Table of Contents

All about ITR 2 for Income Tax Return filing

In India for Income Tax Return filing, ITR 2 is a crucial document in the context of the Indian tax system, serving as a comprehensive platform for individuals and Hindu Undivided Families (HUFs) to declare their income and tax liabilities to the Income Tax Department of India. The ITR-2 form plays a pivotal role in the financial landscape of the nation, enabling taxpayers with diverse income sources, including salary, capital gains, house property, and more, to meticulously disclose their financial particulars. The ITR-2 form is not just about income disclosure; it also serves as a tool for promoting transparency, accountability, and compliance within the taxation ecosystem, reinforcing the government’s efforts to collect revenue, channelize resources for public welfare, and ensure a fair and equitable distribution of the tax burden among the citizenry.

Consequently, a comprehensive understanding of the ITR-2 form is indispensable for taxpayers, tax professionals, and policymakers alike, as it underpins the fundamental principles of fiscal responsibility and fiscal governance in the Indian economic landscape, fostering economic growth, social development, and fiscal stability. You can clear the complications of the different forms available for Income Tax Return Filing by taking the help of a CA for filing Income Tax Return.

Who is eligible to file ITR-2 for FY 2023-24

Here, provide you with a general understanding of who is typically eligible to file ITR-2 for the assessment year (AY) 2023-24 in India. However, tax rules and forms may change over time, so it’s essential to refer to the latest guidelines from the Income Tax Department or consult a tax professional for the most up-to-date information.

The ITR-2 form in India is primarily meant for ITR Filing for Salaried Employees and Hindu Undivided Families (HUFs) who have income from various sources. Here are the key eligibility criteria for filing ITR-2:

-

Individuals:

- Individuals with income from salary or pension.

- Individuals with income from house property (including more than one house property).

- Individuals with income from capital gains (both short-term and long-term).

- Individuals with income from other sources (including income from winning lottery and horse race)

- Foreign assets

- Individuals who generate income of Rs. 5000 and above from agricultural sources.

- Individual who is the director of a company or an individual, who has been invested in unlisted equity shares.

-

Hindu Undivided Families (HUFs):

-

-

- HUFs with income from sources similar to those mentioned for individuals.

-

Who is not eligible to file ITR-2?

-

- Individuals or HUFs who earn full or partial income from a business or profession.

- Individuals who are eligible to fill the ITR 1 form.

- Partners of a Partnership Firm.

What is the structure of ITR-2?

The structure of the ITR 2 form for Income Tax Return filing in India is more complicated than ITR 1. ITR 2 is more detailed as compared to ITR 1.

