Did you receive an Income Tax notice after ITR Filing? It is due to the discrepancy in your ITR found by the Income Tax Department. It can be stressful for taxpayers to receive a notice from the IT Department, but if they understand how to respond to the notice,it will help in reducing their anxiety and stress. There are different reasons for which you may get different notices after Income Tax Return Filing. If you get any notice, you need to authenticate it first. After authentication, you need to reply to the notice in a professional and effective manner. Here, in this blog, we will explain to you everything related to the different Income Tax notices.

But before moving with the Income Tax Notices, let’s have a look at Income Tax, Income Tax Return, and Income Tax Return Filing.

- Income Tax is the direct Tax that the public has paid to the government of India every year. The income tax has been imposed by CBDT, i.e., Central Board of Direct Taxes, on individuals in India.

- Income Tax Return is a self-declaration form that is used by the public to declare income.

- ITR Filing is the process, by which taxpayers can report about their income, deductions, and credits to the government. Tax authorities use this information to calculate the amount of Tax payable or the refund due.

Table of Contents

Reasons for Getting Income Tax Notice after ITR Filing

There are several reasons why a taxpayer can receive an Income Tax Notice from the IT Department. Here, in this section, you will get to know about the reasons for getting notices. You can also seek the advice of a CA near me for ITR Filing regarding Income Tax notices. The reasons are as given below-

- Inaccurate Information in ITR During Online ITR Filing

If there is any inconsistency in your personal details or income details, then you may get the notice. It includes any mismatch in reported income and any discrepancy in asset declarations.

- Mismatch in Declared Income and Actual Income during ITR Filing

You will also get a notice if the Income Tax Department suspects the underreporting of your income. If the department suspects that you did not report all your income, they can send you the notice. In that case, you need to prepare proof of income, including paychecks, invoices, and bank statements.

- Non-Filing or Delay in ITR Filing

If you don’t file Income Tax Return or missed the deadline, you may also receive the Income Tax Notices. So, file ITR on time. The Income Tax Return Last Date will be July 31st, 2024, for FY 2023-24.

- Mismatch in TDS/ TCS

The TDS, i.e. Tax Deducted at Source reported by the taxpayer during ITR Filing online, must match the amount mentioned in Form 26AS and 16A. If there is any mismatch in the TDS amount, then you may get the notice.

- Selection for Audit

If there is any mismatch or incorrect reporting during Income Tax Return Filing, your ITR may get selected for audit. In such a case, you will get the notice under section 143(2). You must have to reply to this notice quickly or else you will be penalized.

- Payments of Refunds Against Outstanding Debts

Sometimes, you may need to remember to include certain interest income when filing an online ITR. In such cases, the Income Tax Department notices it, and you will get the notice that states that any tax due will be deducted from the income Tax Refund that you claimed.

- Tax evasion in Previous Years

If you evade the taxes in previous years but not in the current year, you may still get the notice under section 147 of the Income Tax Act.

- Demand for Tax

If the department finds that you have unpaid taxes as per your return or any adjustments made by them, then they will send you the notice demanding due taxes.

These are the significant reasons for receiving an Income Tax Notice from the IT Department. You have to understand the notice and must reply to it accordingly.

Types of Income Tax Notices You Get After ITR Filing

Taxpayers may receive Income Tax notices under several sections of the Income Tax Act. Here, we will talk about the different notices that you may get after online ITR Filing.

- Notice Under Section 142(1)

If tax authorities want additional information or classification regarding your filed ITR, then you will receive a notice under section 142(1). And if you miss the ITR Filing last date, then you may also receive this notice.

- Notice Under Section 139(9)

This notice will be issued for the “Defective Return”. If your ITR has any error or mistake, then the assessing officer issues you a notice under section 139(9), providing you with a grace period of 5-15 days to rectify the errors.

- Notice Under Section 148

If tax authorities have a solid reason to believe that you have not reported or underreported any income which is chargeable to Tax, you will get a notice under section 148.

- Notice under Section 156

This notice is also known as a demand notice. The Income Tax Department will send you a notice under section 156 asking for the payment of any interest, penalty, or Tax due. Usually, taxpayers will get a time period of 30 days to pay the due amount.

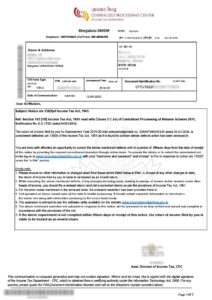

- Intimation under Section 143(1)

If you make any mistake in tax calculation or an incorrect claim, then you will receive the intimation under section 143(1). Basically, the intimation consists of a summary of details of your submitted ITR.

