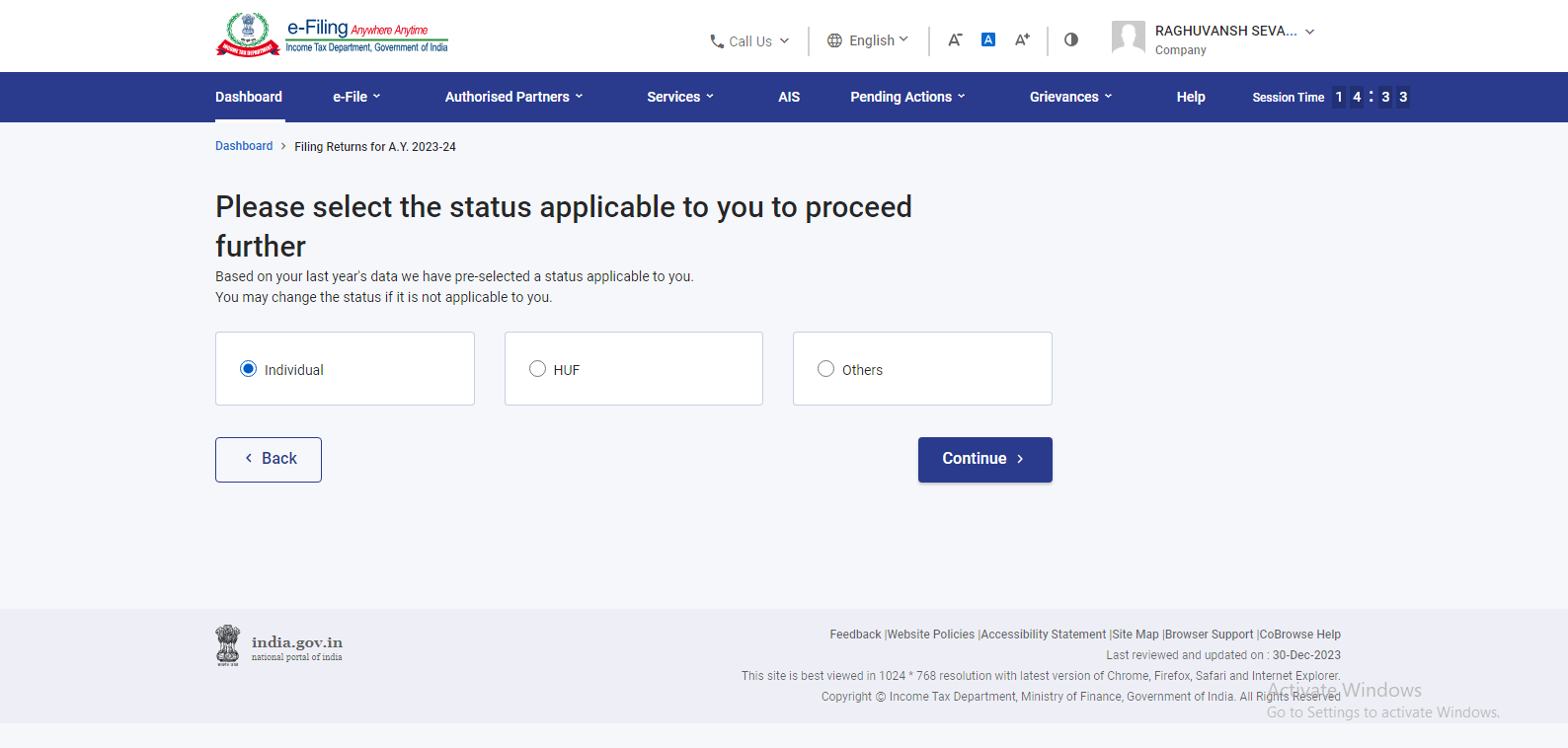

Step 5: Select the status

Then, you have to select the status of filing ITR among Individual, HUF, or others and click on ‘Continue’