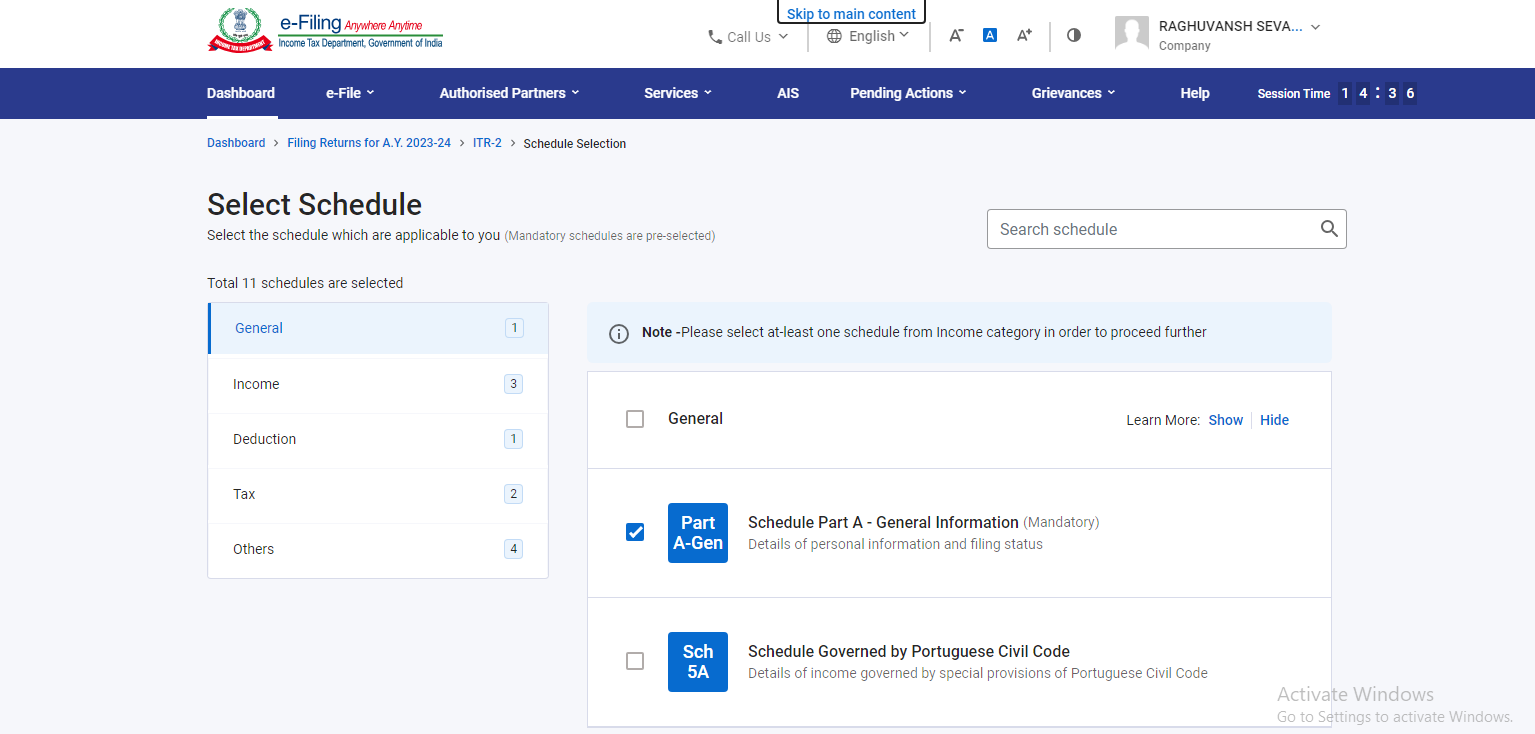

Here is the general structure of ITR-2:

Part A – General Information:

-

- This section includes basic personal details such as your name, address, PAN (Permanent Account Number), and other identification information.

All the schedules

- Different schedules have been there and taxpayers must fill these schedules.

Part B: TI: Total Income Computation

-

- In this section, you provide details of your income from various sources. This includes:

- Income from Salary or Pension

- Income from House Property

- Income from Capital Gains

- Income from Other Sources

- In this section, you provide details of your income from various sources. This includes:

Part B: TTI: Computation of Tax Liability

-

-

- This section helps you calculate your tax liability based on the taxable income computed in Part C. It includes details of your tax computation, such as income tax, surcharge, and any relief claimed.

-

Tax Payments:

-

- This section includes the details of the payments of the advance tax and self–assessment tax

Declaration

-

- This section includes the declaration of the taxpayer. You need to verify the accuracy of the information provided in the return.

The ITR-2 form’s structure encompasses a comprehensive array of sections and schedules, each meticulously designed to capture various facets of a taxpayer’s financial life. From income from salary, house property, and capital gains to other sources of income and deductions claimed under different sections of the Income Tax Act, the form leaves no stone unturned in gathering the requisite financial details. Moreover, it caters to taxpayers with residential status considerations and even extends to those with foreign assets or foreign income, ensuring a holistic approach to tax compliance. To clarify the structure of ITR 1 you can seek help from Income Tax Return Filing near me.

How to file ITR-2

Filing Income Tax Return (ITR) Form 2 (ITR-2) in India involves a series of steps. Here given a general step-by-step guide on how to file ITR-2:

ITR 2 Filing offline

Gather Required Documents and Information:

Collect all the necessary documents, including your PAN card, Form 16 (if you are a salaried individual), bank statements, investment proofs, and other financial records.

Download the Latest ITR-2 Form:

Visit the official Income Tax Department website and download the latest ITR-2 form for the relevant assessment year (AY).

Fill Out the ITR-2 Form:

Fill in the form accurately and completely. Provide your personal information, income details, deductions, and other required information as per the instructions provided with the form.

Verify Your Tax Liability:

Calculate your total income, deductions, and tax liability as per the form’s instructions and guidelines.

Check for Foreign Assets and Income (if applicable):

If you have foreign assets or foreign income, make sure to fill out Schedule FA in the ITR-2 form with the relevant details.

Verify the Tax Computation:

Double-check all your calculations to ensure they are accurate.

Claim Deductions and Exemptions:

Mention all the eligible deductions and exemptions you are claiming under various sections of the Income Tax Act, such as Section 80C, 80D, 80G, etc.

Pay Any Tax Due:

If you have tax dues after considering TDS (Tax Deducted at Source) and other credits, pay the balance tax using the Challan 280 through the official tax payment portal.

Complete the Verification Section:

Sign the ITR-2 form in the verification section. This can be done electronically using a digital signature, Aadhaar OTP, or by sending a signed physical copy to the Centralized Processing Center (CPC) within 120 days of filing.