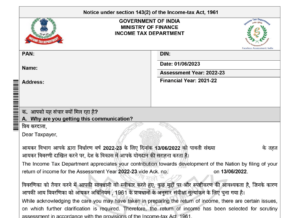

- Notice under section 143(2) and 143(3)

When your ITR has been selected for scrutiny, the Income Tax Department will send you a notice under section 143(2), which states that your books will be checked to determine the correctness of the claims made. And the scrutiny is conducted under section 143(3).

- Notice under Section 131

When tax authorities have substantial proof of tax evasion or unreported income, then taxpayers will receive a notice under section 131 asking them to present in person.

- Notice Under Section 245

If you have any pending tax liability from the previous years, then the Income Tax Department will send you a notice under Section 245.

How to Reply to the Income Tax Notice after ITR Filing?

If you get any notice from the Income Tax Department, then you need to reply to that notice quickly, or else your problem may increase. But to reply to the notice, you should have proper knowledge about its process. Here, in this section of the blog, we will discuss how you can reply to the notices sent by tax authorities. To get a clear picture, you can seek guidance from ITR filing consultants like Legal Pillers. Here are the steps-

Step 1: Read the Notice Carefully

First of all, you have to read all the points of notice carefully, including the section under which the notice is issued, the assessment year in question, the deadline for the reply, and specific issues or inconsistencies mentioned.

Step 2: Gather Necessary Documents

As per the notice issued to you, you have to gather all the necessary documents to validate your response. It may include previous tax returns, bank statements, investment proofs, as well as income and expense records.

Step 3: Visit e-filing Portal

After that, you have to visit the income tax department’s e-filing Portal.

Step 4: Log in to the Portal

Then, you have to log in to the portal with your login credentials (PAN and Password) along with the captcha code.

Step 5: Select “e-Proceeding” Option

After logging in, you have to select the “e-Proceeding” tab given in the menu bar, then choose the option of “e-Assessment/ Proceeding”. Then, find the notice you get from the list of pending options.

Step 6: Draft Your Response

After that, you have to draft your response based on the type of notice you receive.

Step 7: Submit Your Response

Then, you have to submit your response by clicking on the “Submit” button and submitting the reply in the given text box.

In case of demand notice (Notice u/s 156), you have to choose one option among the following-

- Disagree with Demand

- Demand is Correct

- Demand is not correct but ready for adjustment

- Demand is partially correct

Step 8: Follow-Up

After the submission of the reply, you need to follow up by checking the status on a regular basis, responding to further queries, and keeping the proper records.

These are the simple steps that you need to follow in order to reply online to the Income Tax Notice after ITR Filing online. You can also seek the expert guidance of experienced ITR Filing Consultants like Legal Pillers.

Key Considerations to Reply to Income Tax Notice after ITR Filing

- Stay Calm: If you receive an Income Tax Notice, you don’t need to panic! The notice is not necessarily an indication of any wrongdoing. It’s just a part of the tax assessment process.

- Seek Professional Guidance: If you have no idea about how to reply to the notice, so it will be better to seek the professional guidance of tax experts.

- Reply on Time: You should respond to the notice within the given time frame so that you can avoid penalties.

- Maintain Transparency: It is advisable for you to provide accurate and honest information. If you mislead the tax authorities, then it will result in severe penalties.

Final Words

It can be difficult for taxpayers to respond to the notice that they get from the Income Tax Department after online ITR Filing. However, you can handle this formality professionally and efficiently by following the steps given above. It would be best if you had to make sure that your response should be well documented and must be submitted on time. If you have any doubts, don’t hesitate to seek the professional assistance of ITR Filing Consultants like Legal Pillers. Legal Pillers has a dedicated team of professionals with expertise in handling such tax matters carefully and efficiently. We will also help maintain compliance and avoid unnecessary complications. So, don’t wait! Choose Legal Pillers as your trusted partner for your Tax-related matters.

Other Related Blogs

- ITR Filing Online for FY 2023-24

- Step-by-step guide for ITR Fling Online

- ITR 1 Filing

- ITR 2 Filing

- ITR 3 Filing

- ITR 4 Filing

- Filing ITR 5

- Filing ITR 6

- Filing ITR 7

- Chartered Accountant Near Me for Tax Filing

- What is the Importance of Income Tax Return Filing?

- Tax Slabs and Rates for Online ITR Filing For FY 2023-24

- What Happens If I Don’t File Income Tax Return?

- What is the Income Tax Return Last Date for FY 2023-24 (AY 2024-25)?

- HUF Online ITR Filing: Tax Benefits for HUFs

- How to Save Tax for a Pvt Ltd Company While ITR Filing Online?

- Steps to Register DSC on the Portal of Online ITR Filing

- How to File ITR Online in Delhi?

- Understanding Belated & Revised Income Tax Return Filing

- ITR Filing for Sole Proprietorship

- ITR-U: All about Updated ITR Filing Online

- Old vs. New Tax Regime: Which is Better for ITR Filing Online?

- Online ITR Filing for an Income of More Than 50 Lakhs

Leave a Reply