Are you an aspiring entrepreneur and ready to start your business in the dynamic landscape of India? It will be a thrilling task for you to start your entrepreneurial journey. The first step to start this journey is to register your company. Among numerous business structures available, the most popular choice is a Private Limited Registration that has been preferred by most of the entrepreneurs. Pvt Ltd Company Registration Online in India is very important for the growth & expansion of your business. The private limited company registration has been governed under the Companies Act, 2013 & Companies Incorporation Rules 2014. You can register a Ltd company via MCA i.e. Ministry of Corporate Affairs portal. However, many aspiring entrepreneurs usually wonder about the costs associated with registering a Ltd Company in India. Here, in this blog we will discuss about the cost of Pvt Ltd company registration.

Table of Contents

How to identify Charges For Pvt Ltd Company Registration Online in India?

If you want of register a Ltd Company, then it may be crucial for you to understand about the cost involved in the online Private Limited Company Registration. Keep in mind that charges for Pvt Ltd Registration may vary state to state on the basis of various factors including authorized share capital, and number of directors. Here we will tell you about the charges.

Here we will identify Costing Breakup of a Private Limited Company Registration in India

Basic charge of registering a Pvt Ltd. Company typically start from Rs. 8000/-. Costing may vary as per the state stamp duty, authorized share capital and number of directors. Here is the breakdown of the incorporation fees.

There are few factors which are determining Costing of a Private Limited Company as –

- Stamp Duty as per state Law

- Digital Signature Cost

- Fees for PAN & TAN

- Professional Charges

All these costs are variable and depend on the requirement. For example: if you are registering your company in state of Andhra Pradesh, then MOA stamp duty over 1 Lakh capital is Rs. 1,520/-. However, if you are willing to go with multiple subscribers then costing of Digital Signature, paper work and professional charges will also increase and then a final cost will determine.

Here is list of Stamp Duty to be charges on MOA and AOA based on their capital which you can check.

Government Fees for Pvt Ltd Company Registration Online According to Their State and Capital