ITR 2 Filing Online-

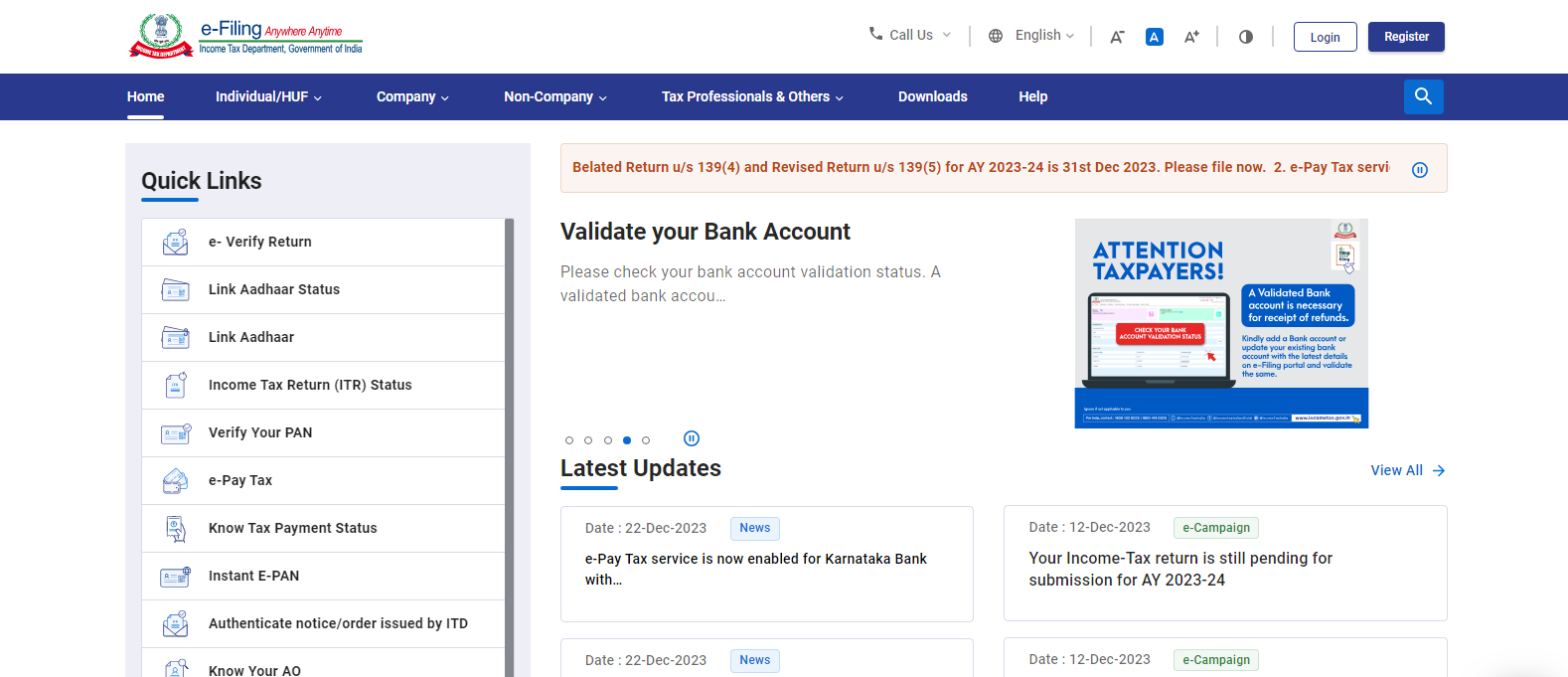

Official website

Visit the Income Tax e-filing website (https://www.incometaxindiaefiling.gov.in/)

