As you know that you need a DSC i.e. Digital Signature Certificate to file your Income Tax Return. But for this it is important to register DSC on the portal of online ITR Filing. DSC is required to sign the electronic documents including Income Tax Returns and other forms where authentication of the user is must. DSC i.e. Digital Signature Certificate works as the identity proof of an individual or organization specifically for the online purposes. It has been also used to e-verify your income tax return filing.

A Digital Signature Certificate is mandatory for the companies and political parties as they have to e-verify their income tax returns via DSC. Additionally it is compulsory to e-verify the income tax returns for the persons whose books of accounts needs to be audited. Here, in this blog, we will tell you about how you can register your DSC on the Income Tax portal. You can also seek the guidance of ITR filing consultants.

Table of Contents

Key Considerations of DSC Registration on the Portal of Online ITR Filing

It is mandatory for the taxpayers to register their DSC on e-filing portal of Income Tax. But you should know about the key requirements of the DSC registration. In this section we will tell you about the key considerations that you should remember while registering your DSC on e-filing portal.

- You must have to be registered at the e-filing portal of Income Tax with a valid username and password.

- Your USB token should be plug into the system throughout the process.

- The DSC USB Token should be a class 2 or class 3 certificate

- Your DSC i.e. Digital Signature Certificate must have to be active.

- The DSC i.e. Digital Signature Certificate should not be revoked.

- You must have to download and install the emsigner utility.

Benefits of DSC Registration on the Portal of Online ITR Filing

It will be very beneficial to register your DSC i.e. Digital Signature Certificate on the e-filing portal of Income Tax. DSC registration on the portal of Income Tax Return filing offers a great importance to the taxpayers. In this section of blog, we will discuss about the major benefits DSC registration on Income Tax portal. Here are the benefits-

- Enhanced Security

Registering DSC i.e. Digital Signature Certificate on the portal of online ITR Filing makes sure about the authentication and integrity of your tax documents. It will reduce the risk of unauthorized access to your ITR i.e. Income tax returns.

- Legal Compliance

If you use DSC filing method to file Income Tax Return, it will fulfill the legal requirements and also authenticate the submitted tax returns.

- Simplified Process

If you sign your tax documents digitally using DSC i.e. Digital Signature Certificate, it will simplify the filing process by eliminating the need of physical signatures.

Who Should Register DSC on the Portal of Online ITR Filing?

It is not mandatory for all the taxpayers to register their DSC i.e. Digital Signature Certificate on the online portal of Income Tax Return filing. For some taxpayers, registration of DSC on e-filing portal of Income Tax is optional.

- Companies and other Taxpayers must have to use the DSC i.e. Digital Signature Certificate for the e-verification of their Income Tax Return.

- Registration of DSC i.e. Digital Signature Certificate is mandatory for those taxpayers whose books of accounts are need to be audited. For the rest of the taxpayers e-verification of their ITR is optional.

- As e-filing of ITR is compulsory for all the individuals or professionals who have an annual gross receipt of Rs. 25 Lakhs & above and also for the businesses having an annual turnover of Rs. 1 Crore & more. So, it is mandatory for them to register their DSC i.e. Digital Signature Certificate on the online portal of ITR Filing.

Steps to Download the Emsigner Utility

It is mandatory to download and install the emsigner utility before moving ahead with the registration of DSC i.e. Digital Signature Certificate on online portal of Income Tax. Here, we will discuss about the steps of downloading the Emsigner Utility.

-

Step 1: Visit e-filing Portal

First of all, you have to visit the e-filing portal for online ITR Filing.

-

Step 2: Go to “Downloads”

After that you have to click on “Downloads” tab that has been given at the top menu bar.

-

Step 3: Click on “DSC Management Utility”

Then you have to click on the option of “DSC Management Utility” that has been given at the left menu bar.

-

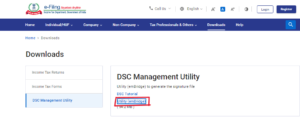

Step 4: Select the option of “Utility (emBridge)

After that, you have to select the option of “Utility (emBridge) that appears on your screen.

-

Step 5: Utility Starts Downloading

At last, the utility will start downloading and after the downloading is complete, you must have to install it.

These are the steps include in the downloading & installation of the Emsigner Utility. You have to follow them properly as without this you will not able to register DSC on online portal of ITR Filing.

Steps Include in the Registration of DSC on the Portal of Online ITR Filing

If you want to register your DSC i.e. Digital Signature Certificate on the portal of Income Tax Return Filing, you have to follow the given steps carefully. The process of DSC Registration on the e-filing portal of Income Tax includes some easy steps. The steps include in the registration of DSC on e-filing portal are as given below-

-

Step 1: Visit the e-Filing Portal

First of all, you have to visit the e-filing portal of ITR Filing.

-

Step 2: Log into the Portal

After that, you have to log in to the e-filing portal of Income Tax by using the valid user credentials.

-

Step 3: Click on “My Profile”

Then, you have to click on the option of “My Profile” that has been given on the dashboard.

-

Step 4: Select the option of “Register DSC”

Then, you have to select the option of “Register DSC” given on the left side of the screen.

-

Step 5: Enter e-mail ID and click on “continue”

After that you have to enter your mail ID that has been linked with the DSC token. Then, select the option of “I have downloaded and installed emsigner utility” and then click on “Continue” button.

-

Step 6: Select Provider & Certificate

After entering email ID, you have to select the provider and the certificate that given in the dropdown menu and enter the ‘provider password’ and at last click on the “Sign” Button.

-

Step 7: Success Message

After the successful registration of DSC, a success message stating that “Your Digital Signature Certificate (DSC) is registered successfully” will appear on the screen.

These are the step you should follow for the registration of DSC i.e. Digital Signature Certificate on the portal of online ITR Filing. Just make sure that you have registered your DSC before the Income Tax Return Last Date. If you still have any confusion, you can connect with the CA near me for ITR Filing.

Final Words

It is mandatory for all the taxpayers to register their DSC i.e. Digital Signature Certificate at the online portal of Income Tax Return filing. You can also seek the expertise of ITR Filing consultants like Legal Pillers. We will help you throughout the process of DSC registration. Our dedicated team of professionals has the expertise in online ITR Filing. We stay updated about the tax laws & regulations. You can find Legal Pillers by simply search for “CA near me for ITR Filing”. Remember that you have to register your DSC before the Income Tax Return Filing Last Date. Choose Legal Pillers as your trusted partner for the registration of your DSC i.e. Digital Signature Certificate on e-filing portal of Income Tax.

Other Related Blogs

- ITR Filing Online for FY 2023-24

- Step-by-step guide for ITR Fling Online

- How can Tax Planning save you from huge losses

- ITR 1 Filing

- ITR 2 Filing

- ITR 3 Filing

- ITR 4 Filing

- Filing ITR 5

- Filing ITR 6

- Filing ITR 7

- ITR Filing Tips for NRIs

- Chartered Accountant Near Me for Tax Filing

- What is the Importance of Income Tax Return Filing?

- How to Choose the Right Online Platform for TDS Return Filing?

- TDS Return Filing Online in 2024

- Where Can I Find Income Tax Return Filing Near Me?

- Tax Slabs and Rates for Online ITR Filing For FY 2023-24

- What Happens If I Don’t File Income Tax Return?

- What is the Income Tax Return Last Date for FY 2023-24 (AY 2024-25)?

- All About ITR Filing Online for Section 8 Company

- How to save tax for Pvt Ltd Company while Filing ITR?

- HUFs Online ITR Filing: Tax Benefits for HUFs

Leave a Reply