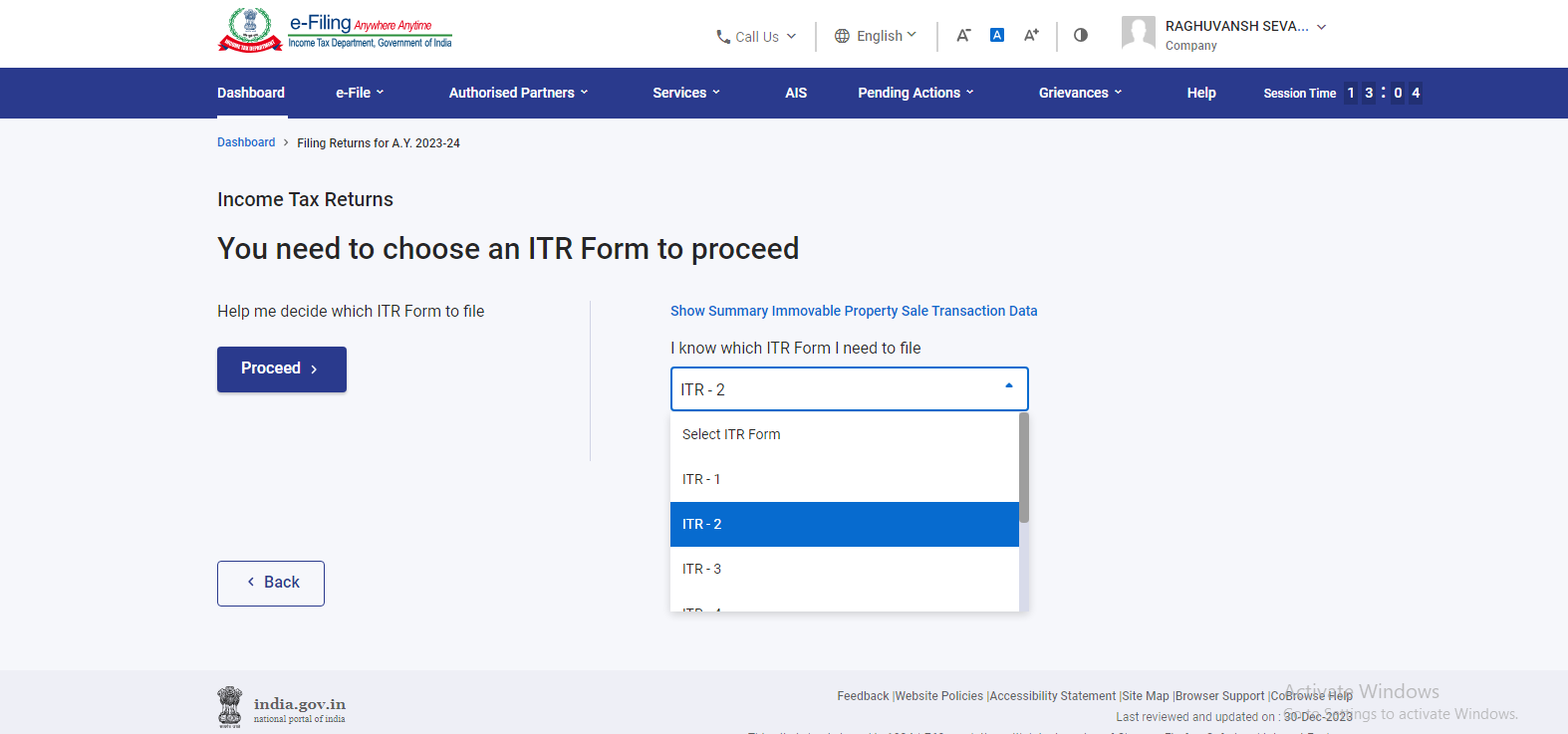

Step 6: Select the ITR type

After that, you have to select the type of ITR form where you have to choose the ITR 7

Step 7: Fill in the Online Form:

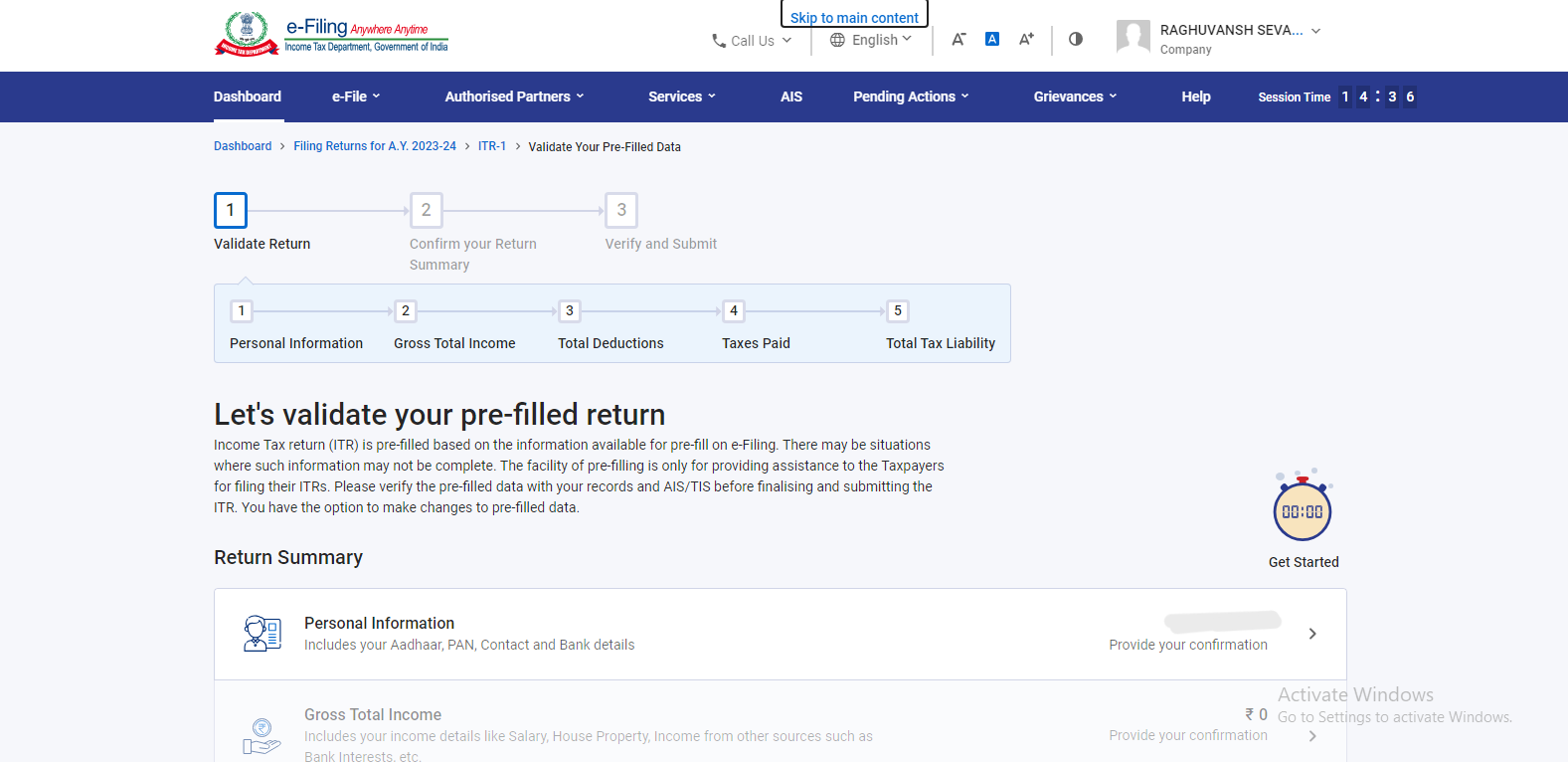

After which, you have to enter the details from the filled-out ITR 7 form into the online form on the e-filing portal along with the schedules. Double-check for accuracy.

Step 8: Submit bank account details

Then, you have to add your bank details. If already been submitted, then you have to make sure that it has been validated. You have to review the correctness of pre-filled information that has appeared on the new page.

Step 9: Upload Digital Signature:

Then, you have to upload your digital signature for electronic verification.

Step 10: e-verification of ITR

After that, the e-verification of ITR is the most crucial step. Your Income Tax Return will be incomplete until you verify it. You have the option to e-verify the ITR via Aadhaar OTP, Net banking EVC i.e. Electronic Verification Code, or by sending a physical copy of the ITR to CPC Bengaluru.