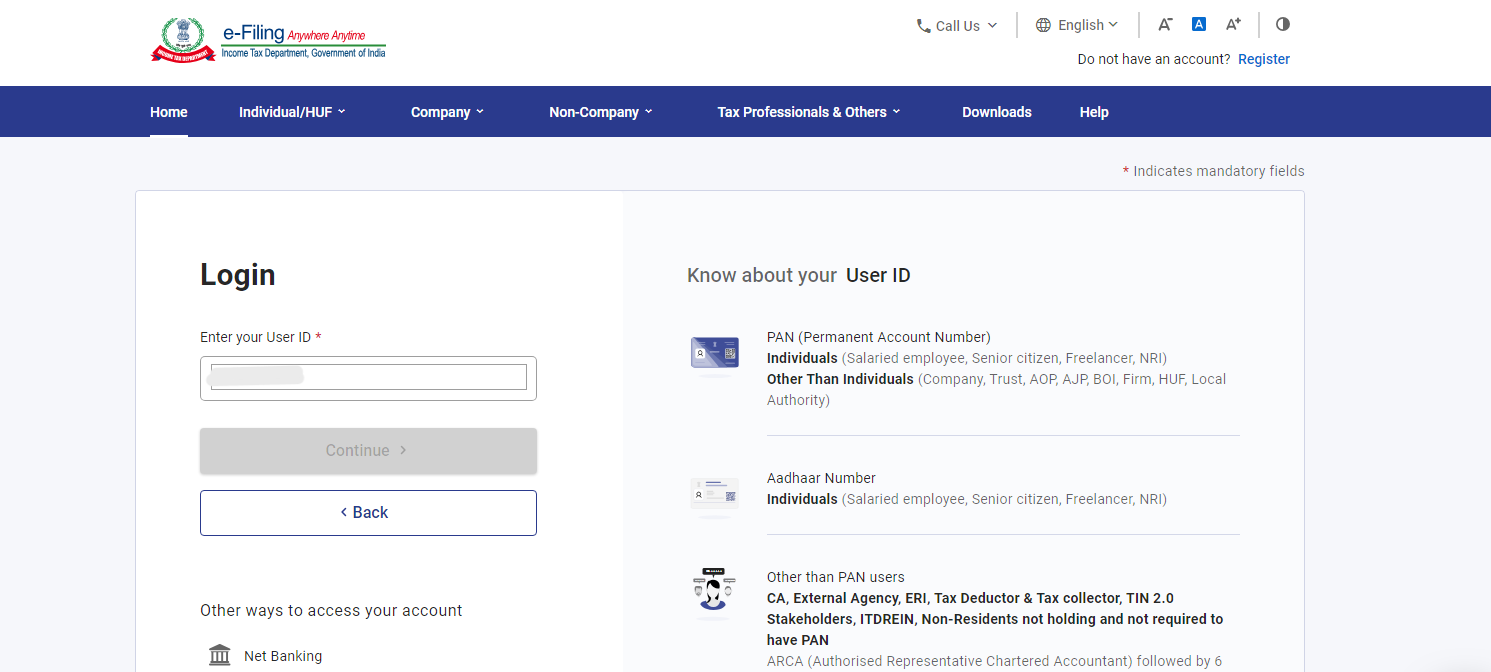

Log in to the portal

You should log in to the portal or register if you haven’t already.

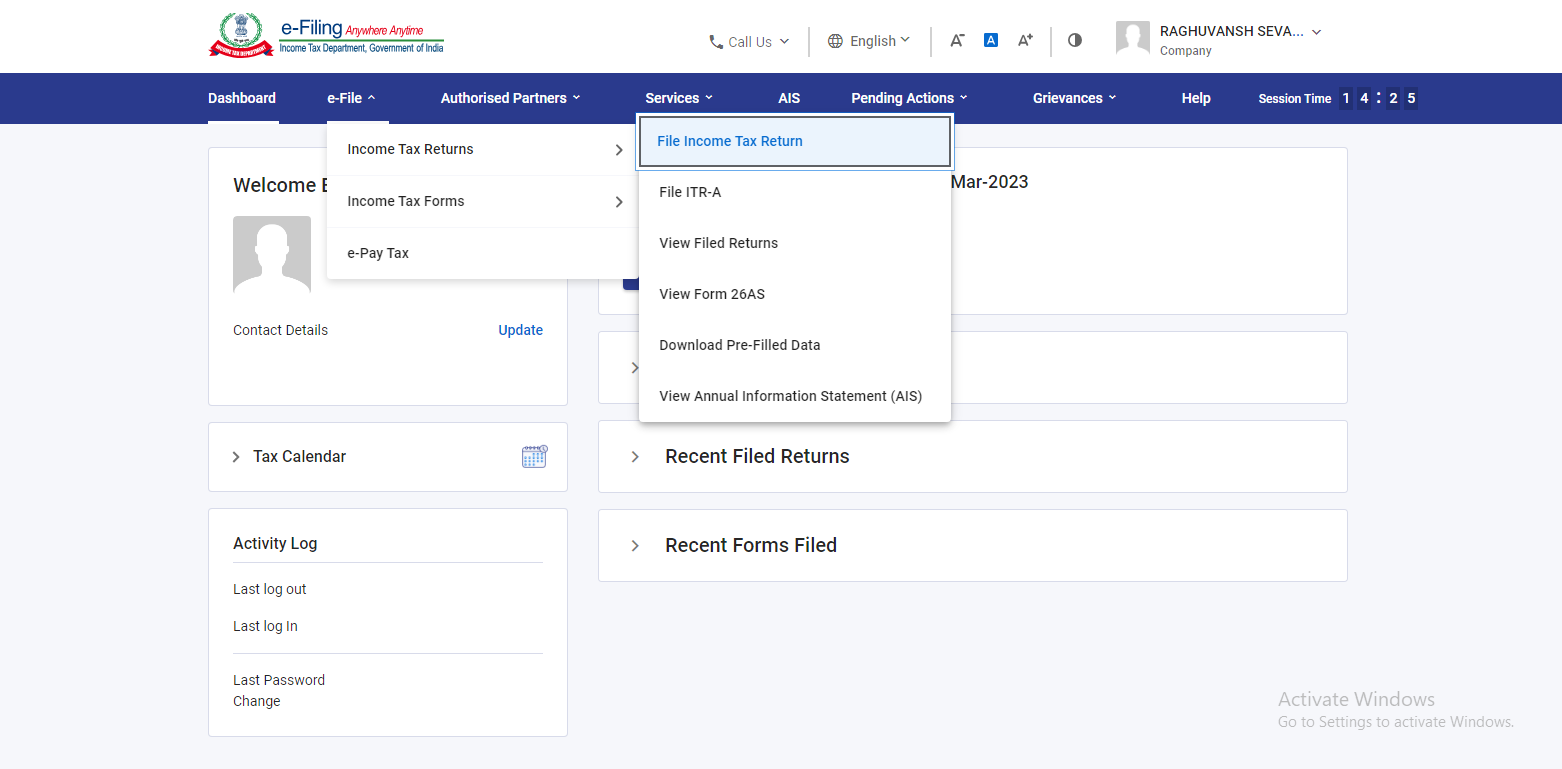

Select the ‘File Income Tax Return’ option:

You have to select the option of ‘Income Tax Return’ given under the tab of ‘e-file’ and then click on ‘File Income Tax Return’.