| S. No. | State | Authorized Capital Up to 1 Lakh

(in Rs.) |

Authorized Capital Up to 5 Lakh

(in Rs.) |

Authorized Capital Up to 10 Lakh

(in Rs.) |

Authorized Capital Up to 20 Lakh

(in Rs.) |

|---|---|---|---|---|---|

| 1. | Andaman & Nicobar Island | 520/- | 520/- | 520/- | 23,420/- |

| 2. | Andhra Pradesh | 1,520/- | 1,520/- | 2,020/- | 26,420/- |

| 3. | Arunachal Pradesh | 710/- | 710/- | 710/- | 23,610/- |

| 4. | Assam | 525/- | 525/- | 525/- | 23,425/- |

| 5. | Bihar | 1,600/- | 1,600/- | 2,100/- | 26,500/- |

| 6. | Chandigarh | 1,503/- | 1,503/- | 1,503/- | 24,403/- |

| 7. | Chhattisgarh | 1,510/- | 1,510/- | 2,010/- | 26,410/- |

| 8. | Dadar Nagar Haveli | 41/- | 41/- | 41/- | 22,941/- |

| 9. | Daman & Diu | 1,170/- | 1,170/- | 2,170/- | 27,070/- |

| 10. | Delhi | 360/- | 960/- | 1,710/- | 26,110/- |

| 11. | Goa | 1,200/- | 1,200/- | 2,200/- | 27,100/- |

| 12. | Gujarat | 820/- | 2,820/- | 5,320/- | 33,220/- |

| 13. | Haryana | 135/- | 195/- | 195/- | 23,095/- |

| 14. | Himachal Pradesh | 123/- | 183/- | 183/- | 23,083/- |

| 15. | Jammu & Kashmir | 310/- | 460/- | 460/- | 23,360/- |

| 16. | Jharkhand | 173/- | 173/- | 173/- | 23,073/- |

| 17. | Karnataka | 10,000/- | 10,000/- | – | – |

| 18. | Kerala | 3,025/- | 3,025/- | 3,025/- | 28,925/- |

| 19. | Lakshadweep | 1,525/- | 1,525/- | 1,525/- | 24,425/- |

| 20. | Madhya Pradesh | 7,550/- | 7,550/- | 7,550/- | 30,450/- |

| 21. | Maharashtra | 1,300/- | 1,300/- | 2,300/- | 27,200/- |

| 22. | Manipur | 260/- | 260/- | 260/- | 23,160/- |

| 23. | Meghalaya | 410/- | 410/- | 410/- | 23,310/- |

| 24. | Mizoram | 260/- | 260/- | 260/- | 23,160/- |

| 25. | Nagaland | 260/- | 260/- | 260/- | 23,160/- |

| 26. | Orissa | 610/- | 610/- | 610/- | 23,510/- |

| 27. | Pondicherry | 510/- | 510/- | 510/- | 23,410/- |

| 28. | Punjab | 10,025/- | 15,025/- | 15,025/- | 37,925/- |

| 29. | Rajasthan | 5,000/- | 5,000/- | – | – |

| 30. | Sikkim | 0/- | 0/- | 0/- | 22,900/- |

| 31. | Tamil Nadu | 520/- | 520/- | 520/- | 23,420/- |

| 32. | Telangana | 1,520/- | 1,520/- | 2,020/- | 26,420/- |

| 33. | Tripura | 260/- | 260/- | 260/- | 23,160/- |

| 34. | Uttar Pradesh | 1,010/- | 1,010/- | 1,010/- | 23,910/- |

| 35. | Uttarakhand | 1,010/- | 1,010/- | 1,010/- | 23,910/- |

| 36. | West Bengal | 370/- | 370/- | 370/- | 23,270/- |

Note- In some states such as Karnataka and Rajasthan, stamp duty on MOA and AOA got increases, however, it is not yet updated on MCA portal.

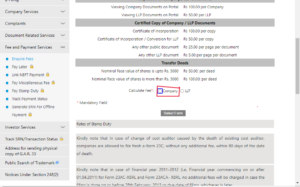

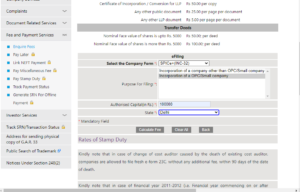

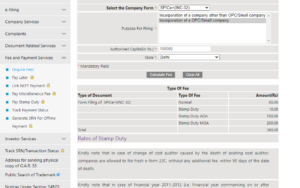

How to Check Stamp Duty on MCA Portal?

You can check the above Stamp duty of Private Limited Registration yourself by following some steps-

- Go to the MCA Portal.

- Select the option of MCA Services >> Fees & Payment Services >> Enquire Fees from

the menu bar.

- Select the option of “Company”.

- Select the company form as SPICe+(INC-32), purpose of filing as “Incorporation of a OPC/ Small Company and then fill your authorized capital & state and at last click on “Calculate Fees”

- The stamp duty will appear on the screen.

In addition to the above given government charges there are some more charges included in the proces of Pvt Ltd registration online. The additional charges for Pvt Ltd Company Registration are as given below-

-

Name Approval Charges

To register Private Limited Company, entrepreneurs must have to apply for name reservation. And for this, you have to pay a name approval fees of Rs. 1,000/-.

-

DIN i.e. Director Identification Number

The entrepreneurs who want to register a Ltd company must have to apply for DIN for all the directors of company. So,you have to pay a fees of Rs. 500/- for applying DIN of 1 director.

-

DSC i.e. Digital Signature Certificate

The cost of obtaining a DSC may vary as per the certifying authority and the validity period of the certificate. If we talk about an average, then the cost of a DSC ranges from Rs. 500 to Rs. 2,000 for 1 director.

At Legal Pillers, our fees for providing Digital Signature Certificate of 2 Directors will be Rs. 3000/- .

-

Professional Fees

Many entrepreneurs hire a professional, like a chartered accountant or company secretary, to help them with the incorporation procedure. Professional charges vary on the basis of the range of services supplied and the experience of the professional.

At Legal Pillers, the professional charges for Private Limited Company Online registration will be Rs. 2999/-.

-

Miscellaneous Charges

In addition to the above specified prices, there can be additional one-time costs such notarization fees, delivery fees and other.

At Legal Pillers, you have to pay a miscellaneous charge of Rs. 500/- for online Private Limited Company Registration.

These are the charges for Pvt Ltd Company registration online in India. So when you are moving ahead with online Private Limited registration, you should have the proper knowledge of the registration cost.

Lets discuss about the process and other important details about Registration

Minimum Requirements for Pvt Ltd Company Registration Online in India

Before registering a Ltd Company in India, you have to know about some of the basic requirements that every entrepreneurs should meet-

- There is a requirement of minimum 2 directors and at least 1 director should be an Indian Resident.

- For Private Ltd Company Registration, no minimum capital will be required.

- You can register Private Limited Company at the residential place also.

- The process of private limited registration is 100% online.

- For Private Limited Registration Online, the age of the applicant must be 18 years & above

- You must choose a unique name for your company.

- To register Pvt Ltd, the number of directors can be 2 to 15.

- For online Private Limited Registration, number of shareholders can be up to 200.