Step 11: Submission of ITR

At last, you have to click on the ‘Submit’ button to submit your ITR. After submission, you will get the acknowledgment from the Income Tax department.

Offline Filing (Physical Submission):

-

Obtain a physical copy of the ITR-7 Form

Visit the Income Tax Department’s website or a local tax office to obtain a physical copy of the ITR-7 form.

-

Fill Out the Form

Carefully fill out the ITR-7 form, providing all the required information about your income and deductions.

-

Verify Information

Double-check all the details on the form for accuracy and completeness.

-

Calculate Tax

Calculate your tax liability based on the income and deductions you have reported.

-

Sign the Form

Sign the physical copy of the ITR-7 form.

-

Submit the Form

Submit the signed ITR-7 form along with all supporting documents to the nearest Income Tax Office or designated centers.

Whether filing online or offline, it’s crucial to keep a copy of the filed return and any acknowledgment or ITR-V (if applicable) for future reference. Additionally, always file your income tax return within the specified due date to avoid penalties and interest charges. If you have complex financial situations or need assistance, consider consulting ‘ITR Filing agents near me’ or a chartered accountant for guidance during the filing process.

Details required for ITR 7 Filing

Filing the ITR-7 form in India involves filling various information to accurately report your income and deductions, especially if you represent entities like trusts, charitable institutions, political parties, educational institutions, and other similar entities. The details that have been required to file ITR 7 are as given below:

-

PAN Card

The Permanent Account Number (PAN) card of the entity or individual is essential for filing income tax returns.

-

Audited Financial Statements

You need to provide the audited financial statements for the relevant financial year.

-

Bank Statements

Gather bank statements for all the entity’s or individual’s bank accounts for the financial year as these statements help in verifying income and deductions.

-

Form 26AS

Obtain Form 26AS, which is an annual tax statement showing details of Tax Deducted at Source (TDS) and other tax-related information. You can access Form 26AS online through the Income Tax Department’s website.

-

Income Detail

- Report income earned by the entity or individual from various sources, such as business operations, capital gains, house property, and other avenues.

- Specify the nature of income, such as trading income, interest income, rent income, dividend income, etc.

-

Deduction Details

- Claim deductions under various sections of the Income Tax Act to reduce taxable income. Common deductions include those under Section 80G, 80GGA, 80GGC, and others.

- Provide details of the deductions claimed.

-

Books of Accounts and Audit Report

If applicable, include books of accounts and the audit report as required by the Income Tax Act.

-

Advance Tax and Self-Assessment Tax Payments

Include details of advance tax and self-assessment tax payments made during the financial year, including challans and receipts.

-

GST information (if applicable)

- Provide Goods and Services Tax (GST) information, including GSTIN (GST Identification Number) and GST-related documents, if the entity or individual is registered under GST.

- Provide Goods and Services Tax (GST) information, including GSTIN (GST Identification Number) and GST-related documents, if the entity or individual is registered under GST.

-

Bank Account Details

Bank account details of the entity or individual, including account numbers and IFSC codes, for receiving income tax refunds, if applicable.

-

Authorized Signatory Information

Details of the authorized signatory who will sign and verify the ITR-7 form on behalf of the entity or individual.

Ensure that you fill in these details properly, as they are essential for accurate tax reporting and compliance with the Income Tax Act.

Documents required for ITR 7 Filing

- There is no need to submit or affix any extra documents, paperwork, or TDS certificates with the Return form.

- If you affix any document with the Return form, you will get those documents back.

- It is a suggestion for the taxpayers to match the taxes deducted, collected, or paid by them with their Tax Credit Statement Form 26AS.

You should keep copies of the filed return, acknowledgment, and any other relevant documents for future reference and to fulfill tax laws and regulations. If the entity or individual has complex financial transactions or needs assistance, consider consulting a tax professional or CA near me for ITR Filing for guidance during the filing process.