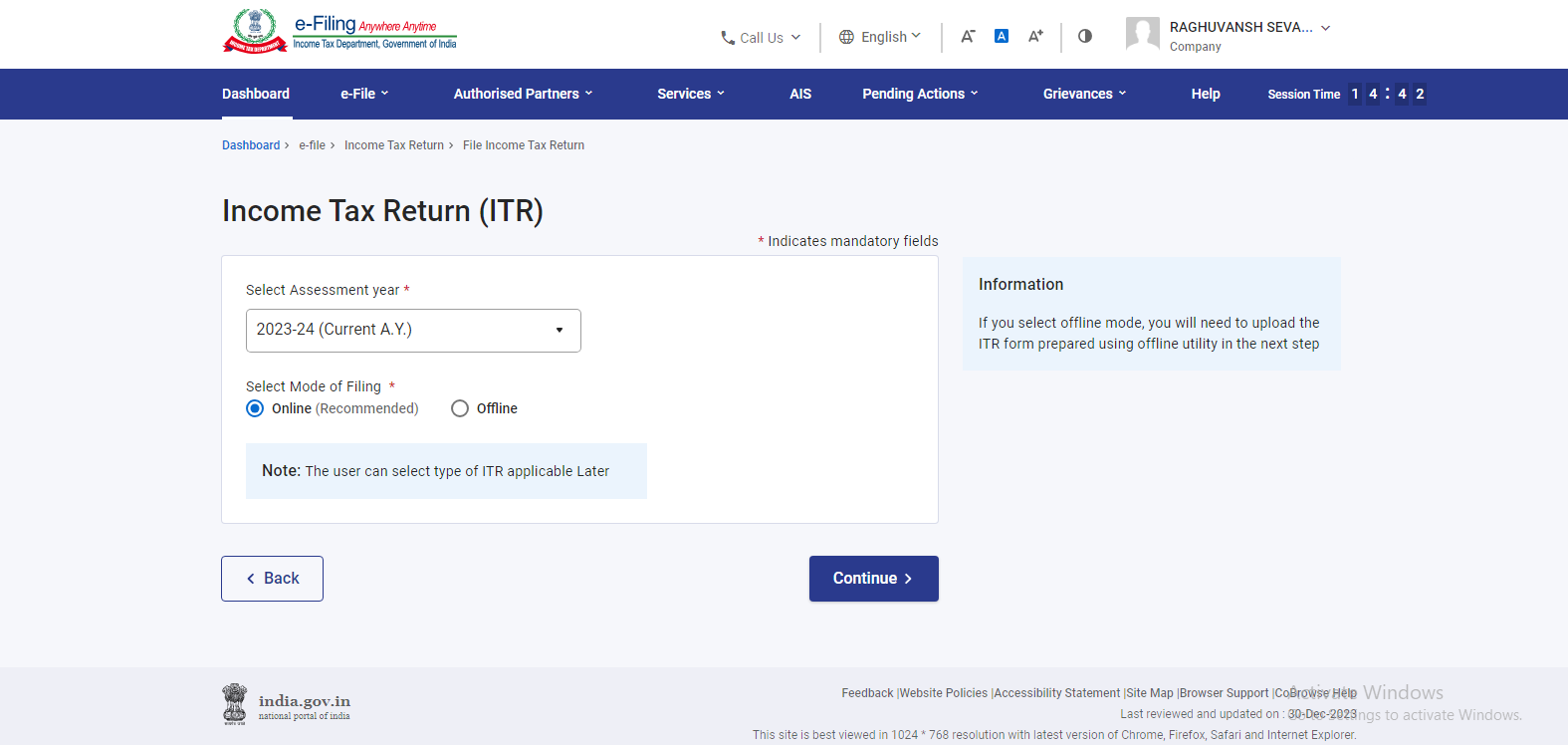

Select Assessment Year:

Choose the correct assessment year (AY 2023-24 for the current example).