Process of Pvt Ltd Company Registration Online in India

Private Limited Company Online Registration includes a number of steps. To register a Ltd Company hassle -free, you should have to follow the given steps properly-

Step 1: Planning & Documentation

Before going for the Private Limited registration, you should make sure that you have all the required documents.

Step 2: Apply for DSC

As the process of Pvt Ltd Company formation is 100% online, so it is essential for all the directors of the company to acquire a DSC i.e. Digital Signature Certificate. You will get it within 24 hours & includes the 3 simple verifications including Document Verification, Video Verification and Phone Verification.

Step 3: Name Approval

After that, you have to apply for the name approval via SPICe RUN. Always remember that the name of your company must be unique and does not identical to any other existing name. You can check the availability of the name on MCA i.e. Ministry of Corporate Affairs portal.

Step 4: Filing the SPICe Form

After the name approval you have to fill the SPICe Form for Private Limited company registration. This form mainly includes the following details-

- Details of the company

- Details of the directors & shareholders

- Application of the DIN i.e. Director Identification Number

- Application for PAN & TAN of the company

- Declaration by the directors & subscribers

- Declaration & certification by the professionals.

Step 5: Filing of MoA & AoA

You must file the SPICe e-MoA & e-AoA forms at the time of registration. In MoA, you have to define the goals & objectives of your company. In AoA, you must have to define the rules & regulations related to the management & internal structure of your company.

Step 6: Issuance of PAN, TAN, & Incorporation Certificate

You will get the PAN, TAN, & Incorporation Certificate of your company by MCA (Ministry of Corporate Affairs) after the approval of the documents mentioned above.

Step 7: Bank Account Opening

At last, you must have to open a current bank account in the name of your company using the documents that have been issued to you.

Documents Required For Pvt Ltd Company Registration Online in India

For Directors

- Copy of Aadhaar Card of all the directors

- Copy of PAN card of all the directors

- Email address & contact number of all the address

- Passport size photo of all the directors

- Updated bank statement of saving account of all the directors (not older than 2 months)

- Copy of passport of directors (in case of foreign national or NRI)

For office address

- Electricity bill of office address (not older than 2 months)

- Rent agreement of office (if available)

- NOC given by the Office Owner (if you are not the owner of registered office of your company)

Why Legal Pillers is Best for Pvt Ltd Company Registration Online in India?

Among the numerous options available for Private Limited Company registration online, Legal Pillers stands as the premier choice of entrepreneurs who want to fulfill their dream. In this section you will learn about the reasons why entrepreneurs choose us-

-

Cost effectiveness

As the cost of Private Ltd Company Registration is usually high and sometimes the quality of the service will not good. But at Legal Pillers we provide you the service of registering Pvt Ltd online in India at the best competitive rates without compromising quality.

-

Time efficient

You will get the quick registration of your Private Limited Company if you choose Legal Pillers as your partner for registration.

-

Easily Accessible

With Legal Pillers, there will be no restrictions to the boundaries. You will get the easy access to the expert professionals of Legal Pillers at your fingertips with just few clicks.

-

Good Track Record

Legal Pillers have a commendable reputation for providing the best services of Private Limited Company Registration. We have a good track record of client satisfaction.

These are some reasons why Legal Pillers is the top choice of entrepreneurs who want to register their company in India.

Final Words

Pvt Ltd Company formation includes various charges like incorporation fees, digital signature certificates, stamp duty, professional fees, and miscellaneous expenses. But remember that the exact cost may vary on the basis of some factors including authorized capital, location, and professional services you get.

Legal Pillers will provide you the quality services at the best competitive price. We are here to help you for the hassle free online Private Limited registration. We simplify the registration process for you with the best prices. So, what are you waiting for? Choose Legal Pillers as your trusted partner for registering a Ltd Company seamlessly and take a step forward to fulfill your entrepreneurial dream.

Other Related Blogs

- Company Registration Process

- Benefits of Company Registration

- A Beginner’s Guide to Private Limited Company Registration

- Documents required for Company Registration

- SPICe Plus Form

- Types of Company Registration for Business Registration

- Nidhi Limited Company Registration in India

- Step-by-step guide for Online Company Registation in India

- One Person Company Registration

- Types of Company Registration in India

- How to register a company in Noida?

- Company Registration in Delhi

- The Advantages and Procedures of Online Company Registration for New Businesses and Entrepreneurs

- The Benefits and Process of Private Limited Registration for Your Business

- The Benefits and Process of Section 8 Company Registration Online

Comments (1)

How Much Does it Cost For Pvt Ltd Company Regis...says:

April 17, 2024 at 4:58 am[…] Learn about the state wise charges for Pvt Ltd Company Registration online in India. Here complete list of registration fees has been given. […]