Conclusion

ITR-7 is a specialized income tax return form in India designed for entities and individuals, such as trusts, charitable institutions, political parties, educational institutions, and others, who are required to furnish returns under specific sections of the Income Tax Act, 1961. It serves as a comprehensive tool for reporting income, deductions, and tax liabilities, ensuring compliance with tax laws. Accurate and timely filing of ITR-7 is crucial to meet tax obligations and fulfill legal requirements. Entities and individuals should maintain meticulous records, gather the necessary documents, and seek professional guidance, if necessary, to navigate the complexities of tax compliance in India. By adhering to the requirements and deadlines, taxpayers can effectively manage their tax affairs and contribute to the transparency and accountability of the taxation system.

At LegalPillers, we provide you the service of filing ITR with the help of the best CA. LegalPillers is here to reduce the complications of filing ITR. As you know about the high ITR Filing fees by CA but LegalPillers gives you this service at reasonable rates.

(FAQs) related to ITR 7 Filing (Income Tax Return-7) in India:

-

What is ITR-7?

- ITR-7 is an income tax return form designed for entities and individuals who are required to furnish returns under Sections 139(4A), 139(4B), 139(4C), and 139(4D) of the Income Tax Act, 1961.

-

Who should file ITR-7?

- Entities like trusts, charitable institutions, political parties, educational institutions, and others falling under the specified sections must file ITR-7.

-

What is the due date for the ITR 7 Filing?

- The due date for filing ITR-7 varies each year and can be extended by the Income Tax Department. It is typically on or before July 31st of the assessment year.

-

Can I file ITR-7 electronically?

- Yes, ITR-7 can be filed electronically through the Income Tax Department’s e-filing portal.

-

What documents are needed for ITR 7 Filing?

- Documents include PAN cards, audited financial statements, bank statements, Form 26AS, income and deduction proofs, and relevant financial records.

-

Can ITR-7 be revised after filing?

- Yes, you can file a revised return using ITR-7 if you discover errors or omissions in your original filing.

-

What is Form 26AS, and why is it important for ITR-7?

- Form 26AS is an annual tax statement that shows details of Tax Deducted at Source (TDS) and other tax-related information. It is essential for cross-verification while filing ITR-7.

-

Is GST information required for ITR-7?

- If applicable, GST information may need to be provided, especially for entities registered under GST.

-

Is a tax audit required for entities ITR 7 Filing?

- A tax audit may be required for entities meeting specified turnover or gross receipts thresholds under the Income Tax Act.

-

What is the penalty for late filing of ITR-7?

- Late filing can attract penalties and interest as per the Income Tax Act. The penalty amount depends on the delay period.

-

Can ITR-7 be filed offline (physically)?

- No, ITR-7 can only be filed electronically. Offline filing is not available for this form.

-

Can individuals or HUFs use ITR-7?

- No, ITR-7 is not meant for individuals or Hindu Undivided Families (HUFs). They should use the appropriate ITR form based on their tax status and income sources.

-

Can a trust file ITR-7 if it has income from other sources besides its primary activities?

- Yes, trusts can report income from various sources in ITR-7, but they should provide accurate details in the relevant sections.

-

What is the role of an authorized signatory in ITR-7?

- The authorized signatory is responsible for signing and verifying the ITR-7 form on behalf of the entity.

-

What is the consequence of providing incorrect information in ITR-7?

- Incorrect information can lead to penalties, fines, or legal consequences, so accuracy is crucial.

-

Is it advisable to seek professional help for ITR 7 Filing?

- Entities and individuals with complex financial transactions or doubts about tax compliance may benefit from consulting a tax professional or chartered accountant for guidance.

-

Can a political party registered in India use ITR-7 for tax filing?

- Yes, political parties can use ITR-7 to fulfill their tax filing requirements under the specified sections of the Income Tax Act.

-

Is there a difference between ITR-7 and other ITR forms?

- Yes, ITR-7 is specific to entities and individuals covered by Sections 139(4A), 139(4B), 139(4C), and 139(4D). Other ITR forms are designed for different categories of taxpayers.

-

What are the consequences of missing the ITR 7 filing deadline?

- Missing the deadline can lead to penalties, interest on tax dues, and other consequences, so timely filing is crucial.

-

Where can I get the latest version of the ITR-7 form and instructions for filing?

- The latest version of the ITR-7 form and filing instructions can be found on the official website of the Income Tax Department of India.

Leave a Reply