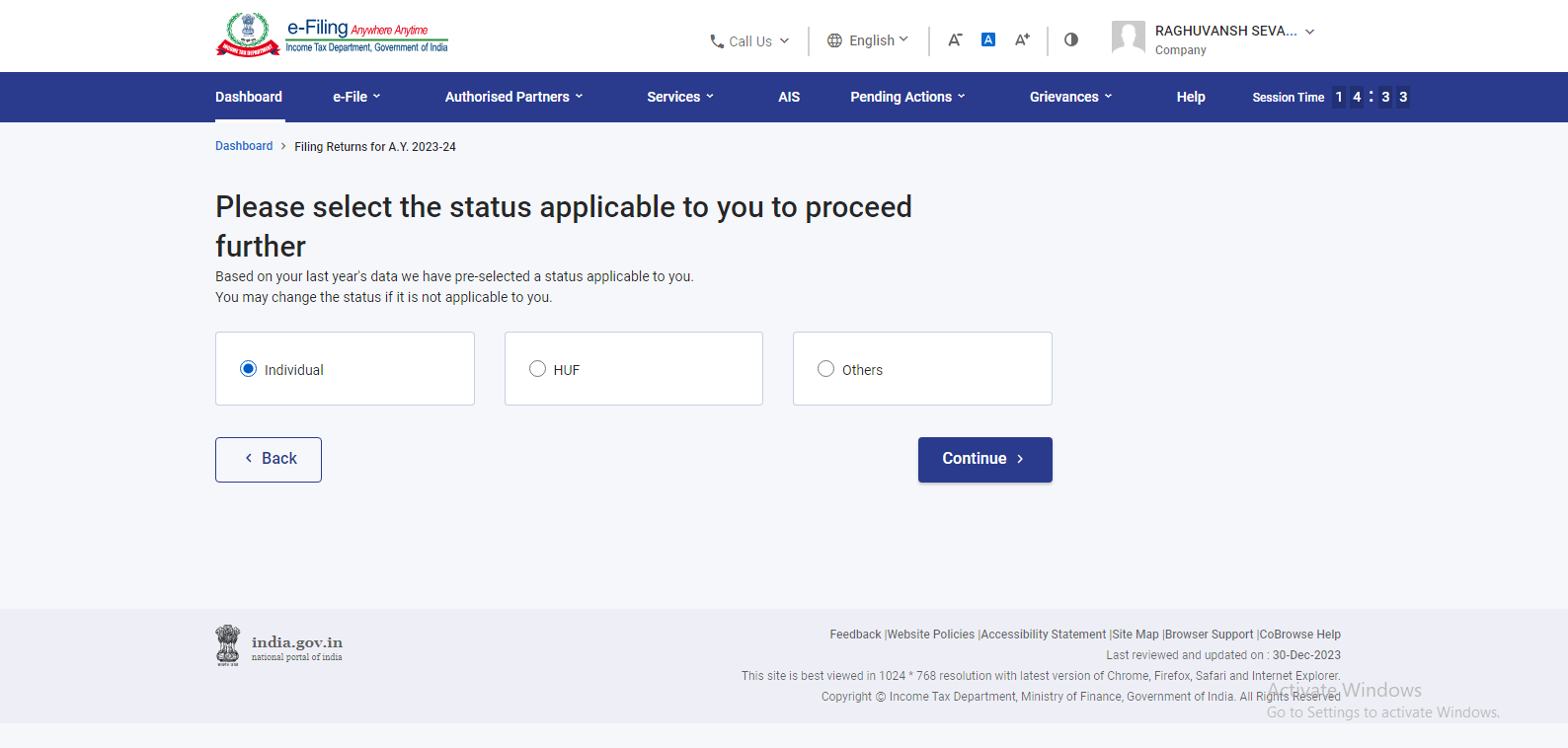

Select the status

Then, you have to select the status of filing ITR among Individuals or HUFs and click on ‘Continue’

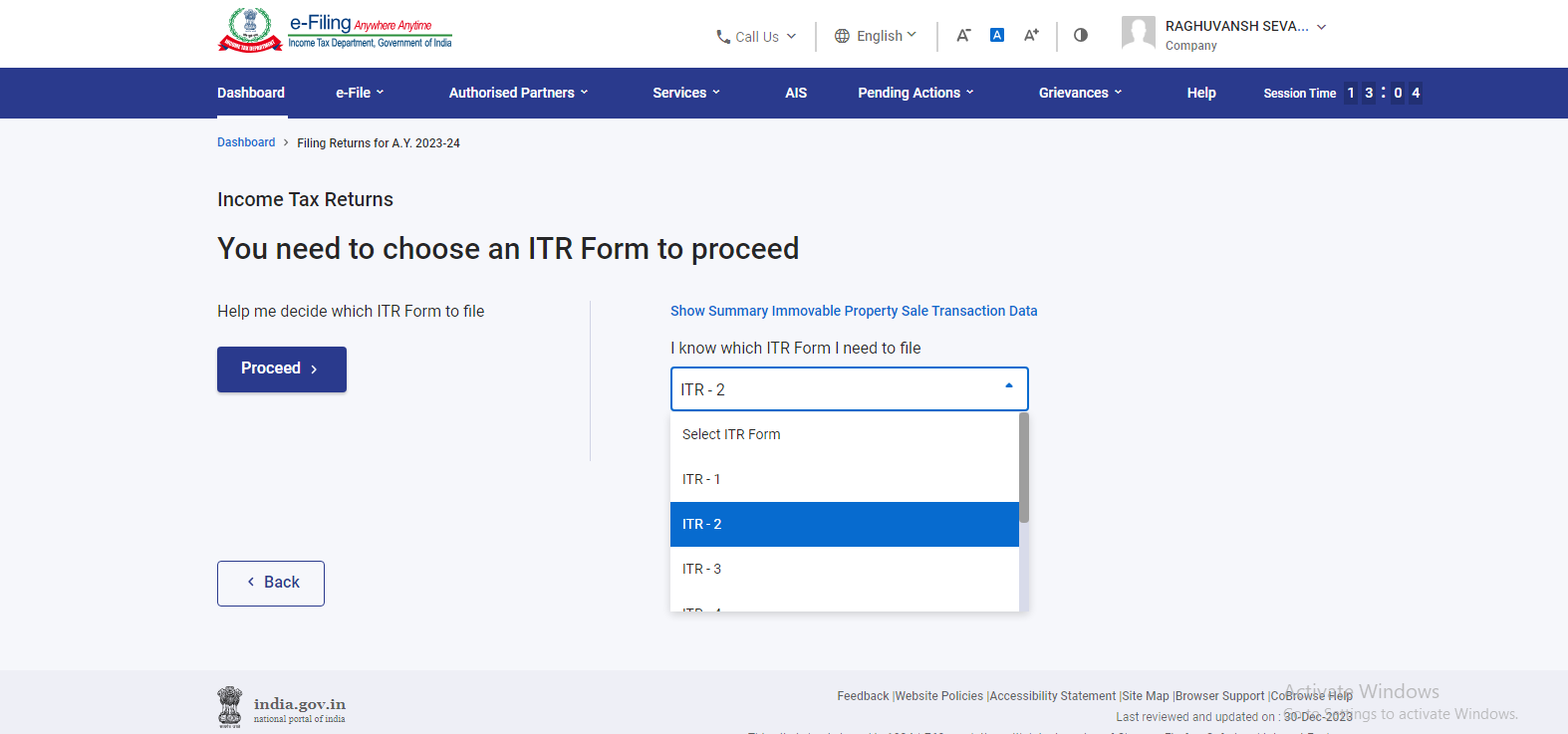

Select the ITR type

After that, you have to select the ITR form where you have to choose the ITR 2

Fill in the Online Form:

Enter the details from the filled-out ITR-2 form into the online form on the e-filing portal. Double-check for accuracy.

Upload Digital Signature (if available):

If you have a digital signature, you can upload it for electronic verification.

Submit Your ITR:

After verifying all the information, click the “Submit” button. A confirmation message will be displayed, and an acknowledgment (ITR-V) will be generated.

Verify Your ITR:

If you haven’t used a digital signature, you’ll need to verify your ITR-V. Download and print the ITR-V, sign it in blue ink, and send it to the CPC address mentioned in the instructions within 120 days of filing.

Confirmation and Processing:

Once your ITR is successfully filed and verified, you will receive an acknowledgment from the Income Tax Department. Your return will be processed, and if any discrepancies or issues arise, you may receive communication from the department.

The process of income tax filing ITR-2 involves a systematic approach, beginning with the collection of necessary documents and information. However, the online filing of ITR-2 via the official Income Tax filing website has streamlined the process, making it accessible to a broader population. The submission involves selecting the appropriate assessment year and ITR form, entering the relevant data, and either digitally signing the return or sending a physical verification document to the Centralized Processing Center (CPC). This electronic system enhances efficiency and transparency while ensuring that taxpayers meet their legal obligations. You can take a professional consultant by simply searching ‘Income Tax Return Filing agents near me’.

Income Tax Return last date

The last of filing the ITR with form ITR 2 is the same as the last date of filing the ITR with other forms.

Document required for ITR-2 Filing

When filing an Income Tax Return-2 (ITR-2) in India, you will need various documents and information to provide accurate details about your income, deductions, and tax liability. The specific documents required may vary based on your sources of income and financial transactions. Here is a list of common documents and information that you may need when preparing to file ITR-2:

-

Personal Information:

-

-

- Permanent Account Number (PAN) card.

- Aadhaar card (for Aadhaar-based verification).

- Bank account details, including the bank’s name, branch, account number, and IFSC code.

-

-

Income Details:

-

-

- Form 16: If you are a salaried individual, your employer provides this document, which includes details of your salary, TDS deductions, and other allowances.

- Salary slips or income certificates from your employer.

- Rental income details if you have rental properties, including rent receipts and details of property.

- Interest income details from bank accounts, fixed deposits, recurring deposits, or other interest-bearing investments.

- Details of any pension income.

-

-

Capital Gains:

-

-

- Details of capital gains from the sale of assets, such as property, stocks, mutual funds, and other investments.

- Purchase and sale documents, including sale deeds, purchase agreements, and brokerage statements.

- Calculation of capital gains and losses.

-

-

House Property:

-

-

- Ownership and rental details of properties owned by you.

- Rental agreements, rent receipts, and other documents related to rental income.

- Home loan interest certificate, if applicable.

-

-

Deductions and Exemptions:

-

-

- Proof of investments and expenses eligible for deductions under various sections of the Income Tax Act (e.g., Section 80C, 80D, 80G).

- Medical bills and health insurance premium receipts.

- Receipts of donations made to eligible charities (for deductions under Section 80G).

-

-

Bank Statements:

-

-

- Bank statements for all your accounts, including savings, current, and fixed deposit accounts, for the financial year for which you are filing the return.

-

-

TDS Certificates:

-

- You have to fill the form 26AS for the verification of TDS on your salary and other sources of income also.

-

Foreign Assets and Income (if applicable):

-

-

- Details of foreign bank accounts, foreign income, and assets, if applicable.

- Statements of foreign bank accounts and other relevant documents.

-

-

Tax Payments:

-

- Proof of advance tax and self-assessment tax payments made during the year.

-

Other Relevant Documents:

-

- Any other documents or receipts related to your income, deductions, or tax liabilities.

You have to maintain all the documents related to income, deductions, tax payments, and other financial transactions for reference and potential future audits.

CONCLUSION

The ITR-2 empowers taxpayers to fulfill their legal obligations, avail themselves of legitimate deductions, and contribute their share to the nation’s progress. While the process may seem intricate, you can get help from the ITR Filing agents near me. It is a necessary aspect of responsible citizenship and contributes significantly to the economic development and stability of India.

At LegalPillers, we are here to help you with the best CA near me for ITR filing. We provide you the appropriate suggestions about the complicated process of filing ITR. Choose LegalPillers as your trusted partner for filing ITR with affordable ITR Filing fees by CA.

(FAQs) related to ITR-2 Filing (Income Tax Return-2) in India

-

What is ITR-2?

- ITR-2 is an income tax return form in India used by individuals and Hindu Undivided Families (HUFs) to report income from various sources.

-

Who is eligible to file ITR-2?

- Individuals and HUFs with income from sources other than business or profession are eligible to file ITR-2.

-

What is the assessment year for which ITR-2 is used?

- ITR-2 is used for the assessment year 2023-24 (AY 2023-24) for income earned in the financial year 2022-23.

-

Can I use ITR-2 if I have business income?

- No, ITR-2 is not meant for individuals or HUFs with business or professional income. They should use other relevant ITR forms, such as ITR-3 or ITR-4.

-

What are the key sections of ITR-2?

- ITR-2 consists of sections covering personal information, income details, deductions, tax computation, and verification.

-

Do I need to file ITR-2 if I have only salary income?

- If your only source of income is salary and you don’t have any other sources, you can use a simpler form, such as ITR-1.

-

What documents do I need to file ITR-2?

- You will need documents such as a PAN card, Aadhaar card, Form 16, bank statements, investment proofs, and receipts for deductions.

-

Can I file ITR-2 online?

- Yes, you can file ITR-2 online through the official Income Tax e-filing website.

-

What is the due date for filing ITR-2 for AY 2023-24?

- The due date may vary, but it’s typically July 31 for individuals not required to get their accounts audited.

-

What if I miss the due date for filing ITR-2?

- You can still file a belated return by the end of the assessment year, but you may face penalties and interest on any tax dues.

-

Can I revise my ITR-2 after filing it?

- Yes, you can file a revised return within a certain time frame if you discover errors or omissions in your original filing.

-

Is it mandatory to link Aadhaar with PAN for filing ITR-2?

- Yes, linking Aadhaar with PAN is mandatory for e-filing your income tax return.

-

Do I need to report foreign income and assets in ITR-2?

- Yes, if you have foreign assets or income, you must report them in the relevant sections and schedules, such as Schedule FA.

-

Can I file ITR-2 without a digital signature?

- Yes, you can file ITR-2 without a digital signature, but you will need to verify your return through other methods, such as Aadhaar OTP or sending a physical verification document.

-

How can I calculate my tax liability in ITR-2?

- Your tax liability is calculated in Part D of the form, taking into account your income, deductions, and applicable tax rates.

-

What is the penalty for not filing ITR-2 on time?

- The penalty for late filing can include a fee and interest on any outstanding tax dues.

-

Can I file ITR-2 if I have agricultural income?

- If you have agricultural income below a certain threshold, you can continue to use ITR-2. Otherwise, you may need to use ITR-3.

-

How can I check the status of my filed ITR-2?

- You can check the status on the official Income Tax e-filing website using your PAN and assessment year.

-

Is it necessary to keep copies of filed ITR-2 and supporting documents?

- Yes, it’s essential to keep copies of your filed ITR-2 and all related documents for at least six years for future reference and potential audits.

-

Where can I get help or assistance with filing ITR-2?

- You can seek assistance from a tax consultant or use the resources available on the official Income Tax Department website for guidance on filing ITR-2.

Leave a Reply